How Trump’s Liberation Day Tariffs Set for April 2 Are Shaping Bitcoin and Crypto Markets

President Donald Trump is gearing up to unveil a fresh wave of reciprocal tariffs on April 2, a move he’s dubbed “Liberation Day” for the U.S. economy. Aimed at tackling the nation’s $1.2 trillion trade deficit, this policy follows his earlier tariff efforts, which have already left their mark on financial markets. With U.S. stocks slipping after Thursday’s announcement of steep auto import duties and crypto prices showing early declines, the stage is set for another round of economic ripples.

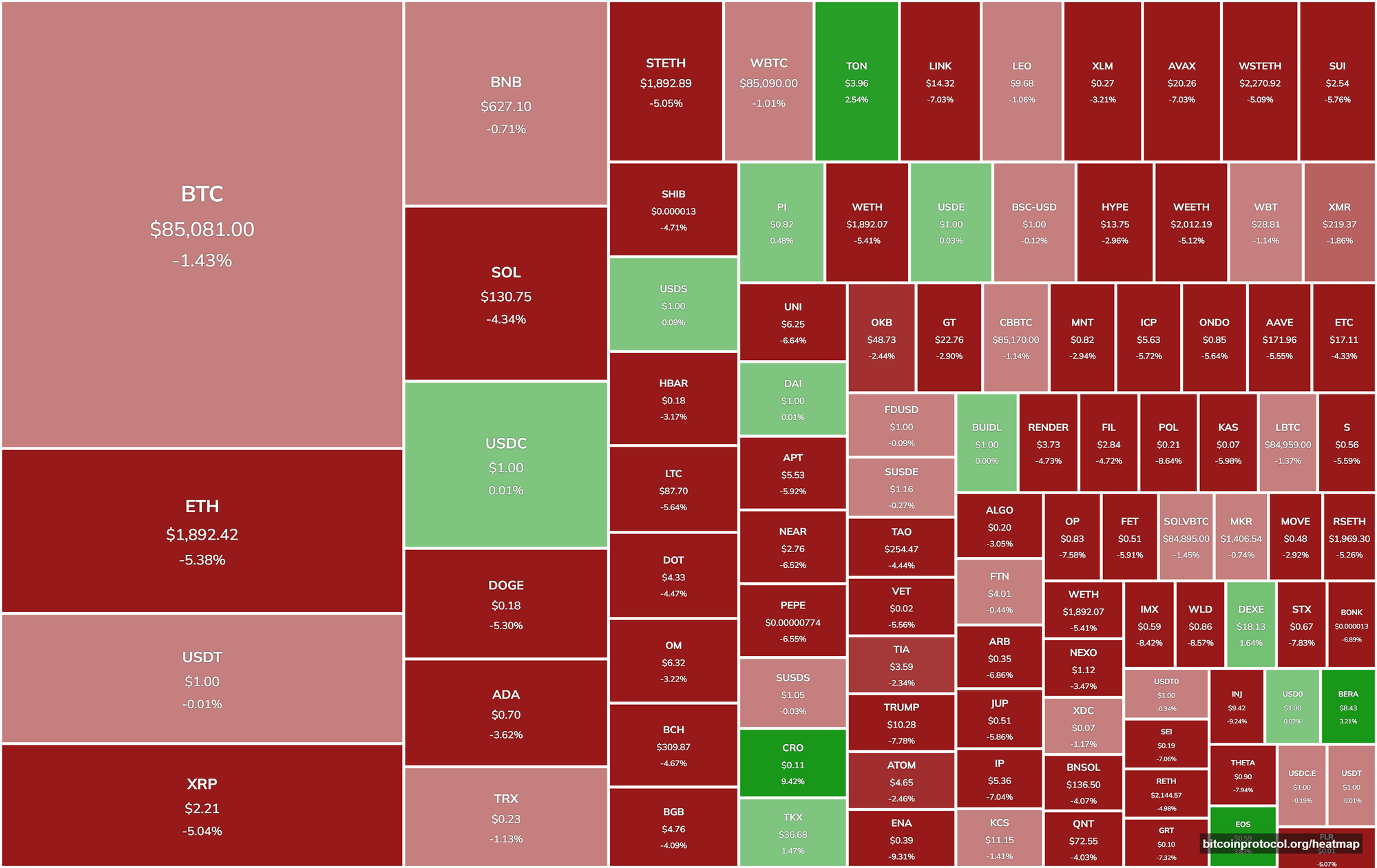

Bitcoin has already dipped over 1%, while Ethereum has fallen more than 5%, with Solana and Dogecoin trailing close behind at 4% and similar drops. The news comes hot on the heels of Trump’s Wednesday executive order, which slapped a 25% tariff on foreign-made vehicles, set to kick in alongside the broader reciprocal duties in April. Adding to the tension, Trump warned Canada and the EU on Thursday that even heavier tariffs could follow if they team up to challenge U.S. economic interests, prompting sharp rebukes from both trading partners.

The auto tariff announcement alone sent U.S. stocks lower, as investors braced for the possibility of a broader trade conflict. Past tariff moves under Trump have rattled the crypto market too, often sparking liquidations and price swings. Now, with Liberation Day looming, the question is how these new policies will play out across both traditional and digital asset spaces.

What’s Next for Trump’s Tariff Strategy?

Trump has hinted at tweaking his approach, potentially softening the blow of these tariffs on certain industries. Sectors like autos, semiconductors, and pharmaceuticals might see delays or lighter measures, with the focus shifting toward nations with the biggest trade surpluses and toughest barriers to U.S. exports. These countries, unofficially called the “Dirty 15,” could bear the brunt of the policy instead of a sweeping, sector-wide crackdown.

Still, nothing is set in stone. Trump has a track record of pivoting on big announcements, and he’s left the door open for flexibility. “I may give a lot of countries breaks, but it’s reciprocal,” he said, adding that April 2 would mark a turning point for U.S. trade relations.

A more targeted or delayed rollout could ease some of the pressure on markets. When tariff plans appear restrained, stocks and crypto prices often find their footing or even bounce back. On the flip side, aggressive moves tend to spark sell-offs, as seen in recent weeks when trade war fears flared up.

The crypto market, in particular, has proven sensitive to these shifts. If the final policy leans hard into autos or tech components, risk sentiment could sour across equities and bonds, dragging digital assets down with them. Bitcoin and Ethereum might face sharper declines as traders hedge against slower global growth and rising inflation.

Capital could also flow out of speculative assets like altcoins and into safer bets like the U.S. dollar or cash, a pattern that’s played out before. Back in February, when Trump doubled down on steep tariffs, Bitcoin slid below $90,000 as markets jittered. A repeat could be in the cards if April 2 brings bold action.

For now, the crypto space is riding a wave of macroeconomic uncertainty. Tariffs stoke fears of sluggish global trade, which in turn fuels inflation concerns. How Trump fine-tunes this policy in the coming days will likely set the tone for whether markets stabilize or take another hit.

With Liberation Day fast approaching, investors are keeping a close eye on every signal. The interplay between Trump’s trade agenda and asset prices is undeniable, and the next week could prove pivotal for both Wall Street and crypto.