Epstein’s 2008 Emails Reveal Idea for Bitcoin‑Like Digital Currency

Newly released Department of Justice files on Jeffrey Epstein contain an unexpected thread: a series of October 2008 emails in which Epstein sketched out ideas for an internet‑based digital currency system to distribute value and reduce what he described as “artificial money scarcity.”

Epstein was a convicted criminal whose actions were indefensible, and nothing in these documents alters that fact. But the correspondence offers a rare look at how he viewed the global financial crisis and the future of digital money during a moment of historic economic upheaval.

In addition, the timing is striking. These emails were exchanged just weeks before Satoshi Nakamoto published the Bitcoin whitepaper on October 31, 2008, a proposal for a peer‑to‑peer electronic cash system built on cryptographic proof rather than institutional trust.

Epstein’s notes touch on similar themes: collapsing confidence in financial intermediaries, the fragility of centralized systems, and the potential for the internet to serve as a new mechanism for distributing value. There is no evidence linking Epstein to Bitcoin’s creation, nor any suggestion he was involved. But the conceptual overlap, emerging from the same crisis‑driven environment, raises a compelling question about whether multiple thinkers were independently converging on similar ideas as the old financial order faltered.

The 2008 Financial Crisis and Bitcoin's Dawn

October 2008 was ground zero for economic Armageddon. Lehman Brothers had collapsed in September, sparking a credit freeze. Stock markets plummeted, housing values tanked, and trust in the financial system hit rock bottom. Governments worldwide pumped trillions into bailouts, highlighting the flaws in centralized finance: opacity, manipulation, and reliance on fallible institutions.

Enter Satoshi Nakamoto (a pseudonym, possibly for an individual or group). On October 31, 2008, the Bitcoin whitepaper was published on a cryptography mailing list, proposing a decentralized network where transactions are verified by nodes using proof-of-work, eliminating the need for banks or governments. Bitcoin's fixed supply of 21 million coins addressed inflation concerns, positioning it as a "store of value" like digital gold. The Genesis block, mined in January 2009, even included a headline: "Chancellor on brink of second bailout for banks," a jab at fiat money's failings.

Epstein, meanwhile, was no stranger to high finance. As a money manager for the ultra-wealthy, he understood "store of value" concepts deeply, gold, assets, currencies, and the history of money. His emails from this period reveal him brainstorming a "new system" amid the crisis, drawing on internet tech, feedback loops, and organic analogies.

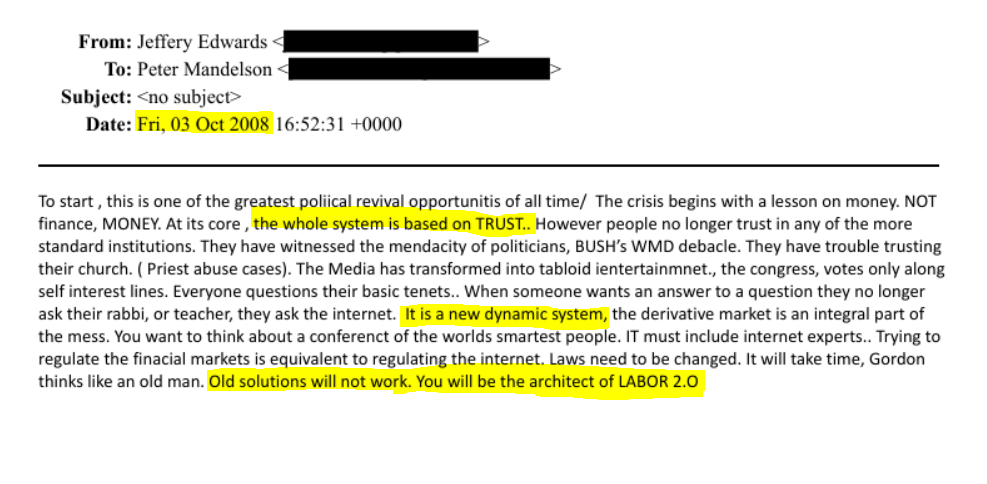

October 3, 2008: A Lesson on Money and Eroded Trust

Epstein's first email frames the crisis as a political opportunity, emphasizing money over finance:

