Epstein Rejected $2 Million Layer1, Grin Investment Over ‘Ponzi Gambling’ Fears

In the world of finance, innovation, and scandal, Jeffrey Epstein's forays into Bitcoin and cryptocurrency reveals a man who was both intrigued by the digital gold rush and at the same time, deeply wary of its pitfalls. Newly surfaced emails from his 2018 correspondence, part of the massive 3.5 million document trove released by the DOJ, paint a vivid picture of a near-miss investment into Layer1, a startup poised to revolutionize privacy-focused crypto through the Grin cryptocurrency.

Epstein was on the verge of dropping $2 million for a 20% stake, but ultimately backed out, labeling Grin and Layer1 as "ponzi gambling" riddled with manipulation and regulatory risks.

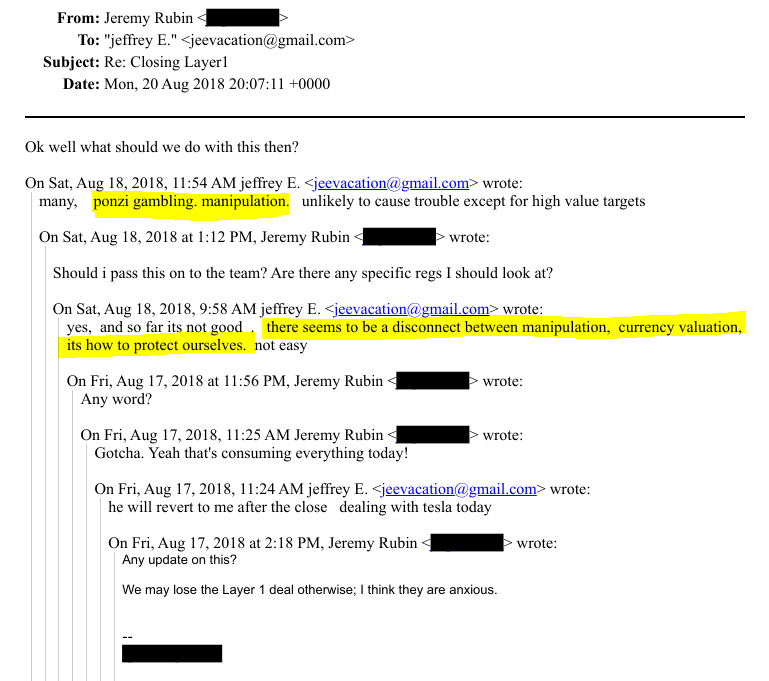

When asked by Bitcoin Core developer Jeremy Rubin who helped to setup a meeting between the Grin/Layer1 founders if there was any word on a possible investment, Epstein said this in an email:

"... so far its not good . there seems to be a disconnect between manipulation, currency valuation, its how to protect ourselves. not easy [...] ponzi gambling. manipulation. unlikely to cause trouble except for high value targets"

This decision, driven by his skepticism, stands in stark contrast to his earlier bets on crypto giants like Coinbase and Blockstream, and it's laced with irony: Peter Thiel swooped in months later, investing as part of a $2.1 million seed round.

Layer1 and the Allure of Grin

Layer1 Labs, founded by Alexander Liegl and John Harada, wasn't your typical crypto play. Launched in mid-2018, the company aimed to blend open-source R&D with investment vehicles, starting with Grin, a privacy-centric cryptocurrency inspired by Mimblewimble protocol. Grin promised anonymous transactions without pre-mined coins or ICO hype; instead, it relied on mining and community development. Layer1's model? Build the tech, mine Grin early, and offer investors exposure via a Special Purpose Vehicle (SPV), essentially betting on Grin as "patient zero" for their strategy.

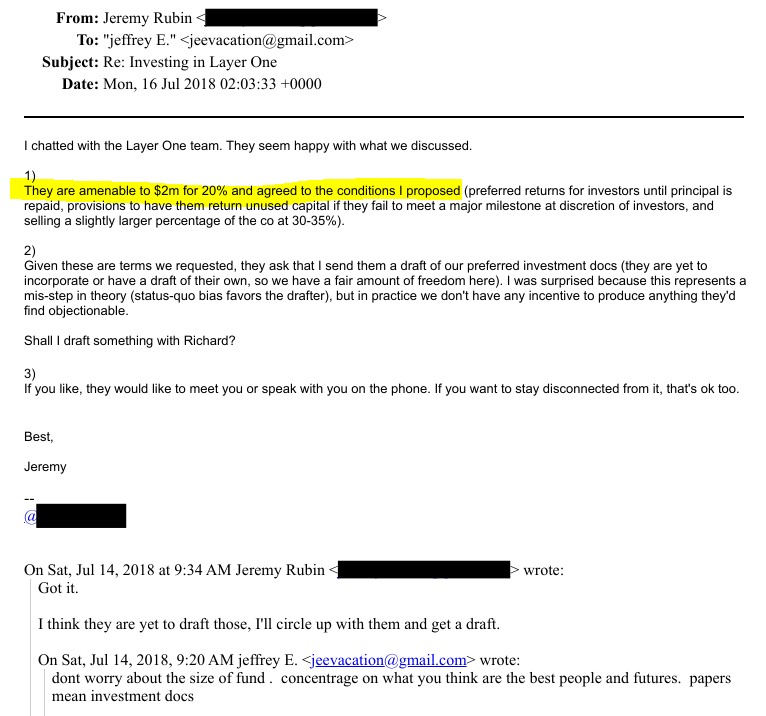

Enter Jeremy Rubin, a young MIT alum and Bitcoin Core contributor, who pitched Epstein in July 2018. Rubin, managing his Deploy Capital fund, saw Layer1 as a gem: a $3.5 million seed raise at a $14 million valuation, with Epstein potentially snagging 1.7% for $250k initially. But Epstein countered aggressively, with emails suggesting $2 million for 20% (or 15% plus warrants).

