First US Engineered Hydro-Cooled Bitcoin Miner Unveiled to Tackle Supply Chain Issues

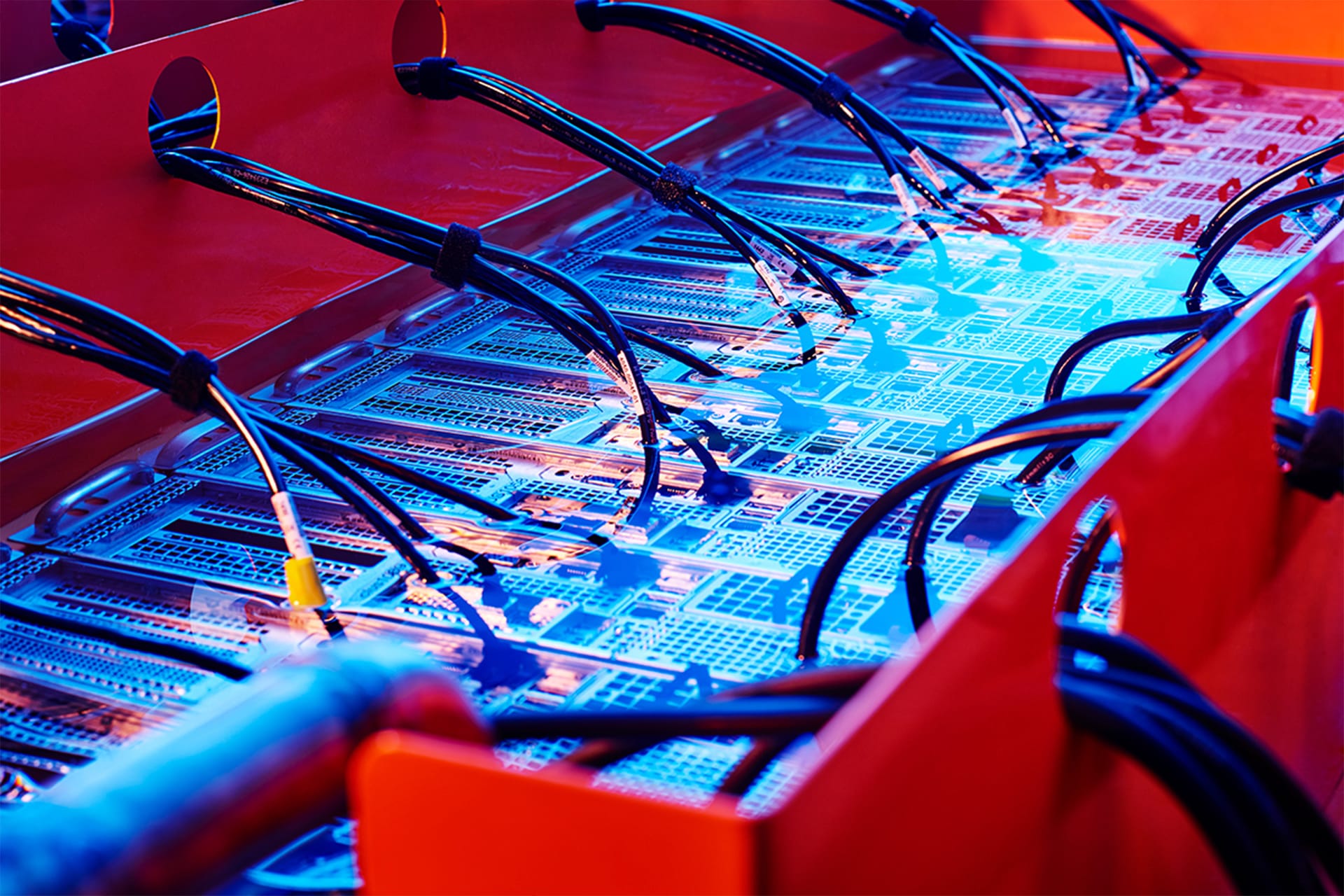

Silicon Valley-based blockchain and AI infrastructure provider Auradine has launched a groundbreaking product in the Bitcoin mining sector with the debut of the Teraflux AH3880, the first hydro-cooled miner engineered entirely in the United States.

