Iran Begins Accepting Crypto Payments for Ballistic Missiles, Drones, and Warships

Iran has begun openly offering advanced weapons systems for sale in exchange for cryptocurrency, marking a significant shift as the country seeks payment methods that can evade Western financial restrictions. According to a Financial Times investigation, Iran's Ministry of Defense Export Center, known as Mindex, is actively promoting deals that include cryptocurrency payment options alongside barter arrangements or payments in Iranian rials. This development represents one of the earliest instances of a nation-state publicly signaling willingness to accept cryptocurrency for high-value strategic military exports.

The initiative has gained traction over the past year, with Mindex highlighting its ability to facilitate transactions outside traditional banking channels. Prospective buyers are directed to a multilingual website that features an online portal and virtual chatbot designed to guide customers through the purchasing process. The site addresses common concerns about international sanctions in a dedicated FAQ section, emphasizing flexible terms that can be negotiated directly between parties.

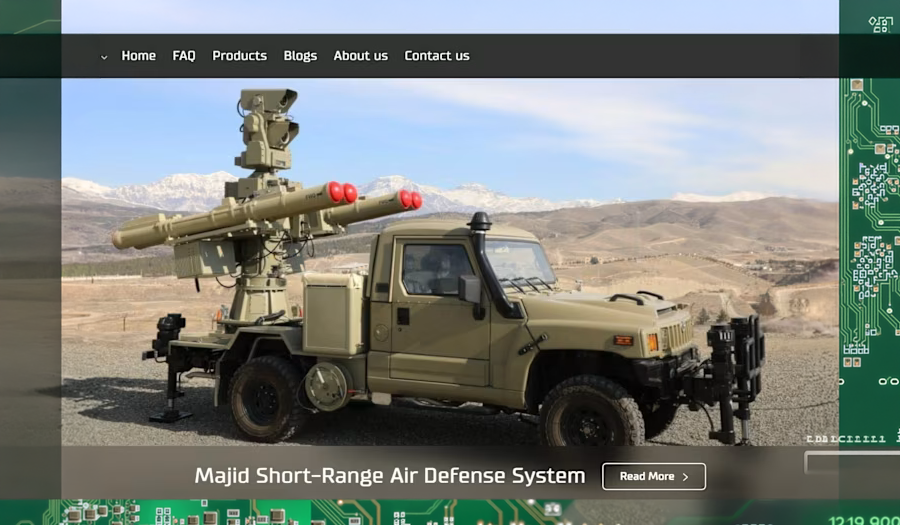

Mindex maintains client relationships with representatives from 35 countries and markets an extensive catalog of weaponry. The offerings include Emad liquid-fueled ballistic missiles capable of carrying heavy payloads over medium ranges, Shahed-series drones that have seen widespread use in regional conflicts, and Shahid Soleimani-class catamaran warships equipped with missile launchers. Additional items range from short-range air defense systems to small arms, rockets, and anti-ship cruise missiles, some of which have been documented by Western intelligence and United Nations reports as supplied to Iran-backed groups across the Middle East.

According to the report, buyers are informed that weapons usage conditions apply during conflicts with other nations, though these terms remain open to discussion. The export center does not publish prices publicly but allows for in-person inspections in Iran, subject to security clearance, and permits payment arrangements to be finalized in the buyer's country. Bitcoin and other cryptocurrencies appear to be accepted, although the report doesn't specify which ones are at this time. This approach underscores Iran's determination to maintain arms export revenue despite comprehensive sanctions that limit access to global financial networks.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishCryptocurrency Enables Trade for Sanctioned Nations

The timing of Iran's cryptocurrency pitch aligns with growing reliance on digital currencies by entities facing financial isolation. United States and European authorities have intensified efforts to disrupt alternative payment networks, including those incorporating cryptocurrency, that support sanctioned military programs. In September 2025, the US Treasury Department imposed sanctions on a financial facilitation network accused of channeling funds to Iran's defense sector through shadow banking mechanisms and overseas front companies.

This strategy gains additional context from shifts in the global arms market triggered by ongoing conflicts. Data from the Stockholm International Peace Research Institute shows Russia's major arms exports dropped 64% between the 2015-2019 and 2020-2024 periods, creating openings for alternative suppliers. Iran climbed to 18th place among global arms exporters in 2024, and analysts have noted that Tehran appears positioned to fill gaps left by Moscow's reduced capacity.

For potential customers, transacting with Iran carries substantial risks under existing sanctions regimes administered by the United States and its allies. Any use of conventional financial channels can trigger secondary restrictions that sever access to Western banking and trade services. By incorporating cryptocurrency options, Iran aims to provide a workable pathway for governments and entities willing to navigate these constraints while acquiring sophisticated military hardware.

The emergence of state-level cryptocurrency acceptance for arms deals highlights the evolving role of digital assets in international commerce under sanctions pressure. As enforcement actions target illicit finance networks, Iran's public embrace of alternative payments demonstrates both the challenges and adaptability within restricted trade environments. Whether this model ends up encouraging other sanctioned countries to adopt similar methods for preserving their strategic exports remains an open question.