Ethereum’s Institutional Moment Builds as Tom Lee Gains Saylor’s Praise

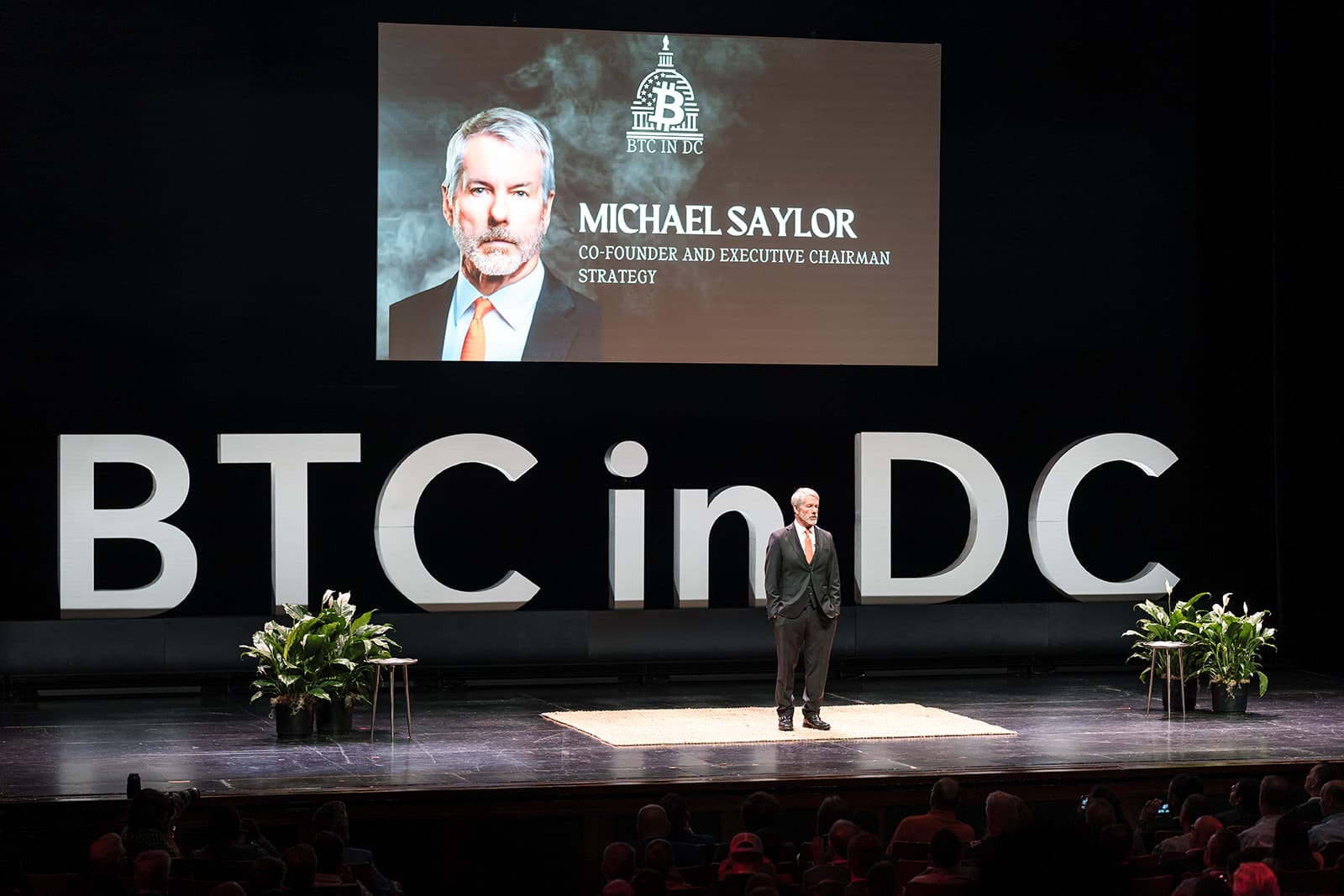

Michael Saylor, executive chairman and co-founder of Strategy, formerly known as MicroStrategy, took the stage at the BTC in DC 2025 conference to outline the transformation of the cryptocurrency sector. Speaking at the Kennedy Center this week, Saylor described how the early days of crypto have given way to a structured global digital asset economy. He credited much of this progress to shifts in Washington’s political and regulatory landscape, which have fostered greater stability and acceptance.

Saylor began his keynote by revisiting the foundational principles that define the industry. Bitcoin stands as a digital commodity defined by its inherent scarcity, a concept that underpins its value in the broader ecosystem. From there, he expanded on ideas like digital property rights, seamless global transferability, and the rise of stablecoins, each building a framework for practical use.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishTokenization and Institutional Momentum

These elements, Saylor explained, set the stage for the current phase of institutional adoption and commercialization. Bitcoin now functions as the digital capital base, protected by its proof-of-work mechanism, providing a secure foundation for value storage and settlement. Meanwhile, smart contract platforms such as Ethereum and Solana enable the tokenization of securities, currencies, and even brands, allowing real-world assets to integrate smoothly into blockchain environments.

During his address, Saylor turned attention to a key figure accelerating this institutional shift: Tom Lee, leader of BitMine Immersion. As one of roughly ten public companies maintaining Ethereum holdings, often referred to as Ethereum treasury companies, Lee’s influence has grown swiftly. Saylor portrayed him as the most visible and impactful voice in the Ethereum ecosystem, rising to prominence in just months or even weeks.

This rapid ascent stems from Lee’s background in traditional finance, positioning him as a bridge between Wall Street and the crypto world. Unlike many early crypto advocates, Lee carries the credibility of the established financial sector, which draws capital toward Ethereum. Saylor emphasized that trust in figures like Lee drives these flows, making the entire movement feel more commercialized and legitimate.

Saylor observed that this integration brings a sense of maturity to the space. The crypto economy gains credibility as it aligns with familiar Wall Street practices, encouraging broader participation from institutions. Lee’s role exemplifies how such crossovers can rationalize and institutionalize what was once a fringe pursuit.

Shifting to the mechanics of tokenization, Saylor highlighted an emerging agreement on best practices for bringing assets onchain. He noted that the industry is settling on smart chains as the ideal venue for representing securities and real-world assets. Among the leading options, he pointed to Binance Smart Chain, Solana, and Ethereum as the most established platforms today.

Proof-of-stake networks like these will handle the complexities of tokenized securities, currencies, and brands, Saylor predicted. In contrast, Bitcoin’s proof-of-work system will anchor global capital settlement, ensuring a robust base layer. This division of labor creates a cohesive structure where each technology plays to its strengths.

Saylor’s vision paints a future where these components work in harmony. The political changes in D.C. have removed barriers that once hindered growth, allowing innovation to flourish under clearer rules. As more entities recognize the potential, the digital asset economy edges closer to mainstream integration.

The BTC in DC 2025 event itself underscored this momentum, drawing leaders from finance, tech, and policy to discuss pathways forward. Saylor’s remarks resonated with attendees eager for signals of regulatory progress. His emphasis on Bitcoin’s enduring role as the settlement layer reinforced its position amid the rise of diverse applications.

Looking at Ethereum specifically, Saylor’s praise for Tom Lee highlights the network’s appeal to institutional players. Companies like BitMine Immersion, with their Ethereum treasuries, signal confidence in its long-term viability. This trend could accelerate as more Wall Street veterans lend their expertise.

Tokenization represents one of the most tangible advancements Saylor described. By enabling assets to exist digitally with verifiable ownership, it opens doors for efficiency in trading and management. Platforms like Solana offer speed and low costs, while Ethereum provides deep liquidity and developer tools.