Howard Lutnick, Jeffrey Epstein, and the Forces Behind Tether’s USDT Dominance

In the swirling nexus of finance, politics, Bitcoin, and cryptocurrency, few figures cast as long a shadow as much as Howard Lutnick. As Chairman and CEO of Cantor Fitzgerald, Lutnick has positioned himself at the heart of the stablecoin space, particularly through his firm's stewardship of Tether (USDT), the world's largest stablecoin with a market value exceeding $168 billion as of early 2026.

But Lutnick's ties to Tether aren't just professional. They weave through a labyrinth of controversial connections, including his documented relationship with Jeffrey Epstein and the shadowy origins of Tether itself. Recent revelations from the Epstein files in January and February 2026 have thrust these links into the spotlight, raising questions about influence, manipulation, and the true nature of power in the digital asset space.

This article dives deep into Lutnick's pivotal role in Tether, supported by legislative maneuvers, historical scandals, and intricate networks that suggest a calculated consolidation of control.

Cantor Fitzgerald: Tether's Custodial Backbone and Lutnick's Golden Ticket

Cantor Fitzgerald's relationship with Tether dates back to late 2021, when the firm became the primary custodian for Tether's U.S. Treasury holdings, the backbone of USDT's purported 1:1 dollar backing. In 2025, reports indicate Cantor held custody of approximately 99% of these Treasuries, which now total roughly $130-140 billion in U.S. government securities. This arrangement generates tens of millions in annual custodial and management fees for Cantor Fitzgerald, turning every USDT transaction, directly or indirectly, into a revenue stream for Lutnick's firm.

Beyond custody, Cantor reportedly holds a convertible bond in Tether (iFinex, parent company of Bitfinex), which some sources value as an effective ~5% economic interest in the company, potentially worth hundreds of millions. Lutnick himself has publicly vouched for Tether's reserves on multiple occasions, including during his 2025 Senate confirmation hearing for Commerce Secretary, where he stated he had personally reviewed the assets and confirmed full backing, comparing criticism of Tether to “blaming Apple because criminals use iPhones.”

This deep financial entanglement became even more significant after the July 18, 2025 signing of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act. The legislation, heavily supported by the Trump administration, mandates that only stablecoins backed 1:1 by U.S. Treasuries or similarly liquid USD assets can operate as “legal” stablecoins in the United States. Critics, including Senators Elizabeth Warren and Jack Reed, pointed directly to Lutnick and Cantor Fitzgerald as the single largest beneficiaries of this shift, arguing the law effectively hands a private Wall Street firm unprecedented influence over the stablecoin market, akin to a “private-sector Federal Reserve” for digital dollars.

The GENIUS Act Turnstile: Bo Hines and the Revolving Door

The connections grow tighter when examining the role of Bo Hines. In 2025, Hines served as a White House crypto advisor under the Trump administration and was instrumental in shaping and pushing the GENIUS Act through Congress. Weeks after the bill's passage, Hines abruptly left his White House role and assumed the position of CEO of USAT, Tether's newly launched U.S.-compliant stablecoin issued through Anchorage Digital Bank and backed by reserves under Cantor Fitzgerald's management.

This swift transition has fueled accusations of a carefully engineered “turnstile” benefiting Lutnick's network: push favorable legislation from inside government, then immediately step into a lucrative private-sector role tied to the same legislation. The GENIUS Act provided Tether a path toward U.S. legitimacy without forcing full onshore restructuring of its offshore (El Salvador-based) USDT operations, while simultaneously cementing Cantor's dominant custodial position and fee stream.

The Epstein Connection: Contradictions and Island Visits

Lutnick's public narrative about Jeffrey Epstein has been one of sharp repudiation. He has repeatedly claimed he severed all ties after a single disturbing visit to Epstein's New York apartment around 2005-2006, describing Epstein as “disgusting” and “gross,” and vowing never to be in the same room with him again; socially, professionally, or philanthropically.

Yet documents released in the January-February 2026 Epstein file drops paint a starkly different picture:

- Lutnick was Epstein's next-door neighbor in New York and reportedly purchased a property directly from him for just $10.

- Business and investment ties existed between the two men.

- Most damningly, emails from 2012 show Lutnick planning a family visit to Epstein's Little St. James island, including listing the ages of his children for the trip, years after Epstein's 2008 conviction for soliciting prostitution from a minor.

- Additional records indicate Epstein donated $50,000 to a 2017 event hosted by Lutnick, well into the post-conviction period.

