El Salvador Changes Bitcoin Legal Tender Policy to Comply with IMF Loan Terms

In a significant policy shift, El Salvador has passed legislation to modify its approach to Bitcoin adoption, aligning with the stipulations of a substantial financial agreement with the International Monetary Fund (IMF). This adjustment comes after a unanimous decision in Congress, reflecting the country's commitment to securing a $1.4 billion loan intended to bolster its economic reform agenda.

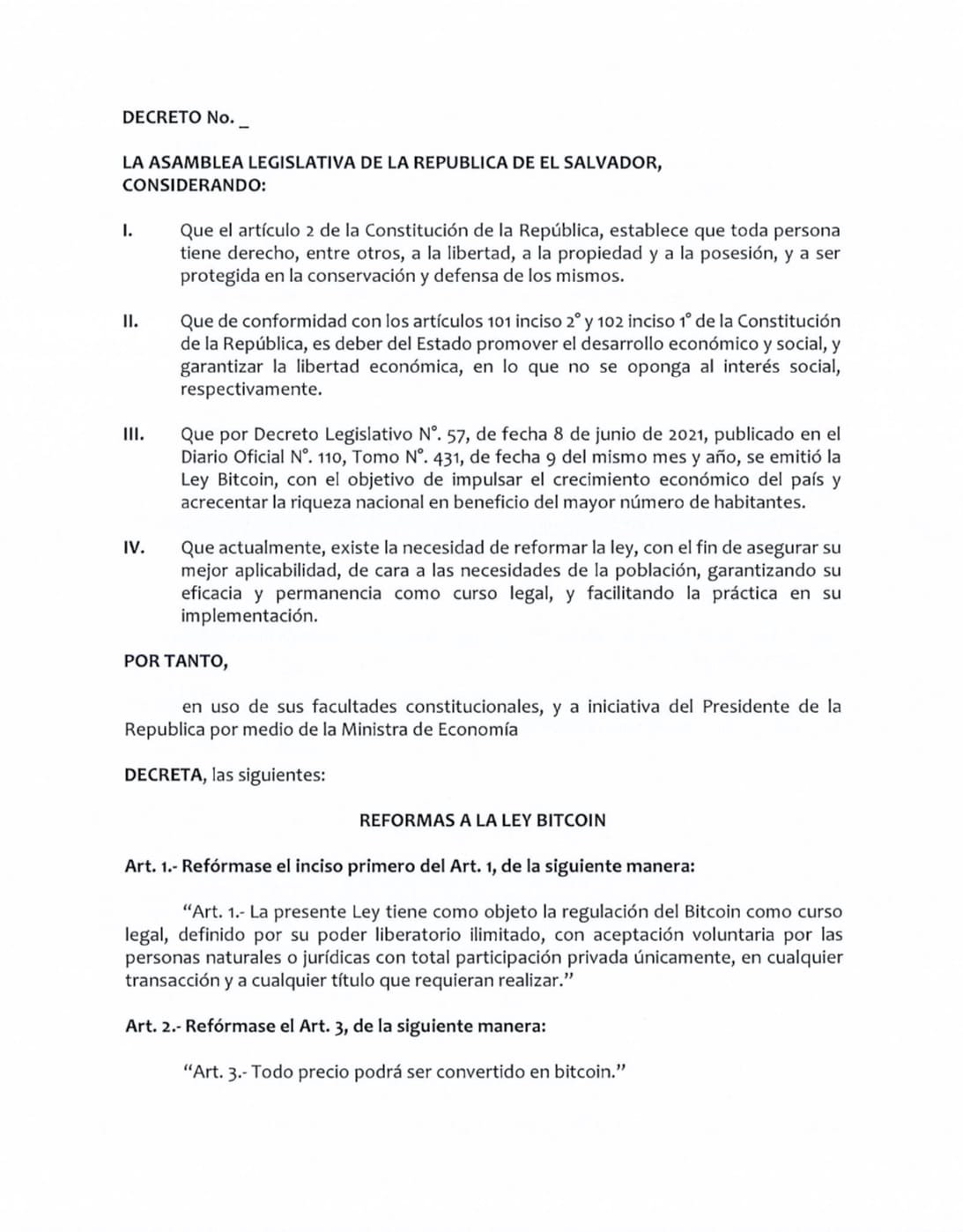

Under the new bill, which was expedited through Congress with just two dissenting votes, the mandatory acceptance of Bitcoin by the private sector has been transformed into a voluntary choice. This legislative change was directly influenced by the conditions set forth in the IMF deal, which was finalized last month as part of a broader strategy to manage El Salvador's balance of payments over the next 40 months.

#Plenaria41 | Con 55 votos a favor, reformamos la Ley Bitcoin para mejorar su aplicabilidad.

— Asamblea Legislativa 🇸🇻 (@AsambleaSV) January 29, 2025

El Salvador Legislative Assembly posted Plenaria41 “With 55 votes in favor, we reform the Bitcoin Law to improve its applicability.”

The IMF has emphasized that this move will enhance transparency, regulation, and oversight of digital assets. Further they said it is crucial for safeguarding financial stability, protecting consumers and investors, and maintaining financial integrity within El Salvador's economy. The fund's statement highlighted these objectives, underscoring the importance of this regulatory overhaul in the context of global financial practices.

El Salvador's journey with Bitcoin began ambitiously in 2021 when it became the first nation to recognize Bitcoin as legal tender. This initiative, spearheaded by President Nayib Bukele, aimed at promoting financial inclusion within the country. Alongside this, Bukele's administration decided to treat Bitcoin as a reserve asset, accumulating a significant amount of the cryptocurrency. According to recent data, El Salvador holds $630 million worth of Bitcoin.

Despite the initial enthusiasm, the adoption of Bitcoin in El Salvador has not progressed as swiftly as hoped. President Bukele himself conceded in August last year that the integration of Bitcoin into everyday transactions faced challenges, suggesting a more tempered view on the cryptocurrency's impact on financial inclusion and economic growth.

Economic Implications and Future Outlook

This legislative pivot marks a pragmatic adjustment in El Salvador's economic policy, reflecting a balance between innovation in digital currencies and the practicalities of international financial relations. By making Bitcoin acceptance voluntary, the government acknowledges the complexities of integrating cryptocurrencies into a traditionally dollarized economy while attempting to maintain the advantages of such digital assets for national reserves.

Looking forward, this could set a precedent for how other nations might navigate the intersection of cryptocurrency policy and international lending requirements. The move also signals to investors and global economic bodies that El Salvador is willing to adapt its strategies to ensure economic stability and growth, even if it means scaling back on some of its more pioneering financial experiments.