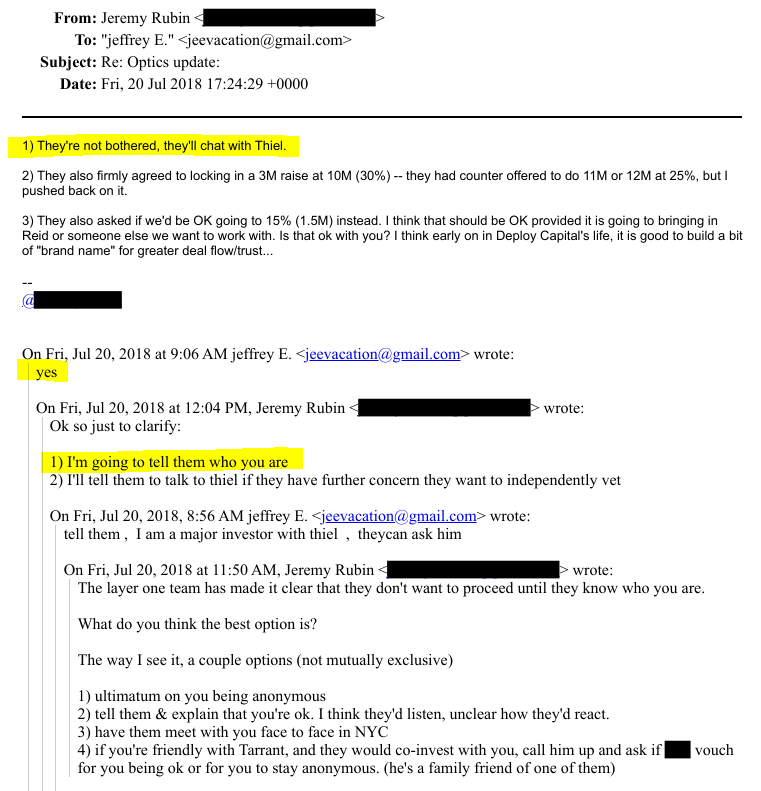

Negotiations heated up, Rubin locked in a lower $3 million raise at $10 million valuation (30% equity sold), added derisking clauses like preferred returns to repay principal first and clawbacks if milestones (like launching the Grin SPV) flopped, and even floated $1.5 million for 15% to make room for "strategic" co-investors.

The emails buzzed with excitement, with soft commits from heavyweights like Thiel ($250–500k), Jeffrey Tarrant ($250k), and others. Rubin pushed for more, eyeing Reid Hoffman and Vincenzo Iozzo's Village Global. A July 19 conference call and an August 9 in-person meeting at Epstein's Manhattan townhouse sealed the diligence phase. It seemed like a done deal.

Epstein's "Ponzi Gambling" Wake-Up Call

But then, cracks appeared. By mid-August, as Rubin pressed for paperwork through Epstein's lawyer Richard Kahn, delays mounted. Epstein's responses turned cautious. In an August 18 email, he wrote: "yes, and so far its not good. there seems to be a disconnect between manipulation, currency valuation, its how to protect ourselves. not easy." He followed up bluntly: "many [regs], ponzi gambling. manipulation. unlikely to cause trouble except for high value targets."

These weren't vague gripes, they zeroed in on Grin's crypto model. Grin, with its emphasis on privacy and no pre-sale, was vulnerable to mining centralization, pump-and-dump schemes, and valuation swings. In 2018, post-ICO bubble, the SEC was cracking down on unregistered securities, and the CFTC eyed manipulation in thinly traded coins. Layer1's SPV structure, investing in the management company while spinning off vehicles for specific cryptos like Grin, smelled like a high-risk gamble to Epstein, where "ponzi" elements (e.g., hype-driven valuations without fundamentals) could expose investors to fraud or regulatory hammers.

Why Pass? Caution Over FOMO

Epstein's decision to walk away boils down to risk aversion. The files show founders initially hesitant about his identity (due to his 2008 conviction), but they warmed up after Rubin disclosed and suggested verifying with Thiel. Epstein even leaned on that connection: "tell them, I am a major investor with Thiel, they can ask him." The "optics" hurdle was cleared, but it appears that Epstein's internal calculus wasn't.

By late August, the trail goes cold. No wire transfers, no signed docs in the files. Layer1 closed its $2.1 million seed in December 2018 without him, at terms eerily similar to what they'd negotiated. Public cap tables list Thiel, Digital Currency Group, Tarrant, and others, but no Epstein or Deploy Capital.

Thiel’s Bet on Layer1 Unravels

Peter Thiel, Epstein's unwitting credibility booster, turned Layer1 into an investment. The startup pivoted from Grin (which launched in 2019 but never hit mainstream hype) to U.S.-based Bitcoin mining and energy infrastructure. By 2019, Layer1 raised a $50 million Series A at a $200 million valuation, led by Thiel and Shasta Ventures.

However, since then, Layer1 faded amid market shifts, and has faced significant turmoil: Multiple lawsuits over control, ownership of power facilities, and allegations of mismanagement (e.g., co-founder disputes, a CEO resignation in 2020, and a 2023 suit against its Swiss parent Enigma Holding AG).

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!