This Bitcoin mining machine aims to address some of the most significant hurdles facing miners today, including surging computational requirements, escalating energy costs, and reliance on foreign hardware suppliers. As the industry evolves, Auradine’s latest offering arrives at a pivotal moment, aligning with broader efforts to bolster domestic manufacturing amid shifting global trade dynamics and a renewed focus on U.S.-produced technology.

The Teraflux AH3880, backed by MARA, boasts impressive specifications that set it apart from competitors. Auradine claims the miner delivers a hash rate of 600 terahashes per second (TH/s) while maintaining an energy efficiency of 14.5 joules per terahash (J/TH).

This performance outpaces the widely used Antminer S19j Pro, which offers a hash rate of 100 TH/s and an efficiency of 29.5 J/TH, according to data from Hashrate Index. The new machine also surpasses the Antminer S21 XP Hydro’s 473 TH/s, though the latter edges out slightly in efficiency at 12 J/TH, and Whatsminer’s M66S Immersion, which delivers 298 TH/s at 18.5 J/TH.

Beyond raw power, Auradine’s hydro-cooling technology allows the Teraflux AH3880 to support integrated Bitcoin and AI liquid-cooled data centers, a feature the company says enhances operational flexibility. The design incorporates a water cooling plate directly mounted to the ASIC chips, transferring heat to a circulating liquid that is then cooled and reused. This process not only extends the hardware’s lifespan but also reduces power consumption while optimizing computational output.

Auradine CEO Rajiv Khemani emphasized the significance of this advancement, stating that the integration of hydro-cooling into the Teraflux platform reflects the company’s commitment to delivering top-tier solutions for Bitcoin miners worldwide. He highlighted the technology’s potential to improve energy efficiency, sustainability, and overall performance, positioning miners to thrive in an increasingly competitive landscape.

Available for order as of March 25, 2025, the hydro-cooled miners build on Auradine’s strong financial foundation, with the firm reporting a $150 million annual revenue run rate following an $80 million Series B funding round completed before last year’s Bitcoin halving.

Stay In The Loop and Never Miss Important Bitcoin and Crypto News

Sign up and be the first to know when we publishNavigating Global Trade and Domestic Priorities

Beyond its technical merits, the Teraflux AH3880 offers a strategic advantage for U.S. based miners grappling with supply chain disruptions and rising operational costs. The majority of Bitcoin mining hardware continues to originate overseas, with China based Bitmain Technologies’ Antminer line commanding over 80% of the market share.

However, recent developments have complicated this reliance. In February, U.S. Customs and Border Protection had intensified seizures of mining equipment at ports of entry, including $5 million worth of MicroBT and Canaan units, following earlier actions against Bitmain products due to their use of chips from trade-restricted Sophgo. The reasons for expanding these seizures remain murky, though it aligns with the Trump administration’s push to bring critical industries like silicon manufacturing back to American soil.

This domestic focus resonates with President Donald Trump’s campaign pledge to “make Bitcoin” in the U.S., a vision he has continued to champion since taking office. Trump has vowed to transform the nation into a Bitcoin mining superpower by boosting electricity generation capacity and supporting the industry’s growth. Adding momentum to this agenda, the U.S. Securities and Exchange Commission’s division of corporation finance recently clarified that proof-of-work mining does not constitute the offer or sale of securities, providing regulatory clarity for the sector.

Despite challenges posed by Trump’s tariff increases on Chinese imports, analysts at Bernstein view these shifts as a $20 billion opportunity for U.S. miners, potentially driving fleet efficiency and opening doors to artificial intelligence and high-performance computing prospects.

Auradine’s Teraflux AH3880 arrives as a timely response to these dynamics, offering a domestically engineered alternative that sidesteps customs delays and tariff uncertainties. Luxor Technology COO Ethan Vera, whose company faced shipment seizures, noted progress in resolving such issues but underscored the growing demand for U.S.-produced hardware. Auradine’s entry into the market could diversify the mining supply chain, challenging Bitmain’s dominance while fostering innovation through closer collaboration with American miners.