Exploring Jack Dorsey’s Proto Rig and Its Impact on Bitcoin Mining

Block Inc has introduced the Proto Rig, a modular Bitcoin mining system designed to address longstanding challenges in the industry. Unveiled last month at a facility in Dalton, Georgia, the product comes from the company led by Jack Dorsey, which holds around 8,700 BTC in its treasury as of mid-2025. Block reports strong financial performance, with gross profits reaching billions in recent quarters, showing its commitment to Bitcoin infrastructure. The Proto Rig promises to extend hardware lifespans to 10 years through swappable and modular components, positioning it as a potential alternative to other dominant players in the market.

Industry observers note that Bitcoin mining has grown more demanding since the 2024 Bitcoin halving, which cut block rewards in half to 3.125 BTC. Miners now face tighter margins and profitability, with daily revenue per terahash dropping to about $0.049 by early 2025. Block’s entry into hardware aims to support decentralization by offering tools that reduce waste and costs. The Proto Rig features an efficiency of 14.1 joules per terahash and a power density of 9.4 kilowatts per linear foot, specs that align with current needs for optimization. Delivery is slated for sometime in 2026.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishExamining Design Strengths and Potential Shortcomings

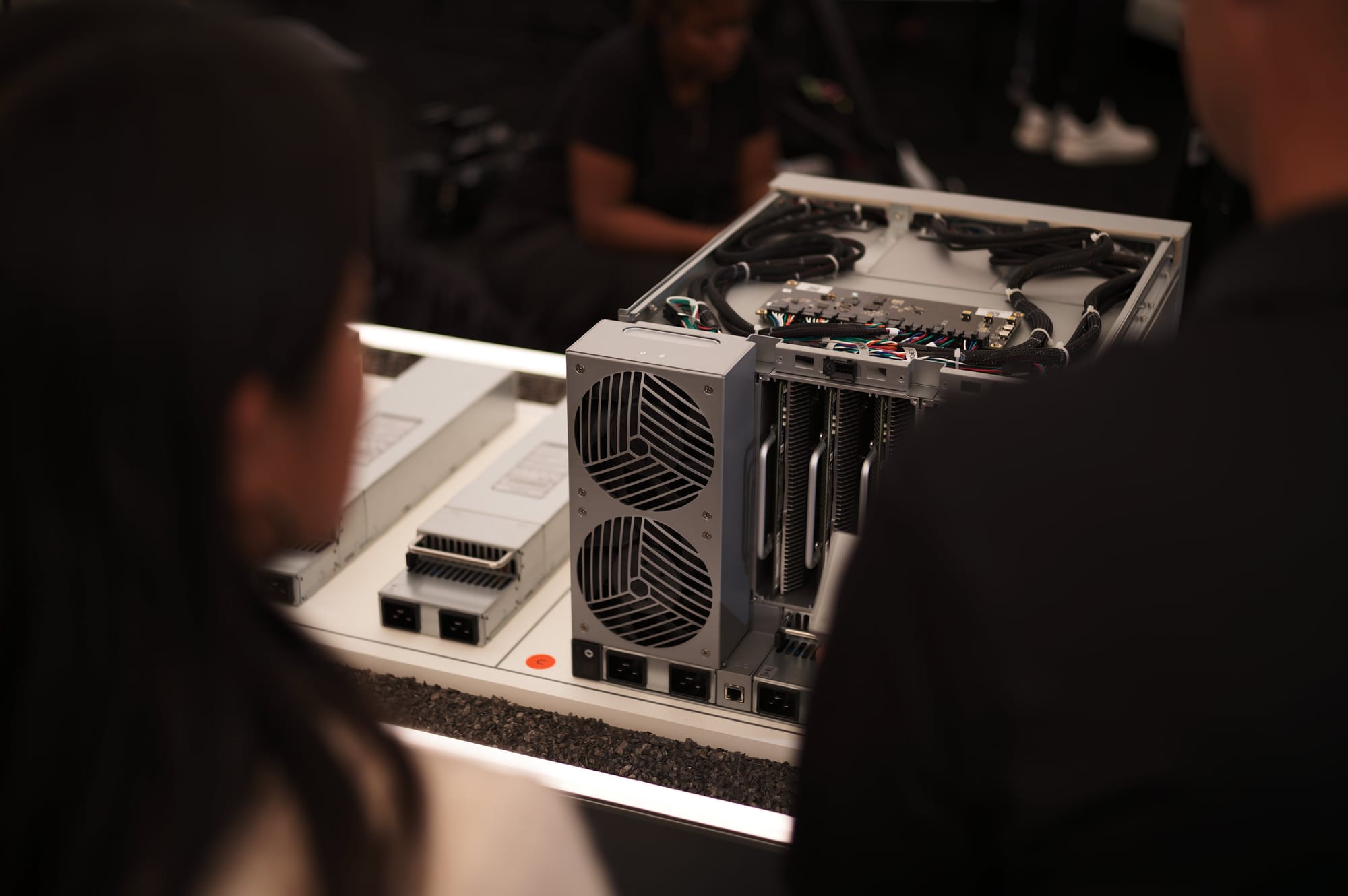

The modular approach of the Proto Rig allows for easy replacement of parts like fans, hashboards, and power supply units, avoiding the need to discard entire machines when issues arise. This design draws from data center practices, where longevity and quick repairs are standard, and Block claims it could lower upgrade expenses by 15 to 20% per cycle. The system integrates with existing setups, making it accessible for operations of varying sizes, and pairs with Proto Fleet, an open-source software for monitoring and maintenance. Such features could appeal to miners seeking reliability in regions with high energy demands, like Texas, which hosts about 30% of global hashrate.

Critics such as Braiins Mining CMO Kristian Csepcsar point out that modularity, while innovative, may introduce practical hurdles based on past efforts in the space. For instance, earlier models like Bitfury’s B8 from 2017 offered swappable parts but struggled with maintenance demands that offset initial benefits. The Proto Rig’s fan setup uses fewer units than competitors, with a two-fan module that lacks screws for simplicity, yet a failure might require replacing the entire module rather than single fans. Airflow concerns arise too, as the bottom fan’s output could be disrupted by vents in the fanless power supply, potentially compromising chip cooling in warmer environments. These elements suggest that while the rig advances durability, real-world testing will determine its edge over established options.

