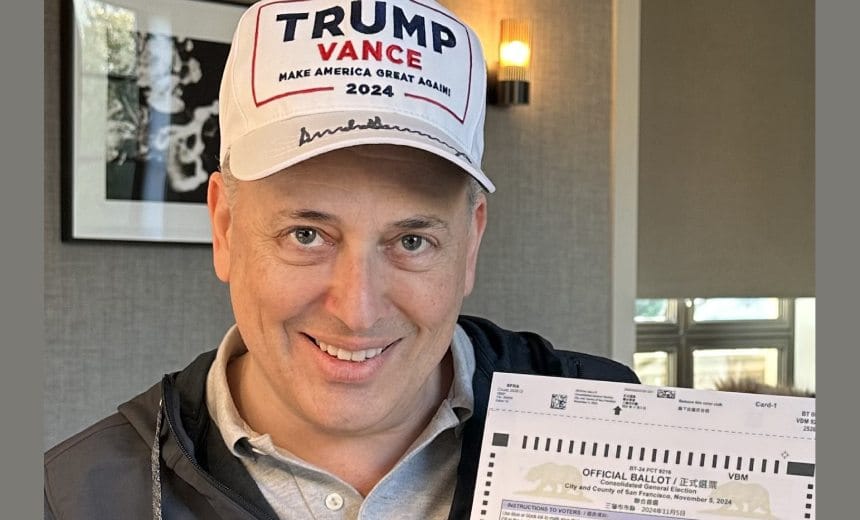

David Sacks Sells Crypto Holdings Before Joining Trump Admin as Crypto Czar

In a move that underscores a commitment to transparency, David Sacks, recently appointed as Donald Trump’s AI and crypto czar, says that he has sold off all his cryptocurrency holdings.

The decision to sell includes digital assets he held such as Bitcoin, Ethereum, and Solana, according to a social media post he wrote. Sacks’ choice to divest comes just as he steps into a high-profile role in an administration poised to influence the future of cryptocurrency in the United States. With Trump pushing forward for a strategic crypto reserve, Sacks’ actions reflect an effort to sidestep any potential conflicts of interest as he takes on this influential position.

The timing of this sale is noteworthy. Trump’s administration has been vocal about embracing crypto, a shift from years of regulatory uncertainty. Reports from late 2024 highlight the president’s push to position the U.S. as a leader in digital assets, including discussions about integrating crypto into national financial strategies.

Sacks, a seasoned tech entrepreneur and investor, brings a deep understanding of both artificial intelligence and blockchain to the table. His decision to unload his personal crypto portfolio suggests a deliberate focus on impartiality, especially as his role could shape policies affecting the very markets he participated in.

Stay In The Loop and Never Miss Important Bitcoin and Crypto News

Sign up and be the first to know when we publishA Broader Context for Crypto in U.S. Politics

Beyond Sacks’ personal financial choices, his appointment signals a broader evolution in how the U.S. government views cryptocurrency. The administration’s interest in a strategic reserve mirrors steps taken by countries like El Salvador, which made Bitcoin legal tender in 2021. Meanwhile, regulatory debates continue to swirl around how to balance innovation with consumer protection.

Sacks’ background, including his time as a venture capitalist backing tech startups, positions him uniquely to bridge Silicon Valley’s ambitions with Washington’s policymaking. His divestment could also reassure skeptics who worry about insider influence in an industry still finding its footing under government oversight.