Crypto ATMs on the Rise, Closing in on Record Numbers

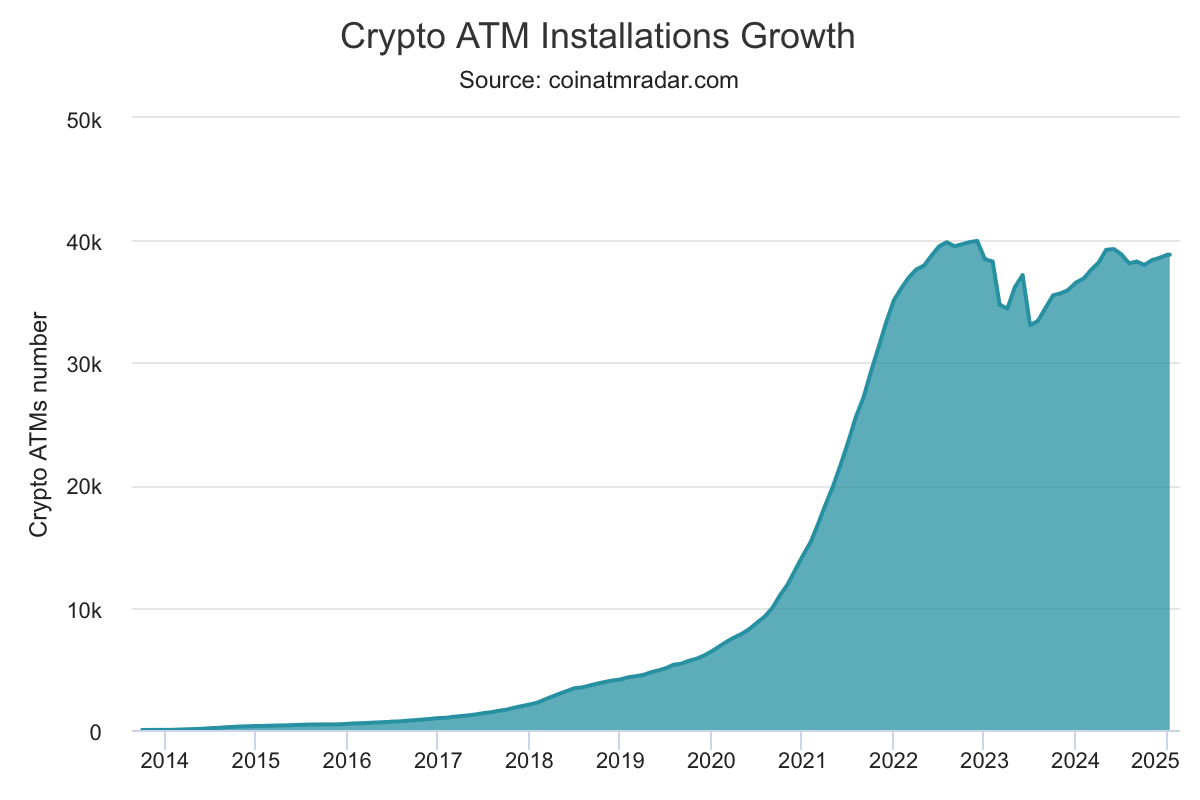

The crypto industry has seen its fair share of ups and downs. However, the landscape of Bitcoin and crypto automated teller machines (ATMs) is showing signs of a robust recovery. As of January 11, 2025, the global count of these machines is just 1,092 units short of the all-time high recorded on December 1, 2022, when there were 39,958 crypto ATMs worldwide.

The Resurgence of Crypto ATMs

After hitting a low of 33,085 machines in July 2023 following multiple industry shocks, for example Terra Luna and FTX, the number of crypto ATMs has been steadily climbing according to data from Coin ATM Radar. The resilience of this sector is evident as the current tally stands at 38,866 machines. This resurgence is not merely a return to form but a testament to the growing acceptance and utility of cryptocurrencies in everyday transactions. Since the start of 2025, 283 new machines have been added, with significant installations in December 2024 alone, showing continued investor and consumer interest.

Bitcoin Depot leads the pack as the largest operator, with 8,486 ATMs under its management, followed by Coinflip with 5,289 and Athena Bitcoin with 3,797. These operators have been pivotal in expanding the network, ensuring that users have accessible points for converting digital currency into cash and vice versa.

Geographically, the United States remains the epicenter for crypto ATM installations, hosting over 81% of the world's machines. This dominance is indicative of a robust market for cryptocurrencies in the country, despite regulatory challenges. Europe, Oceania, and Australia follow, with each region contributing to the global spread of these machines, with Europe holding 4.3%, Oceania 4%, and Australia 3.5% of the total.

The majority of these ATMs support Bitcoin, with 38,855 machines accepting it, which underscores its position as the leading cryptocurrency. However, other cryptocurrencies are gaining traction, with Litecoin supported by 54.2% of the machines, Ethereum by 53.3%, and Dogecoin by 27.7%. This diversification indicates a broadening interest in various digital assets, providing users with more options for transactions.

The growth and distribution of crypto ATMs reflect a broader trend towards decentralized finance (DeFi) solutions. These machines serve as physical touchpoints for digital finance, bridging the gap between the digital and physical worlds. They offer an immediate and tangible way for individuals to interact with cryptocurrencies, providing both an entry point for new users and a convenient exchange for seasoned investors.

The resurgence of crypto ATMs illustrates the sector's adaptability and the underlying demand for accessible, decentralized financial tools. As we move through 2025, the trends in crypto ATM installations will likely continue to be influenced by regulatory changes, market sentiments, and technological advancements.