Hashboards in the Proto Rig slide in for swaps, which sounds straightforward, but exposure during handling could lead to damage over time. Naming conventions for different hashboard versions might confuse compatibility, unlike the clear labeling on Bitmain’s S21 series that indicates hashrate and power needs. Power supplies fit into narrow slots, which could accumulate dust from nearby fans, complicating cleaning in dusty mining sites. The control board, overseeing nine hashboards, swaps easily but weighs heavily without handles, adding strain for teams in large facilities. Block’s partnership with Core Scientific for testing highlights a focus on resiliency, yet these details raise questions about day-to-day usability.

Efficiency metrics for the Proto Rig hold up against leaders like Bitmain’s models, but the emphasis on linear space overlooks cubic volume due to power unit requirements. Bitmain maintains about 80% market share through rapid iterations and pricing flexibility, making it tough for newcomers to gain traction. Post-halving trends show miners prioritizing low-cost energy and hardware upgrades, with some shifting toward AI workloads for diversification and GPUs for alternative computing as Bitcoin profitability squeezes.

Block’s open-source software and U.S.-based manufacturing push align with calls for supply chain independence, especially amid tariffs and global tensions. The rig’s 810 terahashes per unit matches high-end competitors, but unproven longevity tempers enthusiasm. As network hashrate climbs past 800 exahashes per second, efficiency remains key, and the Proto Rig’s liquid-cooling option could help in energy-intensive setups. Miners in areas like Paraguay enjoy 60 to 70% margins thanks to cheap power, while U.S. operations face higher costs around $17,000 per BTC. Institutional players like Riot Platforms are acquiring efficient ASICs and exploring mergers to consolidate.

The Proto Rig is entering the market at a time when smaller miners are exiting, leaving room for innovations that cut operational risks. Block’s treasury growth, adding over 100 BTC in Q2 2025, values its holdings near $1 billion, signaling confidence in Bitcoin’s future. Yet, with delivery delayed until 2026, competitors could advance further, and design tweaks might be needed based on field feedback.

Overall, the product represents a step toward sustainable mining, though its success hinges on addressing hands-on challenges. As miners balance these developments with broader shifts, including regulatory changes and ETF inflows surpassing mined supply, the focus stays on practical gains that support network security without inflating costs. Block’s efforts could foster a more diverse hardware ecosystem, though whether it pays off may become clearer next year.