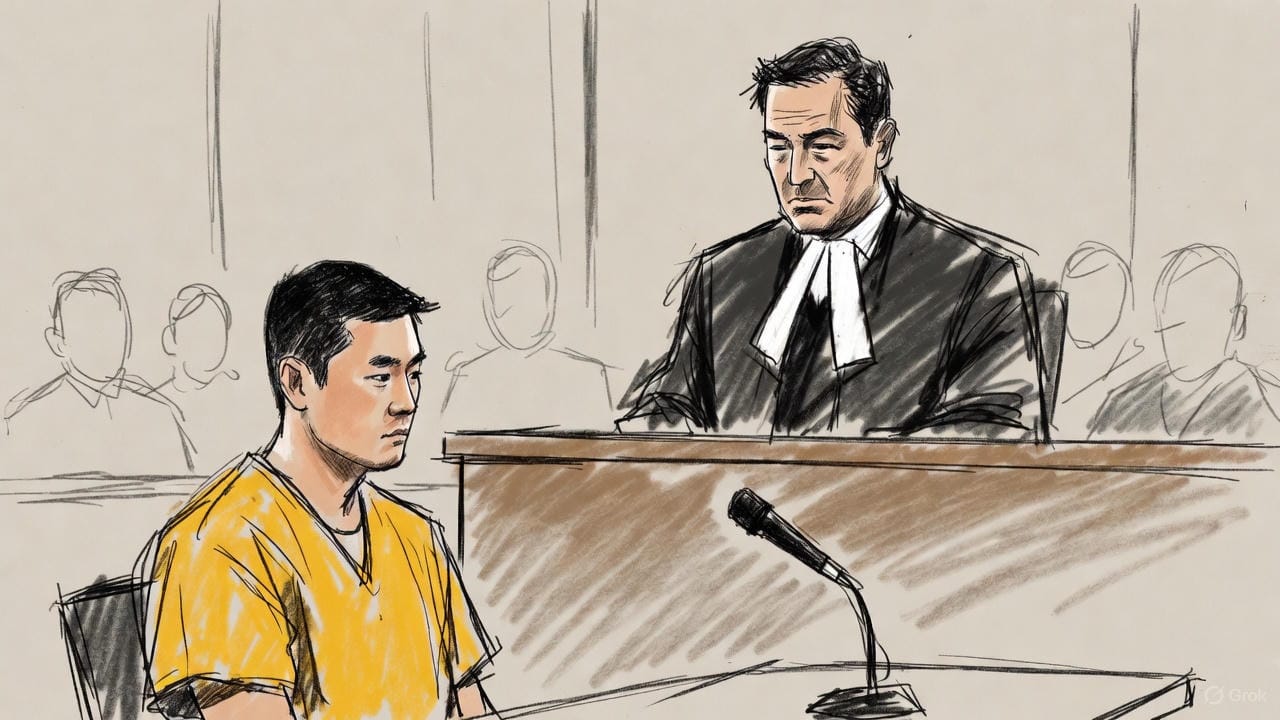

Do Kwon Sentenced to 15 Years in Prison for Terra Luna Collapse Fraud

Terraform Labs co-founder Do Kwon received a 15-year prison sentence in a Manhattan federal courtroom on Thursday for his role in one of the largest financial frauds in cryptocurrency history. The punishment follows the spectacular 2022 collapse of the $40 billion Terra ecosystem, which wiped out savings for hundreds of thousands of investors worldwide. U.S. District Judge Paul Engelmayer handed down the term after describing the scale of the fraud as staggering, even by the standards of New York's Southern District, a court that has handled some of the country's most notorious financial crimes.

The 33-year-old South Korean national had pleaded guilty in August to multiple counts of fraud and market manipulation. During the hearing, Judge Engelmayer repeatedly emphasized Kwon's deliberate deception, pointing to public statements Kwon made on social media at the height of the crisis.

The judge singled out Kwon's now-infamous tweet “Deploying more capital – steady lads” as particularly damaging because it encouraged investors to hold their positions while the algorithmic stablecoin UST was already in freefall.

Kwon cultivated a brash online persona that often dismissed critics and projected unbreakable confidence in Terra’s design. There were other statements he made aside from the 'deploying more capital' that came back to haunt him. For example, the judge referenced his remark on how he wouldn't "debate the poor."

Judge Calls Terra Fraud “Unusually Serious” as Victims Share Devastating Stories

Several victims addressed the court before sentencing according to courtroom reporters, painting a stark picture of financial ruin. One Ukrainian investor told Judge Engelmayer he lost close to $200,000, money he had saved over 17 years, because he believed Kwon's repeated assurances that the system was safe despite offering unsustainable 20% yields through the Anchor lending protocol. Another victim described how the collapse forced him to delay retirement and take on multiple jobs to recover losses. Judge Engelmayer appeared visibly affected by the testimony and later compared Kwon's influence over retail investors to that of a cult leader who deliberately exploited trust.

Federal prosecutors had requested a 12-year sentence, arguing Kwon built an entire financial ecosystem on falsehoods and used sophisticated arbitrage bots to create the illusion of stability. Kwon's defense team asked for five years, highlighting their client's relative youth and lack of prior criminal history. In the end, Judge Engelmayer exceeded the government's recommendation, calling the offense “unusually serious” and stressing that Kwon “chose to lie” at critical moments when transparency could have limited the damage.

Dressed in a yellow prison jumpsuit, Kwon spoke briefly to express remorse and accept full responsibility. He told the court the blame belongs entirely to him for failing to operate the protocol properly and said he hopes his case serves as a warning to future cryptocurrency founders. Kwon also noted he has not seen his family in three years and requested to serve part of his sentence in South Korea. Prosecutors agreed to allow him to transfer there for the second half of his term.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishThe Terra collapse in May 2022 triggered a domino effect across the cryptocurrency industry that contributed directly to several high-profile bankruptcies, including FTX's implosion months later. Unlike other stablecoins backed by cash or bonds, UST relied on complex trading incentives and arbitrage to maintain its dollar peg, a mechanism that proved fatally fragile under market pressure. Earlier this year, a separate civil jury found Kwon and Terraform Labs liable for fraud, resulting in a $4.5 billion settlement with the Securities and Exchange Commission. The company has since moved to dissolve.

Kwon's path to Thursday's sentencing was unusually protracted. After the collapse, he spent months in hiding before being arrested in Montenegro in March 2023 while attempting to board a private flight using a forged Costa Rican passport. A prolonged extradition battle followed until U.S. authorities finally secured his transfer. With credit for time served, Kwon is expected to spend roughly 13 and a half years in custody before becoming eligible for transfer to South Korea.