These contradictions have exploded across social media and financial circles, with many questioning whether Lutnick's public disavowal was genuine or strategic.

Lutnick Money Laundering, Redactions, Whistleblowers, and Troubling Patterns

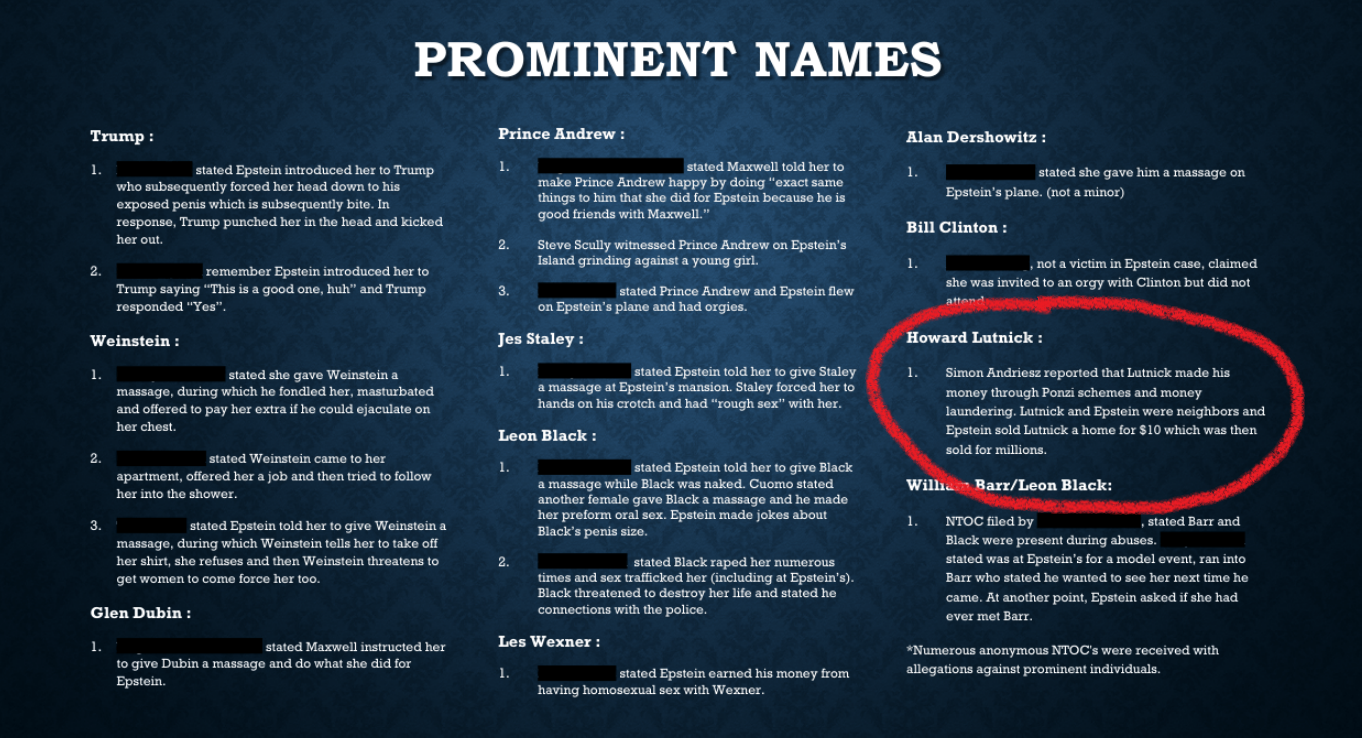

While Howard Lutnick’s public image has long been anchored in his stewardship of Cantor Fitzgerald, recent disclosures as mentioned above, suggest a far more complicated picture. Newly surfaced FBI documents, released as part of the 2026 Epstein file wave, reference an active case about alleged money laundering by Howard Lutnick via BGC Financial and Cantor Fitzgerald.

These revelations land atop a pre‑existing regulatory history. Cantor Gaming, a Nevada sports‑betting subsidiary founded by Lutnick, paid $22.5 million in 2016 to settle federal charges involving illegal gambling and money‑laundering violations, part of a broader pattern in which the company “repeatedly violated state and federal laws,” according to reports.

Compounding the scrutiny, whistleblower Simon Andriesz has alleged that Lutnick accumulated wealth through Ponzi‑style schemes and money laundering, pointing to a long‑standing relationship with Jeffrey Epstein.