"To start , this is one of the greatest poliical revival opportunitis of all time/ The crisis begins with a lesson on money. NOT finance, MONEY. At its core, the whole system is based on TRUST.. However people no longer trust in any of the more standard institutions. They have witnessed the mendacity of politicians, BUSH'S WMD debacle. They have trouble trusting their church. ( Priest abuse cases). The Media has transformed into tabloid ientertainmnet., the congress, votes only along self interest lines. Everyone questions their basic tenets.. When someone wants an answer to a question they no longer ask their rabbi, or teacher, they ask the internet. It is a new dynamic system, the derivative market is an integral part of the mess. You want to think about a conferenct of the worlds smartest people. IT must include intemet experts.. Trying to regulate the finacial markets is equivalent to regulating the internet. Laws need to be changed. It will take time, Gordon thinks like an old man. Old solutions will not work. You will be the architect of LABOR 2.0"

This email hits on trust as the bedrock of money, now shattered by scandals across institutions. People turning to the internet for answers? That's the shift to decentralized finance. Epstein calls for a summit of "internet experts" to rethink regulation, likening financial markets to the ungovernable web.

Parallels to Bitcoin: Trust erosion is Bitcoin's origin story. Satoshi's whitepaper states: "What is needed is an electronic payment system based on cryptographic proof instead of trust." The decentralized network mirrors Epstein's "new dynamic system," and including tech experts echoes the cypherpunk community (e.g., Wei Dai's b-money in 1998) that birthed Bitcoin. However, Epstein veers into politics and "LABOR 2.0," while Bitcoin was designed as an apolitical tool.

Differences and Context: Epstein's focus on derivatives (which ballooned to $600 trillion notional value by 2008) was spot-on, they amplified the subprime mess. His critique of old thinkers ("Gordon thinks like an old man") might reference figures like Gordon Brown, then UK PM pushing bailouts. This wasn't novel; economists like Friedman had long questioned fiat trust. But amid TARP's signing that day, it shows real-time crisis reflection.

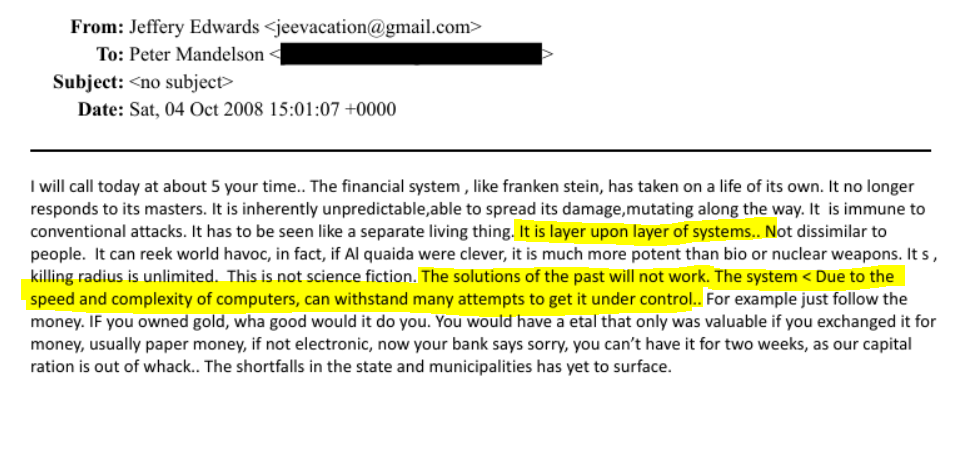

October 4, 2008: The Financial System as a Living Monster

Building on the chaos, Epstein personifies the system in this email:

"I will call today at about 5 your time.. The financial system , like franken stein, has taken on a life of its own. It no longer responds to its masters. It is inherently unpredictable,able to spread its damage,mutating along the way. It is immune to conventional attacks. It has to be seen like a separate living thing. It is layer upon layer of systems.. Not dissimilar to people. It can reek world havoc, in fact, if Al quaida were clever, it is much more potent than bio or nuclear weapons. Its , killing radius is unlimited. This is not science fiction. The solutions of the past will not work. The system < Due to the speed and complexity of computers, can withstand many attempts to get it under control.. For example just follow the money. IF you owned gold, wha good would it do you. You would have a etal that only was valuable if you exchanged it for money, usually paper money, if not electronic, now your bank says sorry, you can't have it for two weeks, as our capital ration is out of whack.. The shortfalls in the state and municipalities has yet to surface."

