Crypto Market Soared to $3.91 Trillion in 2024 According to Binance Research

The cryptocurrency market in 2024 wasn't just another blip on the financial radar; it was a monumental rise to a record-breaking $3.91 trillion market cap, as reported by Binance Research. This surge wasn't just numbers on a screen; it was a clear sign of Bitcoin's growing acceptance in the financial world, reaching an all-time high of $108,364. But what fueled this massive growth?

The year was marked by significant institutional adoption, with key Bitcoin acquisitions by major players, alongside a clearer regulatory landscape that seemed to finally embrace the potential of digital currencies. However, this growth wasn't without its hiccups. Towards the end of December, the U.S. Federal Reserve announced a cutback in planned rate reductions for 2025, from four to just two, which led to a sharp correction, shaving off nearly $0.5 trillion from the market's value.

Bitcoin's Stellar Performance

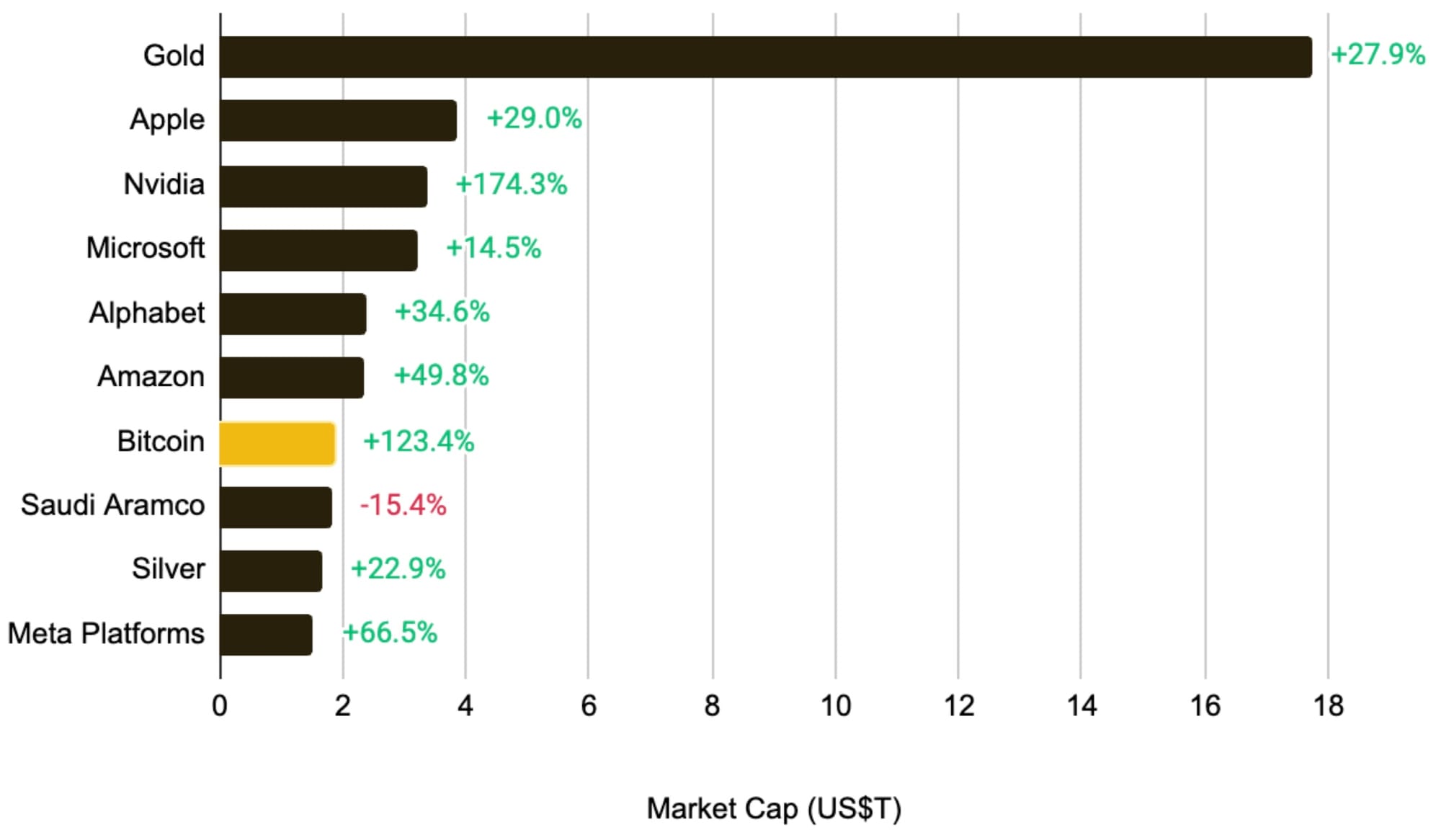

Bitcoin didn't just ride the wave; it led it, ending the year with a staggering over 120% increase in market cap. This performance was not just about numbers; it was about Bitcoin overtaking traditional giants like silver and Saudi Aramco to become the seventh-largest asset globally by market cap. The reasons behind this surge were multifaceted: the Bitcoin halving event, the advent of spot ETFs, and shifts in global monetary policies. These factors combined to paint Bitcoin not just as a speculative asset but as a legitimate part of the investment world.

In the broader crypto ecosystem, stablecoins like USDT and USDC continued to dominate, but the rise of Ethena's USDe, reaching over $5.9 billion, was a noteworthy development, pushing it past DAI to claim the spot of the third-largest stablecoin. The decentralized finance (DeFi) sector also thrived, with record highs in trading volumes for both spot and perpetual markets, and new peaks in total value locked for lending and liquid staking, suggesting a robust expansion trajectory into 2025.

Moreover, the integration of artificial intelligence (AI) agents into the crypto world marked another significant trend. Tokens associated with leading AI agents have now reached valuations in the billions, with daily impressions soaring to around 100,000. Pioneers like ai16z, with their Eliza framework for AI agent creation, and Aixbt, providing daily market insights, illustrate how AI is becoming an integral part of crypto's evolution.

Looking ahead, the crypto industry seems set for another growth spurt in 2025. Institutional interest is not waning; if anything, it's intensifying, and global adoption rates are on an upward trajectory. The market's resilience against corrections and its ability to bounce back indicate not just recovery but a maturation of the crypto space. As more traditional financial entities and new tech innovations like AI weave into the fabric of crypto, we're likely looking at a landscape that's only just beginning to show its potential.

In sum, 2024 was a year where crypto proved its mettle, not just as a speculative venture but as a fundamental part of the new financial order, setting the stage for what could be an even more transformative 2025.