El Salvador Halts Bitcoin Accumulation Under New IMF Loan Agreement

El Salvador has agreed to cease accumulating Bitcoin in its national portfolio, marking a significant policy shift as outlined in a comprehensive 111-page report released by the International Monetary Fund on March 3, 2025. This decision comes as part of a $1.4 billion loan agreement with the IMF, reflecting the country’s efforts to secure financial support while addressing concerns over its cryptocurrency strategy.

Since adopting Bitcoin as legal tender in 2021, El Salvador had positioned itself as a global leader in cryptocurrency adoption, but the new terms with the IMF signal a retreat from that approach.

Details of the Policy Shift

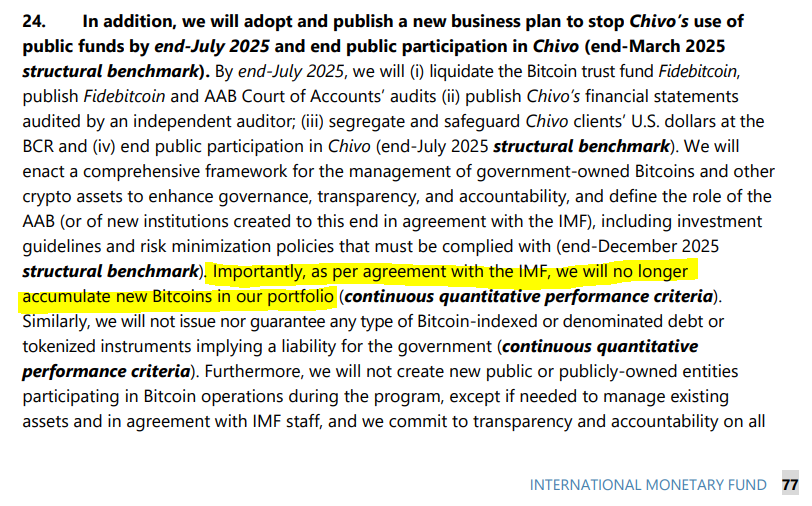

The report specifies that the Salvadoran government will no longer purchase or mine Bitcoin, extending this restriction to its public energy company, La Geo. This move aligns with IMF conditions aimed at mitigating financial risks associated with Bitcoin, which the fund has long viewed skeptically.

The agreement includes specific deadlines for implementation, with changes set to take effect in March, June, and December 2025. These timelines cover a range of adjustments, including halting voluntary Bitcoin accumulation by the public sector and prohibiting the issuance of debt or tokenized instruments tied to the cryptocurrency.

This development follows a period of tension between El Salvador and the IMF, particularly after the country recently added 5 Bitcoin to its strategic reserves. That purchase, reported in early March 2025, appeared to defy the loan conditions, drawing attention from global financial observers and cryptocurrency advocates.

The IMF’s report underscores a broader effort to confine public sector engagement with Bitcoin, ensuring that acceptance of the cryptocurrency remains voluntary for private businesses and prohibiting its use for tax payments or state bills. While El Salvador’s Bitcoin policies have drawn international interest, the new agreement highlights the country’s focus on addressing macroeconomic challenges and securing additional funding from multilateral institutions like the World Bank and the Inter-American Development Bank.