December 2025 Bitcoin and Crypto Market Sees Cautious Recovery: Report

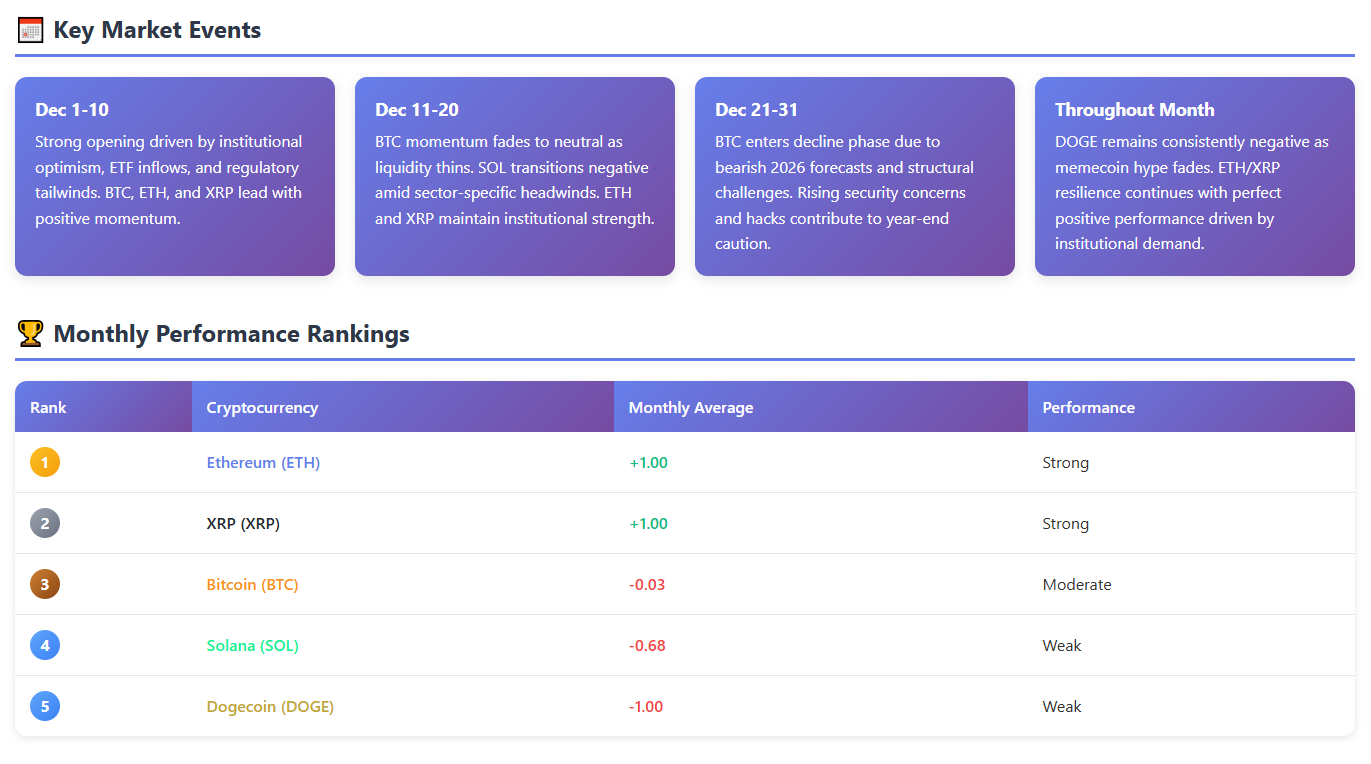

We have has released our latest monthly Bitcoin and Crypto Insights report, capturing the key developments in the cryptocurrency space throughout December 2025. The month brought a period of cautious recovery, as institutional inflows into exchange-traded funds for assets such as Bitcoin and XRP provided support against persistent volatility and slowing momentum in leading coins. This balance allowed the market to stabilize after earlier pressures, setting a tempered tone as the industry moved into the new year.

Altcoins including Solana navigated difficulties, with fading enthusiasm for memecoins and heightened attention to security vulnerabilities contributing to uneven performance. Regulatory conversations advanced in jurisdictions like the United States and Hong Kong, where discussions around stablecoin frameworks and blockchain upgrades offered constructive signals for long-term growth. These elements, combined with continued innovation, helped foster a sense of measured progress despite challenges from hacks and cautious on-chain metrics.

Performance of Leading Cryptocurrencies

Bitcoin traded in a consolidation phase during December, beginning with some institutional outflows from ETFs before inflows resumed and broke recent negative trends. Corporate treasury strategies remained active, exemplified by Metaplanet adding thousands of Bitcoin to reach a total holding of 35,102 BTC by the end of the month. Price levels settled in the $87,000 to $90,000 range, indicating potential stabilization even as some analysts pointed to possible softness in early 2026.

Ethereum exhibited underlying strength through robust network growth, recording a quarterly high of 8.7 million new smart contract deployments in the final three months of 2025. The platform drew significant net inflows while contending with periodic selling pressure and outflows from its ETFs, resulting in relatively contained price movement. This activity reinforced Ethereum's position as a primary destination for capital within layer-one networks.

XRP demonstrated consistent institutional appeal, marked by steady ETF inflows that approached notable milestones and growing engagement in decentralized finance focused on payments. Utilization for cross-border transactions gained further recognition, helping to offset short-term price underperformance and mixed on-chain signals. The asset stood out for its alignment with real-world financial applications amid the broader market environment.

Bitcoin and Crypto Insights December 2025 Report

Read the report & see what's driving growthOverall market sentiment for the cryptocurrency sector in December reflected cautious optimism, supported by increasing institutional participation and technical advancements across protocols. Ongoing security incidents, with exploits contributing to substantial losses during the month, together with lower trading volumes, kept expectations grounded. Signs of maturing infrastructure and wider adoption trends suggested room for gradual improvement ahead.

Entering January 2026, we are closely watching regulatory evolution, including progress on the CLARITY Act and stablecoin policy in the United States. Flows into and out of ETFs for Bitcoin, Ethereum, and XRP will serve as important indicators of changing investor confidence. Efforts to strengthen security across decentralized finance platforms and exchanges will play a vital role in sustaining trust.

Download the complete December 2025 Bitcoin and Crypto Insights report, our exclusive monthly breakdown of the biggest news, trends, and developments, published in the first week of each month and available only to paid subscribers. You can also explore all previous monthly reports in our Insights archive.