IMF Seeks to Cap El Salvador’s Bitcoin Holdings Amid Bukele’s Push for Growth

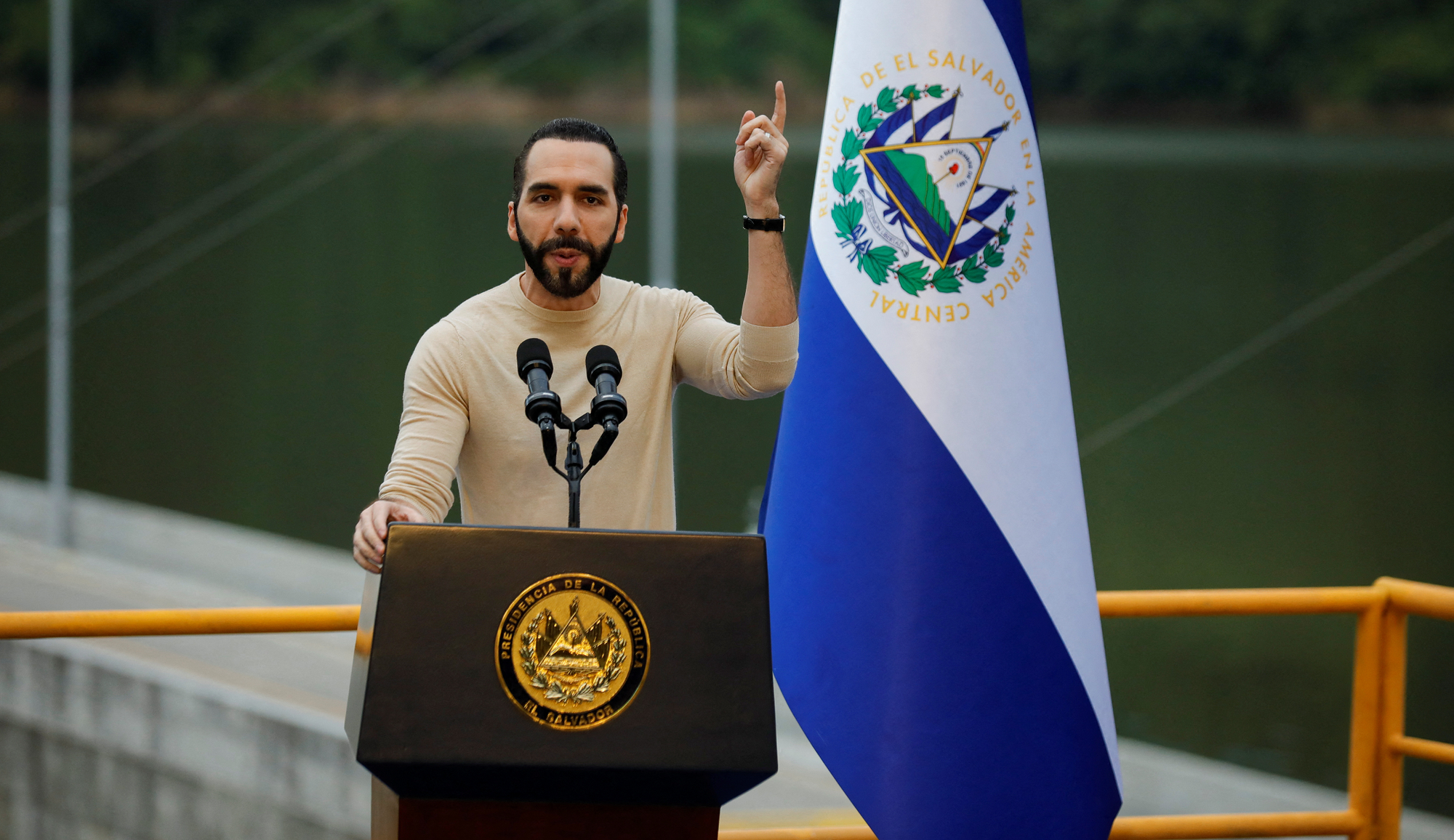

The International Monetary Fund (IMF) has taken a firm stance on El Salvador’s Bitcoin reserves, announcing plans to ensure the nation’s government does not increase its crypto holdings. This position, revealed on Tuesday, directly challenges President Nayib Bukele’s ongoing efforts to expand the country’s Bitcoin portfolio. The IMF’s statement coincides with a staff-level agreement reached during the first review of El Salvador’s Extended Fund Facility (EFF) deal, marking a critical moment in the nation’s financial relationship with the global institution.

The EFF agreement, initially struck in December, provides El Salvador with a $1.4 billion loan over 40 months, with potential additional support from institutions like the World Bank, bringing the total financing package to approximately $3.5 billion. To secure this deal, El Salvador’s Congress passed amendments to its Bitcoin Law, notably making Bitcoin acceptance voluntary for private businesses. In February, the IMF Executive Board approved the arrangement, enabling an initial disbursement of $120 million pending further board approval. The program aims to stabilize El Salvador’s macroeconomic challenges while addressing structural economic issues.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishBukele’s Bitcoin Vision Faces IMF Constraints

The IMF has consistently expressed concerns about the risks associated with El Salvador’s Bitcoin reserves, which it believes could destabilize the nation’s economy, though it noted these risks “have not yet materialized.” As part of the EFF deal, the IMF seeks to limit government engagement in Bitcoin related activities, including further purchases. This approach contrasts sharply with Bukele’s vision, who has championed Bitcoin as a cornerstone of El Salvador’s economic strategy. Despite the IMF’s restrictions, in early May, El Salvador officials have confirmed to continue buying more Bitcoin.

Bukele’s commitment to Bitcoin has yielded significant unrealized gains, with the president recently highlighting that El Salvador’s holdings had generated over $357 million in profit. However, the IMF’s latest announcement appears to have introduced ambiguity into the government’s plans. While Bukele reposted the IMF’s statement on Tuesday, he did not comment on the section addressing the restriction on Bitcoin purchases, leaving observers questioning whether El Salvador will adhere to the IMF’s terms. Adding to the complexity, El Salvador’s Bitcoin Office announced shortly after the IMF’s statement that the country had acquired an additional 8 BTC, increasing its total holdings to 6,190.18 BTC.

This recent purchase underscores the ongoing tug-of-war between El Salvador’s government and the IMF. Bukele’s administration has positioned Bitcoin as a tool for economic sovereignty and innovation, particularly since adopting it as legal tender in 2021. The president’s social media activity reflects unwavering confidence in the cryptocurrency, even in the face of international skepticism. Yet, the IMF’s influence, backed by substantial financial support, presents a formidable challenge to El Salvador’s ambitions.

The staff-level agreement reached this week signals progress in El Salvador’s EFF program, but it also highlights the delicate balance the nation must strike. Complying with the IMF’s conditions could secure critical funding to address fiscal pressures, yet it risks curbing the government’s Bitcoin strategy, which has become a defining feature of Bukele’s presidency. Conversely, prioritizing Bitcoin accumulation could jeopardize the IMF deal and strain relations with global financial institutions.

As El Salvador moves forward, the exchange between Bukele’s cryptocurrency advocacy and the IMF’s cautious approach will likely shape the nation’s economic trajectory. The government’s ability to navigate these competing priorities will determine whether it can sustain its Bitcoin experiment while meeting the demands of its international partners. For now, the acquisition of additional BTC suggests that El Salvador remains committed to its cryptocurrency path, even as the IMF seeks to impose limits.