Global Crypto Exchange Volume Soars to Record Highs in July 2025 Amid Market Rally

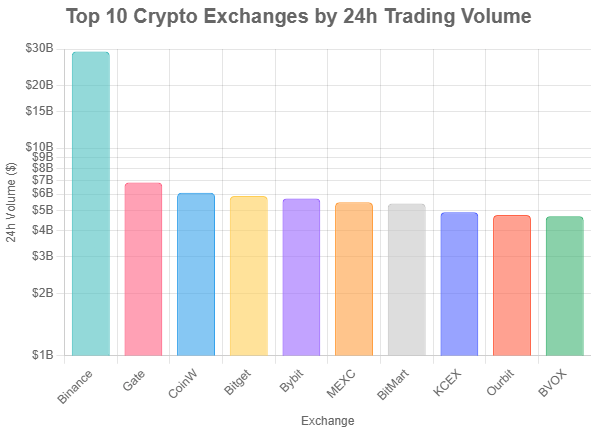

The crypto market reached a fever pitch in July 2025, with global crypto exchange trading volume hitting its highest level since February. Over the past 24 hours, the top 50 exchanges recorded a staggering $114.84 billion in trading volume, underscoring the intense activity gripping the market. The top 10 exchanges alone, including industry giants like Binance, Gate, Bitget, Bybit, and MEXC, accounted for $79.94 billion, or nearly 70% of the total volume. Binance solidified its position as the market leader, capturing the largest share of trading volume throughout the month. This surge in activity reflects a broader market rally, fueled by significant price gains in major cryptocurrencies and a wave of positive developments in regulation and adoption.

The unprecedented trading volume in July coincided with robust performance across leading cryptocurrencies. Bitcoin achieved its highest monthly close in history at $115,644, marking a 7.5% gain from its starting point of approximately $107,000. Ethereum outperformed with a remarkable 49.5% surge, while Solana posted a solid 12% increase over the same period. These price movements highlight the market’s bullish momentum, driven by a combination of institutional interest and favorable regulatory shifts. Despite a recent dip in prices over the past day, the overall sentiment remains optimistic as the crypto ecosystem continues to mature.

Regulatory Tailwinds and Institutional Adoption Fuel Optimism

The crypto market’s buoyancy in July was underpinned by several positive trends, particularly in the United States. The Trump administration’s pro-crypto stance has been a significant catalyst, with clear regulatory frameworks emerging to support the industry’s growth. Landmark U.S. legislation, such as the GENIUS Act and the CLARITY Act, has established federal rules for stablecoins and defined crypto market structures, fostering greater trust and encouraging industry expansion. These developments have been complemented by global acceptance of cryptocurrencies, with countries worldwide embracing digital assets as part of their financial systems.

Institutional demand has also played a pivotal role in driving market sentiment. Major corporations are increasingly adopting Bitcoin as a treasury asset, a trend that gained traction in 2025. Bitcoin treasury companies are emerging as a dominant force, with analysts predicting this trend will continue into the second half of the year. BlackRock’s iShares Bitcoin Trust, holding over 662,500 BTC, exemplifies the scale of institutional involvement, while spot Bitcoin ETF inflows reached $14.4 billion through July 3, according to Farside Investors. This influx of capital from traditional finance has bolstered liquidity and reinforced Bitcoin’s status as “digital gold.” Ethereum and Solana have also benefited from institutional interest, with spot Ethereum ETFs holding nearly 3 million ETH and asset managers filing for Solana ETFs, signaling broader acceptance of altcoins.

Despite these positive developments, the market faced challenges in the past day. Bitcoin and altcoin prices dipped following hawkish statements from Federal Reserve Chair Jerome Powell, which contributed to a broader stock market decline. These macroeconomic headwinds introduced short-term volatility, but the crypto market’s underlying strength remained intact. The 14-day Relative Strength Index (RSI) for the crypto market stood at 68.14, indicating strong but not overheated momentum, suggesting room for further growth after a brief consolidation. Analysts remain confident that the $3.62 trillion support level will hold, setting the stage for a potential rally toward $3.85 trillion to $4 trillion in the coming weeks.