Here, the system is a mutating entity, computer-amplified, more destructive than WMDs. Gold's limitations in a crisis underscore money's fragility.

Parallels to Bitcoin: The "layer upon layer" complexity evokes blockchain's stacked protocols. Bitcoin counters this with transparency and immutability, addressing Epstein's point about uncontrollability. Skepticism toward gold aligns with Bitcoin as "digital gold", portable, divisible, and crisis-resistant without banks. Satoshi solved the "follow the money" issue with a public ledger.

Differences and Context: Epstein's organic metaphor (Frankenstein) differs from Bitcoin's mechanical precision. This was during the credit crunch; bank runs and capital ratio issues were real (e.g., Wachovia's near-collapse). His Al-Qaeda comparison highlights finance's weaponization potential, prescient given later cyber threats.

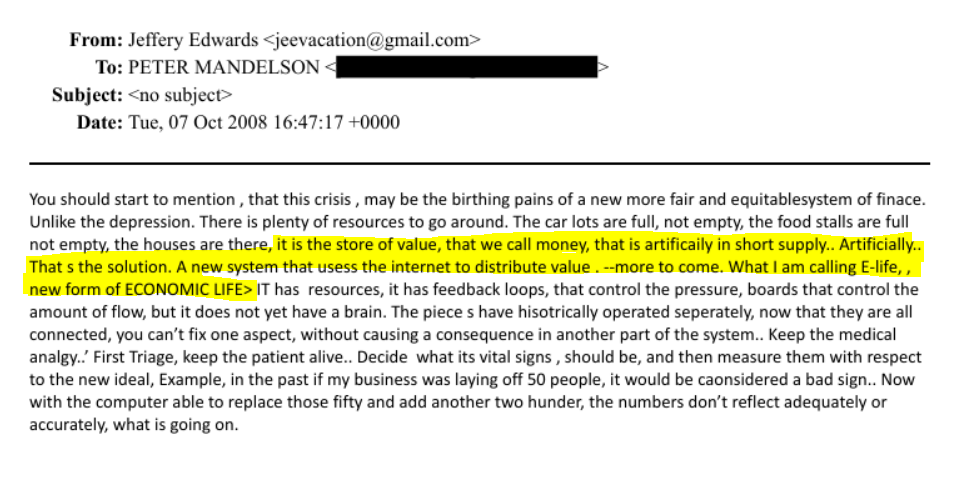

October 7, 2008: Birthing Pains of a New Internet-Based Value System

The most Bitcoin-esque email, sent just three weeks before Satoshi published the Bitcoin whitepaper :

"You should start to mention , that this crisis , may be the birthing pains of a new more fair and equitablesystem of finace. Unlike the depression. There is plenty of resources to go around. The car lots are full, not empty, the food stalls are full not empty, the houses are there, it is the store of value, that we call money, that is artificaily in short supply.. Artificially.. That s the solution. A new system that usess the internet to distribute value. --more to come. What I am calling E-life„ new form of ECONOMIC LIFE> IT has resources, it has feedback loops, that control the pressure, boards that control the amount of flow, but it does not yet have a brain. The pieces have hisotrically operated seperately, now that they are all connected, you can't fix one aspect, without causing a consequence in another part of the system.. Keep the medical analgy2 First Triage, keep the patient alive.. Decide what its vital signs , should be, and then measure them with respect to the new ideal, Example, in the past if my business was laying off 50 people, it would be caonsidered a bad sign.. Now with the computer able to replace those fifty and add another two hunder, the numbers don't reflect adequately or accurately, what is going on."

Epstein sees abundance in resources but scarcity in money's "store of value," proposing an internet-distributed system with feedback loops and interconnected "E-life."

