Iran Turns to Bitcoin as Protests Grow and Currency Collapses

Street protests have swept across multiple cities in Iran since late December, driven by widespread frustration with the government and a worsening economic situation. As demonstrators clashed with authorities and inflation continued to erode savings, many Iranians took steps to secure their cryptocurrency holdings. A clear spike in Bitcoin withdrawals from local Iranian exchanges to personal crypto wallets emerged during this period, reflecting growing interest in direct control over digital assets.

Blockchain intelligence firm Chainalysis documented the trend in a report released this week. Between December 28, when protests began, and January 8, when the government imposed a nationwide internet blackout, transactions moving Bitcoin from Iranian exchanges to unattributed personal wallets increased significantly. The firm described the surge as evidence that citizens were actively taking possession of their Bitcoin at a higher rate than before the unrest started.

Chainalysis Findings Reveal Broader Patterns in Iranian Crypto Activity

Chainalysis attributed the behavior to the rapid collapse of the Iranian rial, which has lost substantial value against the U.S. dollar in recent weeks. The currency fell from roughly 420,000 rials per dollar at the end of December to more than 1,050,000 this week, sharply reducing the purchasing power of ordinary savings accounts and giving rise to massive street protests in the country. In response, many Iranians appear to view Bitcoin as a more reliable store of value during times of extreme monetary instability.

Bitcoin’s fixed supply of 21 million coins and its decentralized structure make it resistant to the inflationary pressures affecting national currencies. The cryptocurrency can be transferred across borders without relying on banks or government approval, offering users greater financial autonomy. For individuals facing capital controls or restricted access to traditional finance, these features provide practical liquidity and a way to preserve wealth outside official channels.

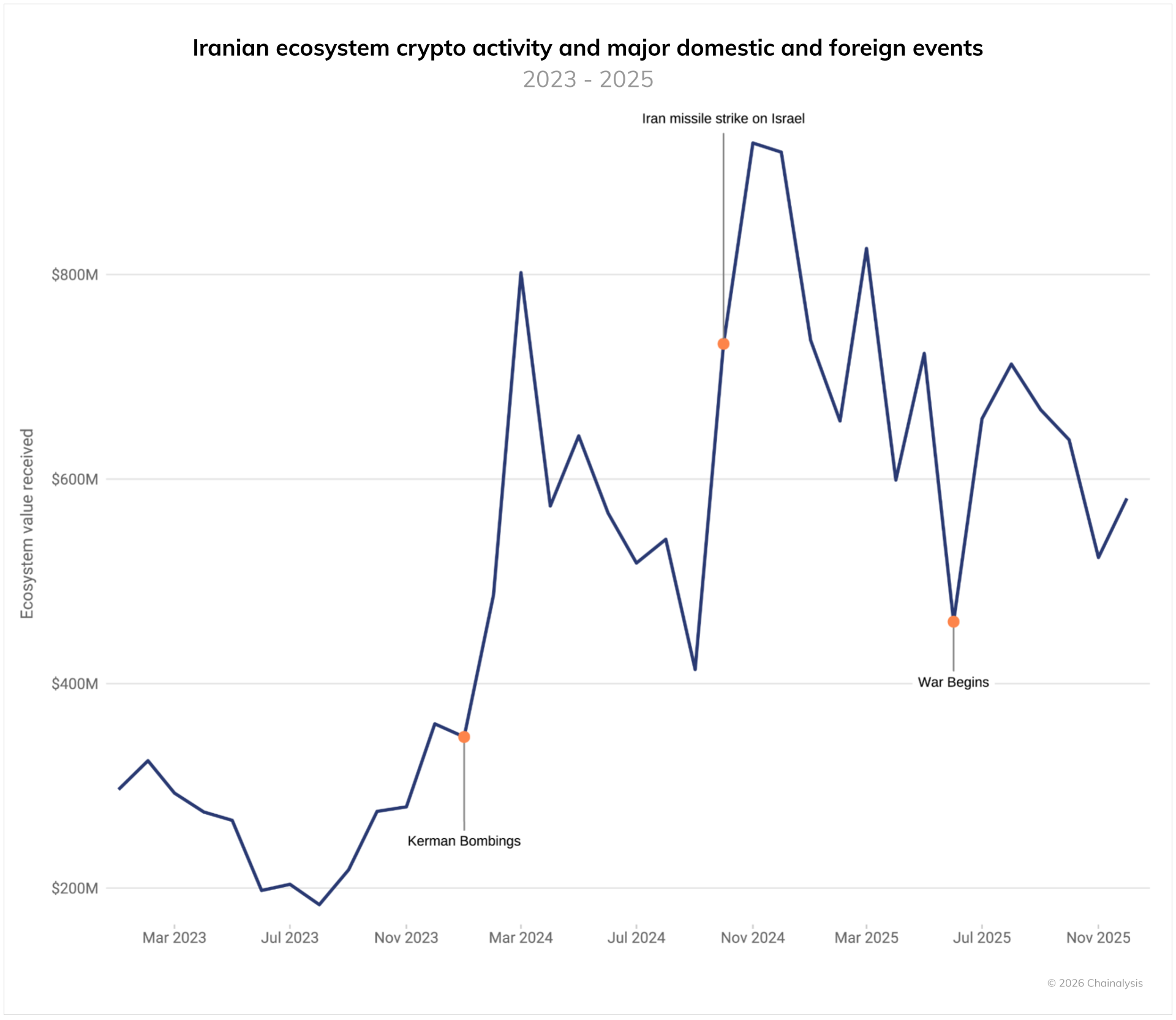

The current withdrawal trend fits a broader pattern that Chainalysis has observed globally. Regions experiencing political unrest, economic sanctions, or armed conflict often see heightened cryptocurrency adoption as citizens seek alternatives to weakened local currencies. Iran’s overall crypto market reached $7.78 billion in transaction volume during 2025, marking accelerated growth compared to the previous year.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishPast events in Iran have also triggered noticeable increases in cryptocurrency activity. The Kerman bombings in January 2024, which claimed nearly 100 lives at a memorial ceremony, coincided with a measurable uptick. Activity rose again following Iran’s missile strikes on Israel in October 2024, after the assassinations of senior Hamas and Hezbollah leaders.

A further spike appeared during the intense 12-day conflict in June 2025, when joint U.S.-Israeli operations targeted Iranian nuclear and missile facilities. That period also saw cyberattacks against Nobitex, Iran’s largest cryptocurrency exchange, and Bank Sepah, alongside breaches of state television broadcasts that aired protest footage. Such incidents likely reinforced public interest in decentralized financial tools that operate beyond government reach.

Within Iran’s crypto ecosystem, addresses linked to the Islamic Revolutionary Guard Corps have gained prominence. These wallets accounted for more than half of all cryptocurrency value received in the country during the final quarter of 2025. On-chain activity tied to known IRGC addresses exceeded $2 billion last year, pushing the yearly total above $3 billion, though Chainalysis cautioned that the true figure is probably higher since only sanctioned wallets are tracked.

The combination of domestic protests, severe currency devaluation, and ongoing geopolitical tensions continues to drive Iranians toward Bitcoin. By moving assets to personal wallets, users gain direct control that cannot be easily frozen or confiscated. This shift highlights the practical role cryptocurrency can play when traditional financial systems face extraordinary strain.