Following Epstein's $83 Million Money Trail to Bitcoin's Earliest Builders

A growing set of financial records tied to Jeffrey Epstein’s network is beginning to reveal a far more detailed picture of how his money moved and where it ultimately landed. Newly surfaced transaction files from the recent Epstein document release, including internal bank records and wire logs spanning several Epstein‑controlled entities, show consistent patterns across multiple years and accounts. Buried in these documents are explicit wire memos referencing investment vehicles used to fund early Bitcoin related companies, including the subscription payment routed through Kyara Investments to support Blockstream.

Taken together, these records form the most complete view seen of Epstein’s financial footprint inside Bitcoin’s formative ecosystem so far. What emerges is not a handful of isolated transfers, but a coordinated flow of capital into the developers, funds, and infrastructure that helped shape Bitcoin’s earliest years.

A newly discovered Deutsche Bank document gives us a financial trail that is explicit enough to map where Epstein’s money went, which entities he used, and how those flows intersected with the earliest Bitcoin startups. Across Southern Financial LLC, Southern Trust Company, and Epstein’s personal accounts, the records show $83.26 million in investments and payments. When cross‑referenced with known crypto‑linked companies and funds, a clear pattern emerges: Epstein was not a bystander. He was a quiet, consistent source of capital for early Bitcoin development and adjacent ventures.

And this $83 million is likely only the beginning. As we discover more documents, the total may exceed $100 million easy, if not more.

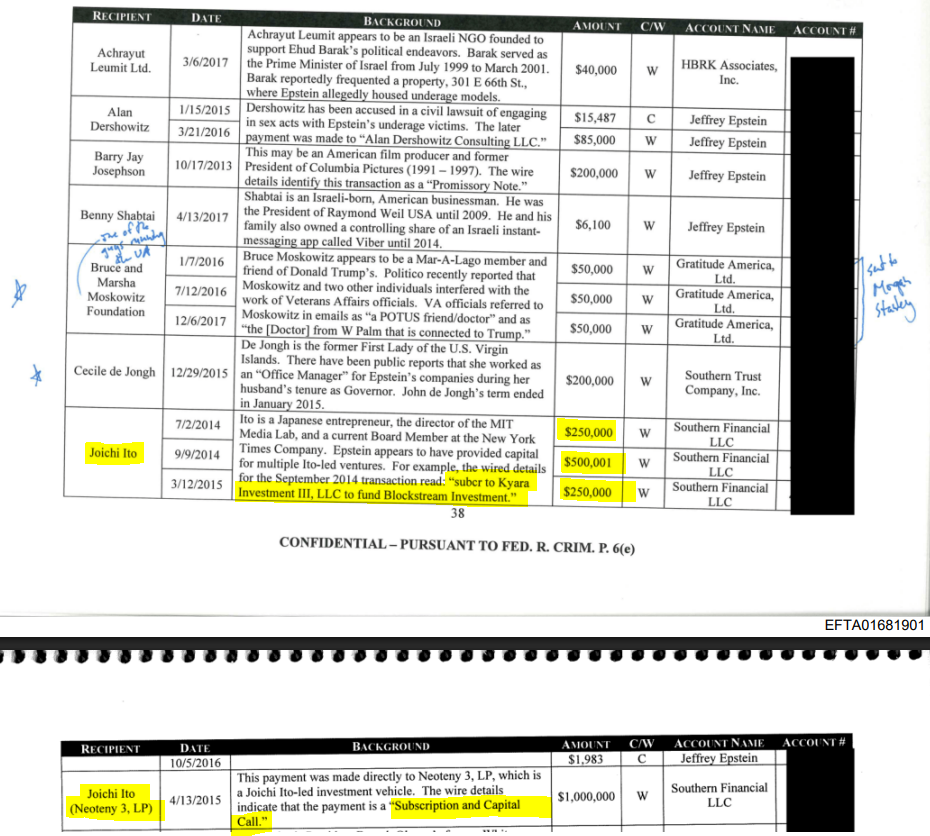

Clear Links in the Epstein-Bitcoin Money Trail

Among the many transactions in the newly discovered Deutsche Bank file, one stands out for its blunt clarity. On September 9, 2014, Southern Financial LLC wired $500,001 to Kyara Investment III, LLC. The wire memo reads:

“subcr to Kyara Investment III, LLC to fund Blockstream Investment.”