Parallels to Bitcoin: This screams Bitcoin: peer-to-peer value transfer via the internet, fixed supply combating artificial scarcity, and network consensus as feedback (e.g., difficulty adjustment). "Store of value" is Bitcoin's core pitch, and interconnected consequences mirror blockchain propagation.

Differences and Context: Vague compared to Satoshi's tech details (no mention of cryptography). Ideas like eCash (1980s) predated this, but the crisis timing, post-Lehman, days prior to the whitepaper, is uncanny. Epstein's automation example foreshadows AI's job impacts.

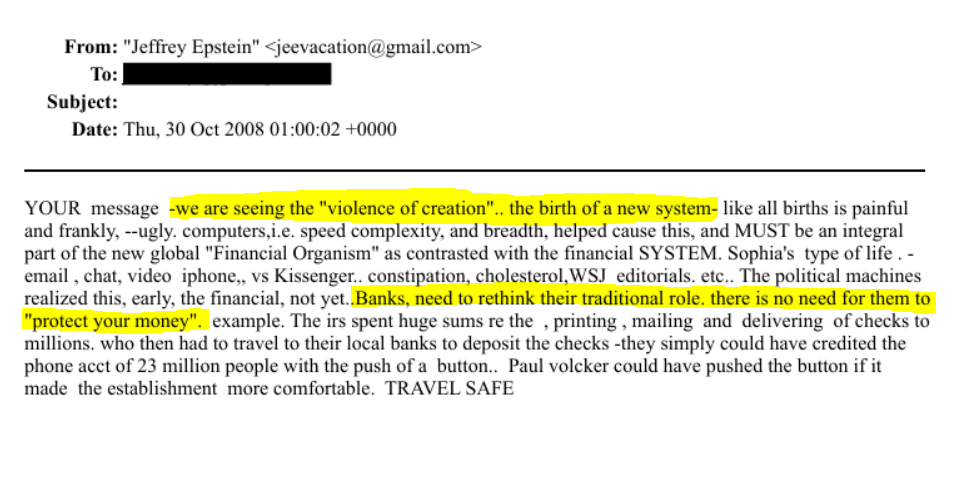

October 30, 2008: The Birth of a "Financial Organism"

Just a one day before the Satoshi Bitcoin whitepaper, Epstein wrote:

"YOUR message -we are seeing the "violence of creation".. the birth of a new system- like all births is painful and frankly, --ugly. computers,i.e. speed complexity, and breadth, helped cause this, and MUST be an integral part of the new global "Financial Organism" as contrasted with the financial SYSTEM. Sophia's type of life . email , chat, video iphone„ vs Kissenger.. constipation, cholesterol,WSJ editorials. etc.. The political machines realized this, early, the financial, not yet..Banks, need to rethink their traditional role. there is no need for them to "protect your money". example. The irs spent huge sums re the , printing , mailing and delivering of checks to millions. who then had to travel to their local banks to deposit the checks -they simply could have credited the phone acct of 23 million people with the push of a button.. Paul volcker could have pushed the button if it made the establishment more comfortable. TRAVEL SAFE"

Epstein evolves to a "Financial Organism," ditching banks for digital efficiency.

Parallels to Bitcoin: Disintermediating banks? Bitcoin's mantra. The IRS example is digital wallets in action. Computers as culprits and saviors align with blockchain's tech foundation. The day before Satoshi's whitepaper announcement is very interesting, in particular, the mention of a "birth of a new system" in context with these other emails in October 2008.

Differences and Context: More biological than Bitcoin's math. The 2008 stimulus checks highlight analog inefficiencies; Epstein's tech contrast (iPhone vs. Kissinger) captures disruption.

Coincidence or Convergence

These emails paint Epstein as a crisis-era visionary on finance's flaws, eerily timed with Bitcoin's birth. Overlaps in trust, internet distribution, and scarcity are striking, but digital cash ideas predated 2008 (Szabo, Chaum). No evidence ties Epstein to Satoshi on the surface, his networks (MIT, tech funders) might explain exposure, but it's speculative.

What does it mean? The 2008 crisis was a catalyst, pushing thinkers toward decentralized alternatives. Today, with Bitcoin and crypto reshaping finance, these musings remind us that innovation often emerges from turmoil.

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!