Former Tether CEO Unveils Yield-Bearing Stablecoin Rival Set for Ethereum and Solana Launch

Reeve Collins, a name tied to the very roots of the stablecoin world, is stepping back into the spotlight with a fresh venture. As one of Tether original founders, Reeve Collins is now gearing up to launch his own stablecoin under the Pi Protocol banner, according to a report from Bloomberg. This isn’t just another dollar-pegged token aiming to mirror the likes of Tether’s USDT or Circle’s USDC. Instead, Pi Protocol promises something different—a yield-bearing stablecoin designed to put returns directly into holders’ hands. The project is slated to debut on the Ethereum and Solana blockchains, with a target rollout in the second half of 2025, though it could arrive even sooner.

What sets this apart from the stablecoin issuers is its focus on generating yield, likely tied to tokenized real-world assets. Think U.S. Treasuries or similar financial instruments turned into digital form—assets that can produce steady revenue streams. This approach echoes a growing trend in the crypto space, where newer players like Ethena and M^0 are shaking up stablecoins by offering returns rather than just price stability.

For context, Mountain Protocol’s USDM, launched last year, delivers around 5% annual yield to its holders through its underlying assets. Ethena’s sUSDe, meanwhile, dominates the synthetic dollar space with a hefty $4.5 billion in circulation, trailed by MakerDAO’s savings DAI and BlackRock’s BUIDL fund. Tether itself raked in over $13 billion in net profits in 2024 alone, fueled by a reserve mix of government bonds, repos, and money market funds. Collins’ Pi Protocol seems poised to tap into this lucrative shift, though the exact mechanics of its yield generation remain under wraps for now.

Never Miss Important News

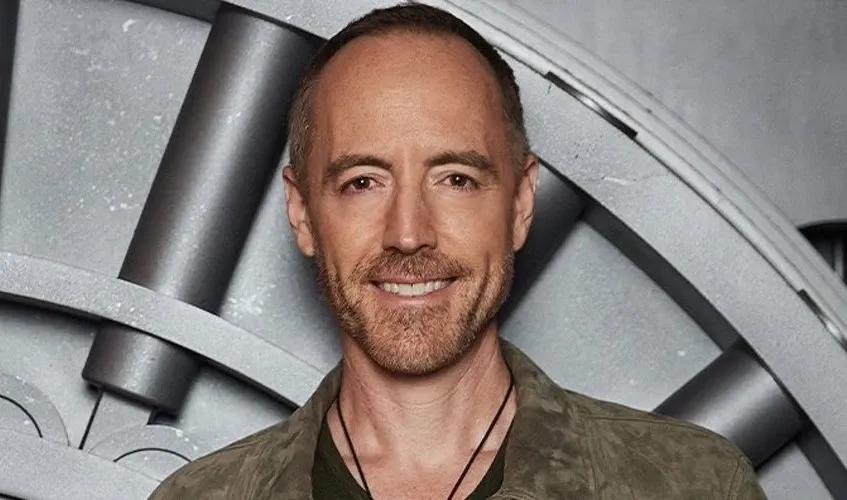

Sign up and be the first to know when we publishA Look at Reeve Collins

Collins isn’t new to building from the ground up. Back in 2013, he co-founded Tether alongside Brock Pierce and Craig Sellars, serving as its CEO until 2015. During his tenure, he played a key role in shaping the stablecoin that would eventually dominate the market. It was Collins who pushed to rebrand Tether’s predecessor, “Realcoin,” into the household name it is today, launching it on the Bitcoin Omni layer in late 2014. He also forged Tether’s early ties with the Bitfinex exchange, a relationship that solidified after his exit when Bitfinex acquired Tether outright. With a value now sitting at $141 billion, Tether stands as the most traded crypto globally.

Beyond Tether, Collins has kept his entrepreneurial fire burning. He went on to create BLOCKv, one of the earliest NFT platforms, which pulled in $22 million through a 2017 initial coin offering. More recently, he sold Pala Interactive, a gaming startup he built, to Boyd Gaming for a cool $70 million. Now, with Pi Protocol, he’s circling back to his stablecoin roots, this time with an eye on innovation.

The promise of yield could draw in a new wave of users, especially as tokenized assets gain traction in the broader financial world. While details are still scarce, the Ethereum and Solana launch combo signals a bid for flexibility and scale using smart contracts.