This is a second primary‑source financial document directly ties Epstein to Blockstream, one of the most influential Bitcoin infrastructure companies. The first was EFTA00027019, which confirmed the $500K investment into Blockstream.

The payment sits alongside two other six‑figure transfers to Joi Ito that same year, reinforcing that Epstein was a financial backer of Ito‑led ventures, including the one that seeded Blockstream’s early funding rounds.

MIT’s Digital Currency Initiative

The Deutsche Bank files also show a total $1.5 million routed through Joi Ito and his investment vehicle Neoteny 3, LP, including two $250,000 payments to Ito personally and a $1 million capital call to Neoteny in 2015. These payments align with the period when MIT’s Digital Currency Initiative (DCI) was supporting Bitcoin Core developers and hosting early blockchain research.

Earlier reporting established that Epstein’s MIT donations were quietly funneled into DCI. These newly surfaced financial records strengthen that connection: the money didn’t just pass through MIT, it passed through Ito’s venture structures, the same structures tied to the Blockstream investment.

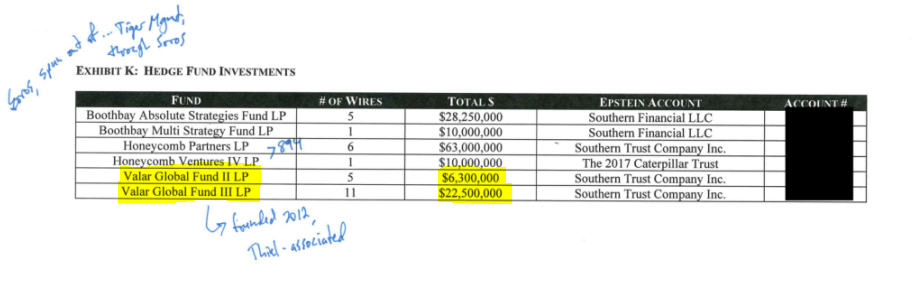

Valar Ventures and Other Crypto Exposure

The document also lists $28.8 million in commitments to Valar Global Fund II and III, routed through Southern Trust Company. Valar Ventures, managed by Peter Thiel, later became a major investor in crypto platforms such as Bitpanda, Vauld, and One Trading. Combined, Velar Ventures invested hundreds of millions into crypto startups, but Epstein's money was just a portion of that initial funding.

Earlier reporting we did confirm the total figure though from Epstein to Valar Ventures to actually be $40 million; these wires are probably found in other documents outside of the Deutsche Bank file.

While the files don’t label these as crypto investments, the downstream exposure is clear. Based on typical VC allocation patterns, we estimate that $8-$12 million of Epstein’s capital ultimately flowed into crypto‑related companies through Valar’s portfolio.

Boothbay Crypto Strategies Quant Fund

Epstein also placed $38.25 million into the lesser known Boothbay funds. Boothbay is a multi‑strategy and quantitative trading including crypto strategies. Even a conservative 15-20% allocation suggests $5.5-$8 million in effective crypto exposure.

Maria Drokova and Emerging VC Networks

A much smaller payment but yet still significant was for $7,027 and went to Maria Drokova, founder of Day One Ventures. We covered Drokova more deeply in our article Russian Operative Touted Blockchain Prodigy Better Than Vitalik Buterin in Epstein Emails if you want to learn more about her.

While the document doesn’t specifically mention crypto, she was a well known 'talent scout' in Russia, and her firm later backed projects like Worldcoin and other crypto hybrids. It’s a minor detail, but it shows Epstein’s network brushing up against the next generation of crypto‑aligned venture capital.

