Epstein Funneled Millions Into Bitcoin Through Brock Pierce’s Crypto Currency Partners Fund

In the latest bombshell from the Epstein files, unsealed just weeks ago in a massive dump of over 3.5 million docs, as we thoroughly go through all the relevant Bitcoin and crypto related files, we are starting to get a clearer picture of the financier's shadowy web of influence.

While much of the media focus is on Trump and Epstein and his relationships with high-profile associates, one subject stands out that we continue to look into: Jeffrey Epstein's hidden hand in the early cryptocurrency boom.

Buried in the documents are emails and legal filings from 2014 to 2018 revealing that Epstein didn't just dabble in Bitcoin, he poured millions into it through a bespoke investment vehicle designed to keep his name off the books. At the center of it all is Brock Pierce, the former child actor turned crypto evangelist, and his firm Blockchain Capital. This wasn't casual investing. It was a meticulously structured "funnel" to channel Epstein's cash into the nascent Bitcoin and blockchain ecosystem; companies that would later become well known names in the space.

The revelations paint a picture of Epstein as an early, anonymous whale in crypto, pumping funds into what was then a fringe technology. And thanks to the Epstein files, we now have the paper trail.

The Birth of Crypto Currency Partners II: Epstein's Shadow Fund

It all started in the fall of 2014, when Bitcoin was trading around $400 and the blockchain world was still a wild west of innovators and opportunists. Enter Crypto Currency Partners II (CCP II), a Delaware limited liability company (LLC) structured as a venture capital fund. Officially managed by Brock Pierce and Blockchain Capital, LLC, the fund was pitched as a high-risk, high-reward play on "crypto currencies" and early-stage blockchain startups.

But the real story emerges from the emails. On September 24, 2014, W. Bradford Stephens (co-founder of Blockchain Capital) emailed Brock Pierce the Limited Partnership Agreement (LPA) for "Crypto Currency Partners II, LP," along with wire instructions for an initial capital call. "We anticipate calling a quarter of committed capital every 3-5 months," Stephens wrote, "with the intention to deploy Fund II within the next year and a half."

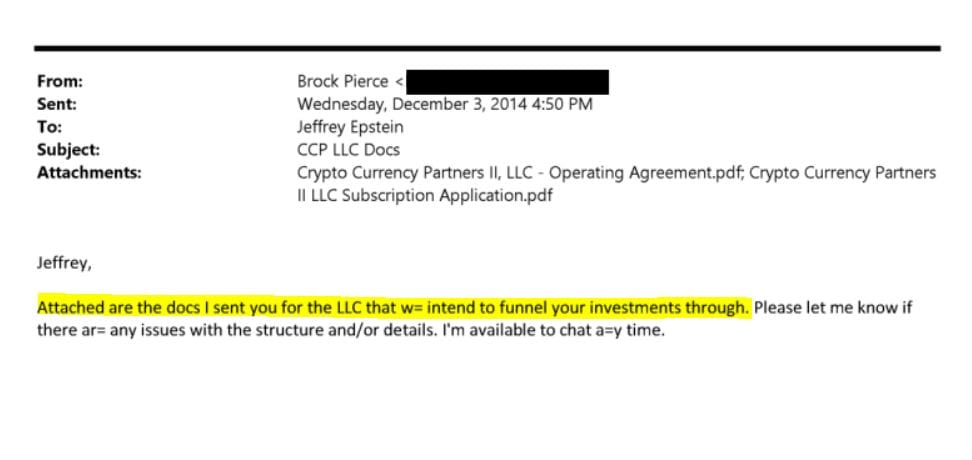

Just weeks later, on December 3, 2014, Pierce forwarded the operating agreement and subscription application directly to Epstein. The subject line? "CCP LLC Docs." In the body, Pierce was crystal clear:

"Jeffrey,

Attached are the docs I sent you for the LLC that we intend to funnel your investments through. Please let me know if there are any issues with the structure and/or details. I'm available to chat any time."

This wasn't subtle. The fund was explicitly designed as Epstein's personal piggy bank for crypto plays. Anonymous, tax-advantaged (treated as a partnership for U.S. tax purposes), and insulated from public scrutiny. The subscription document describes it as a vehicle for "sophisticated, high-net-worth investors" targeting "early-stage, high-risk opportunities" in the crypto space.

By October 2015, CCP II was already deploying capital. An investor update from that period lists a who's who of Bitcoin's foundational players:

- Abra (crypto banking app)

- BitGo (digital asset custody)

- Blockstream (Bitcoin infrastructure)

- Coinbase (crypto exchange)

- ExpressCoin (Bitcoin payments)

- itBit (crypto exchange)

- Kraken (crypto exchange)

- LedgerX (Bitcoin derivatives, also Designer Babies)

- Ripple (cross-border payments)

- And several others

This wasn't pocket change. Epstein's stake in just Coinbase and Blockstream was already big; rumors had swirled for years that he was an early Bitcoin and crypto backer. Now the Epstein-Bitcoin emails confirm it, and then some. Through CCP II, he was spread across the entire ecosystem, seeding what would become a trillion-dollar industry.