Andriesz claims Epstein sold Lutnick a property for $10, which was later resold for millions. A transaction that some argue resembles a concealed transfer of value rather than a legitimate sale. While these remain just allegations, they have intensified calls for transparency, especially as the White House continues to defend Lutnick and affirm President Trump’s unwavering support amid mounting public pressure.

Taken together, Cantor’s regulatory history, and the whistleblower allegations, form a constellation of concerns that deepen the unresolved questions surrounding Lutnick’s financial empire, and its connections with Epstein’s network, and what has transpired after.

The Deeper Network: Brock Pierce, Tether's Origins, and Bitcoin Price Manipulation

The trail doesn't end with Lutnick. Tether's early history is inseparable from Brock Pierce, a figure who connects Epstein, early crypto infrastructure, and the stablecoin itself. Pierce co-founded Tether (originally called "Realcoin") in 2014 and has been linked to Epstein through multiple channels: he reportedly brokered Epstein's investment in Coinbase, introduced Epstein to figures like Larry Summers, and maintained correspondence with Epstein into at least 2018.

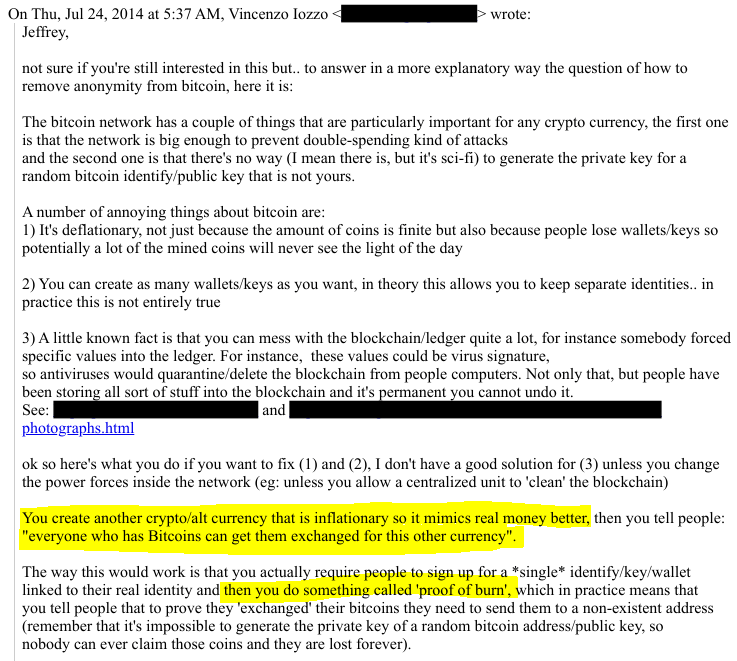

In 2014, Vinceno Iozzo wrote in an email to Epstein saying:

"Jeffrey, not sure if you're still interested in this but.. to answer in a more explanatory way the question of how to remove anonymity from bitcoin, here it is: ... You create another crypto/alt currency that is inflationary so it mimics real money better, then you tell people: 'everyone who has Bitcoins can get them exchanged for this other currency'. ... This is in short how you go from bitcoin to another currency (with the properties you care for) while preserving the bitcoin network and its strengths."

In the same email thread, Epstein responds saying:

"the goal is to create a fully transparent currency, but secure, It does not need to replace dollars with complement them, for ex . corporate cash. so corporations and gods can transact transparently, much more like a game world. inflation is needed if there will be loans, ( to compensate for risk)."

Later, in a follow up email from Iozzo to Epstein, he wrote:

"no in the case I was sketching in my email you don't actually replace the dollars, you just replace bitcoins ... you can easily embed transactions descriptions/codes ... You can either do what some bitcoin services do (it's called called/hot storage) or have the govt as an insurer of last resort ... I feel like that story you told me about you trying to decode hand signals back in the days, in the sense that I'm either missing something here or my pessimistic view of things is shaping my thinking too much."

In the above 2014 email exchanges, occurring just months before Tether's launch as an inflationary, dollar-pegged stablecoin, Vincenzo Iozzo outlines how to strip anonymity from Bitcoin by creating a new transparent cryptocurrency that mimics real money through inflation and real-identity linking, while preserving Bitcoin's network strengths.

Epstein responds by emphasizing the vision of a secure, fully transparent digital currency to complement traditional dollars for corporate transactions, with Iozzo's follow-up clarifying mechanisms like embedded transaction codes and government-backed insurance, eerily foreshadowing Tether's role in bridging fiat and crypto with programmable, traceable features.