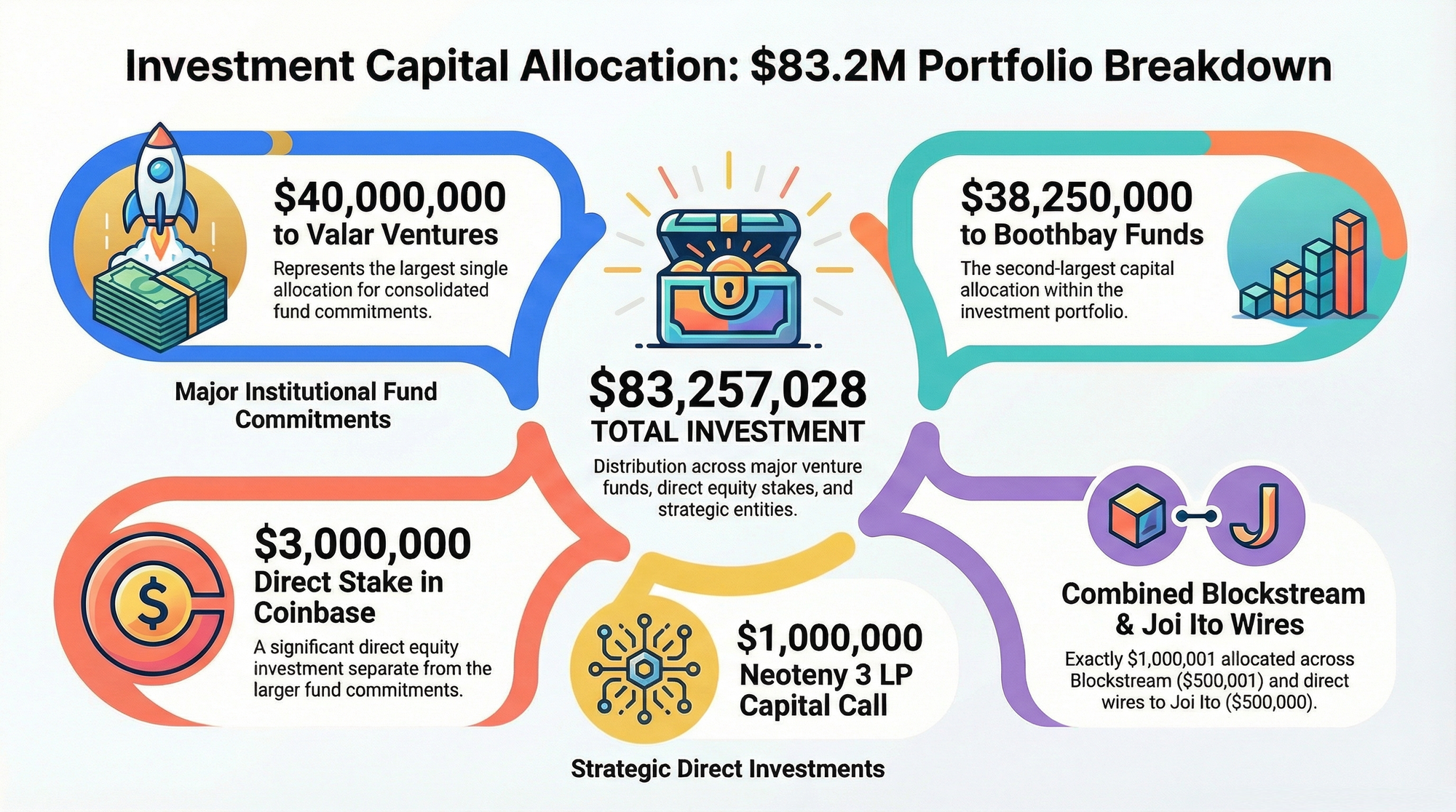

Adding it All Up

After consolidating the transactions across all entities, the financial picture becomes more clear: $83.257 million in documented investments.

| Investment / Recipient / Entity | Original Amount | Notes |

| Coinbase | $3,000,000 | Direct equity stake |

| Blockstream (via Kyara) | $500,001 | Explicit Blockstream wire |

| Joi Ito – Direct (non‑Blockstream) | $500,000 | Two wires: $250k + $250k |

| Neoteny 3 LP | $1,000,000 | Capital call |

| Valar Ventures Funds (II & III) | $40,000,000 | Consolidated fund commitments |

| Boothbay Funds | $38,250,000 | Consolidated fund commitments |

| Maria Drokova | $7,027 | Talent scout / crypto investment |

| Grand Total | $83,257,028 |

This is the bare minimum that we have uncovered, there is more than likely more funds that are not yet known. The Deutsche Bank file covers only one bank, one slice of time, and only the accounts flagged for review. The real number could be significantly higher.

What these documents provide is something rare: a verifiable financial map. And when you follow that map, the money leads straight into the early Bitcoin ecosystem, its developers, its infrastructure companies, and the venture funds that shaped its first decade.

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!