The 2016 Fund Close: Epstein as a "Limited Partner"

Fast-forward to January 7, 2016. With the fund fully raised at just over $10 million (slightly above target), Stephens sent a glowing update to the limited partners, including Epstein and Pierce himself. Forwarded by Pierce to Epstein's inner circle (Richard Kahn and Jeffrey Epstein), the email celebrated:

"We are excited to share that we completed our fundraise last month for Crypto Currency Partners II, LP. The fund closed just above our target of $10m.

We are appreciative to have you onboard as limited partners. The fund has already made some excellent investments that are progressing well."

The note highlighted a research call with bank analyst Mike Mayo of CLSA, where over 100 institutional investors discussed blockchain's threat to traditional finance. "2016 is going to be a very exciting break-out year for the blockchain ecosystem," Stephens wrote. Little did they know how right he'd be.

This email cements Epstein's role. He wasn't just an investor—he was a limited partner in a fund that was laser-focused on Bitcoin's infrastructure. And with Blockchain Capital's track record (they'd later invest in surveillance firms like Chainalysis), Epstein's money was helping build the rails for crypto's mainstream explosion.

The 2018 Coinbase Drama: Selling the Epstein Position

By 2018, Coinbase was exploding. Valued at billions after its Series C round. Epstein's $3 million investment (split across CCP II LLC and related entities) was now worth a fortune.

In a string of emails from January 2018, Blockchain Capital's Brad Stephens reached out to Epstein's lawyer, Darren Indyke, offering to repurchase the Coinbase stake held in Epstein's dedicated LLC. The pitch was a clean exit for Epstein, who had "two other bids" but preferred selling to them.

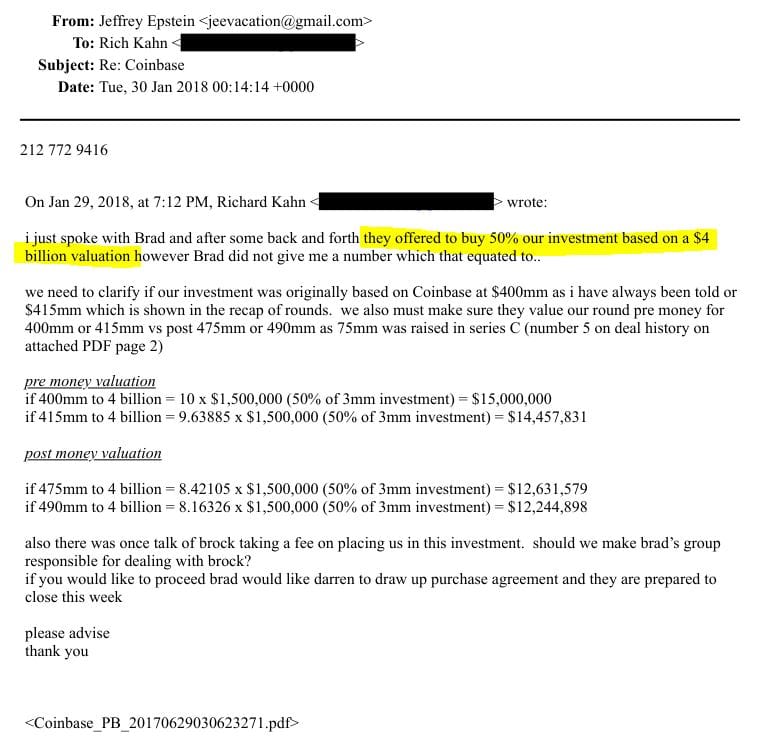

Valuation negotiations were fierce:

- Stephens initially floated $15 million for the full $3 million position (at a $2 billion Coinbase valuation).

- Epstein's team countered with a $4 billion pre-money ask, pushing for $15 million on 50% of the stake.

- Back-and-forth included debates over pre-money vs. post-money valuations, with Epstein's team referencing the original $400 million round.

One email from Richard Kahn to Epstein summed it up: "We need to clarify if our investment was originally based on Coinbase at $400mm... also there was once talk of Brock taking a fee on placing us in this investment."

The deal closed later and the trail shows Epstein's LLC was a key vehicle. It also reveals the lengths taken to obscure his involvement:

"Due to the dedicated LLC structure you created to house the position, purchasing the position from Jeffrey appears to be the simplest, and doesn't need to go through Coinbase," Stephens noted.

Why This Matters: Epstein's Crypto Legacy

The Epstein files don't just expose a rich guy playing in crypto, they reveal a systematic effort to launder influence and shape Bitcoin's future. Jeffrey Epstein invested during crypto's early years, when Bitcoin was being dismissed. His capital helped legitimize projects that now underpin DeFi, NFTs, and institutional adoption.

Consider the scale:

- Coinbase went public in 2021 at a $86 billion valuation. Epstein's early stake? Potentially $100 million+ in paper gains.

- Blockstream remains a Bitcoin core developer, which was a formative player in shaping Bitcoin's path forward.

- Ripple, Kraken, and others? All well known names in a $2 trillion market.

Brock Pierce, who left Blockchain Capital in 2017, has long been vocal about crypto's libertarian roots. But these documents raise uncomfortable questions: How much of the "decentralized" revolution was quietly funded by one of history's most notorious predators?

We created an Epstein Bitcoin Email archive to go through all the newly released Epstein emails relating to Bitcoin, cryptocurrency, and blockchain, to search through all the communications for important information relating to this topic. Try it out!