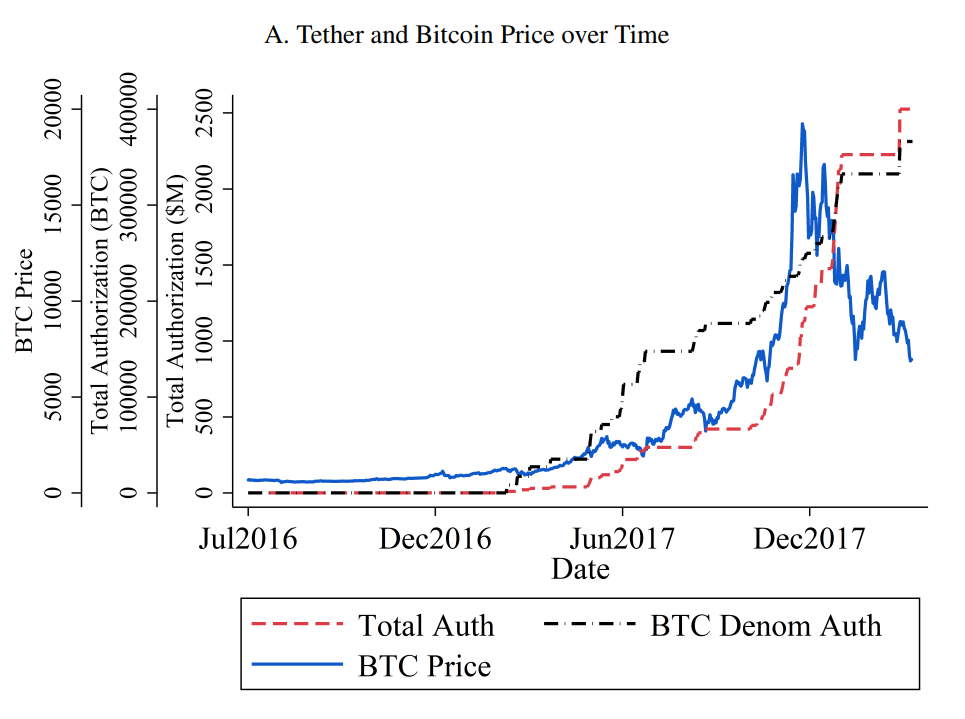

Those early conversations take on added weight when viewed alongside later academic work examining how Tether influenced Bitcoin’s market behavior.

Academic research, most notably the 2018 University of Texas study “Is Bitcoin Really Un-Tethered?” by Griffin and Shams (later published in the Journal of Finance), found strong evidence that large mints of new USDT, often following Bitcoin price drops, were followed by massive BTC purchases that accounted for roughly 50% of Bitcoin's 2017 bull run. Tether has never undergone a full independent audit; it relies on quarterly attestations that critics argue are easily manipulated.

In 2021, the CFTC fined Tether and Bitfinex $42.5 million for misleading statements about reserves, revealing that USDT was fully backed by dollars only 27.6% of the time between 2016 and 2019.

The same stablecoin whose issuance patterns helped inflate Bitcoin's price, and whose lack of transparency has drawn repeated regulatory action, is now custodied almost entirely by Howard Lutnick's firm.

The man closest to Trump and who claims moral revulsion at Epstein, who now controls the U.S. Treasury pile that legitimizes and profits from the same controversial stablecoin Pierce helped launch. Interesting to say the least, especially when considering how Epstein and his shadowy web of crypto pioneers helped to shape the Bitcoin network in it's most formative years, as outlined by Aaron Day of the Brownstone Institute.

A Private Empire Over Digital Dollars

Through custody fees, equity-like exposure, public endorsements, legislative positioning via allies like Bo Hines, and the structural advantages granted by the GENIUS Act, Howard Lutnick and Cantor Fitzgerald have achieved extraordinary influence over the largest stablecoin in existence. When layered atop the Epstein contradictions and the historical manipulation concerns surrounding Tether, the picture that emerges is one of centralized private control over a critical piece of global digital finance, far removed from the decentralized ideals many early crypto advocates envisioned.

Whether this represents innovation, regulatory capture, or something more troubling remains unknown. But one thing is clear: few individuals today sit at the intersection of Wall Street, Washington, Epstein's network, and the future of money quite like Howard Lutnick.

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!