Crypto Trading Volumes Hit $18.83 Trillion in 2024, Yet Fall Short of 2021’s Record High

The crypto space in 2024 was a whirlwind of activity, with trading volumes across the top 15 centralized exchanges reaching an impressive $18.83 trillion. That’s a hefty jump from the $8.05 trillion recorded in 2023, marking a growth of over 134%.

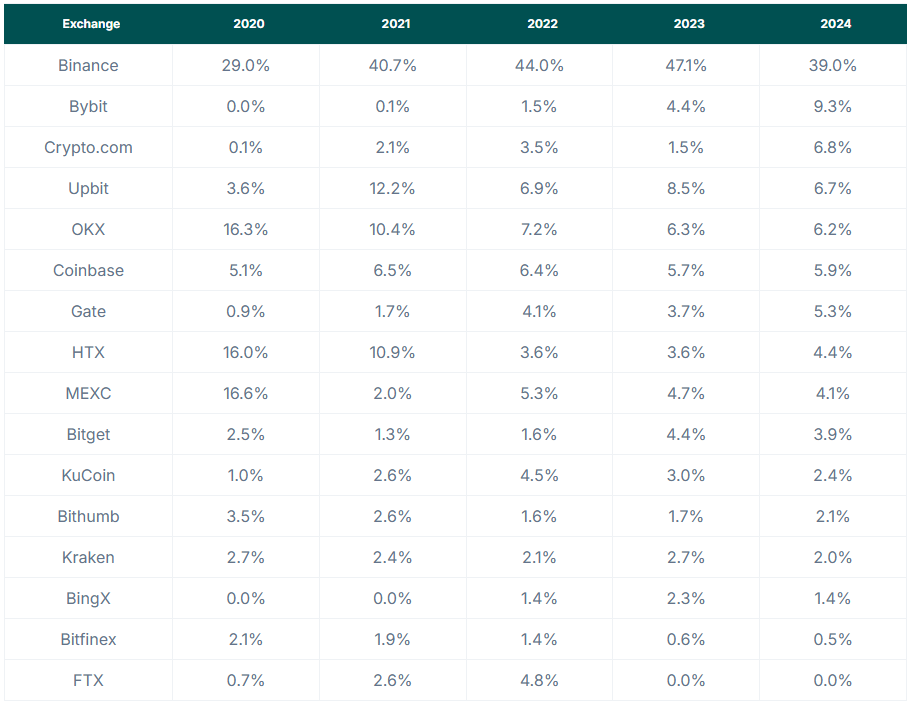

Binance led the pack as the largest player, commanding a 39% market share and racking up $7.35 trillion in trading volume. Right behind it was Bybit, securing a 9.3% slice of the market with $1.75 trillion, while Crypto.com rounded out the top three with a 6.8% share and $1.29 trillion in spot trading volume. Despite these eye-catching numbers, 2024 still couldn’t touch the heights of 2021, when trading volumes soared to a staggering $25.21 trillion during the peak of the bull cycle. The market has clearly rebounded from the quieter years of 2022 and 2023, but that 2021 benchmark remains a towering reminder of just how wild things can get.

When it comes to growth, Crypto.com stole the show in 2024, skyrocketing by nearly 970%. Its trading volume leaped from a modest $120.6 billion in 2023 to a colossal $1.29 trillion, crossing the trillion-dollar threshold for the first time. Bybit wasn’t far behind in the growth race, expanding by almost 398% and climbing from $351.2 billion to $1.75 trillion, also hitting the trillion-dollar mark for the first time since its inception. Gate.io took third place among the fastest risers, with a 241.5% increase that pushed its volume from $294.5 billion to $1.01 trillion.

These surges highlight a dynamic shift in the exchange landscape, where newer platforms are flexing their muscles and challenging the old guard.

Never Miss Important News

Sign up and be the first to know when we publishA Look Back at the Market’s Highs and Shifts

Reflecting on the past few years, 2021 stands out as the undisputed king of trading volume. That year, the top 15 exchanges collectively hit $25.21 trillion, a jaw-dropping 566.8% leap from 2020’s $3.78 trillion.

It was a time when Bitcoin touched $69,044, Terra’s UST stablecoin gained traction, and NFTs exploded onto the scene. Chains like Binance Smart Chain, Polygon, Avalanche, and Fantom buzzed with activity, while Coinbase made waves as it debuted on Nasdaq, quickly becoming the biggest publicly traded crypto firm. The total market value even breached $3 trillion, a milestone that underscored the frenzy of that era. By contrast, 2024’s $18.83 trillion, while strong, shows the market hasn’t yet recaptured that same feverish energy.

Not every exchange has kept pace with the evolving scene. Since 2020, OKX, HTX, and MEXC have seen their market shares slip. Back then, they held 16.3%, 16%, and 16.6% respectively, but by 2024, those figures had dwindled to 6.2%, 4.4%, and 4.1%. Even though their trading volumes either held steady or grew, they’ve been outshone by aggressive newcomers like Crypto.com, Bybit, and BingX.

The rise and fall of FTX also stirred the pot, as it climbed to 2.6% of the market in 2021 and 4.8% in 2022 before crashing out entirely. Meanwhile, Binance has remained a steady titan, maintaining its dominance through the ups and downs. The data, pulled from CoinGecko and spanning January 1, 2020, to December 31, 2024, paints a clear picture of a market in flux, where adaptability and innovation are key to staying relevant.