Corporate Bitcoin Holdings Soar in Q1 2025 Bitwise Report Reveals Growing Adoption Trend

The latest Q1 2025 report from Bitwise paints a clear picture of a significant shift in the corporate world as more public companies embrace Bitcoin as a treasury asset.

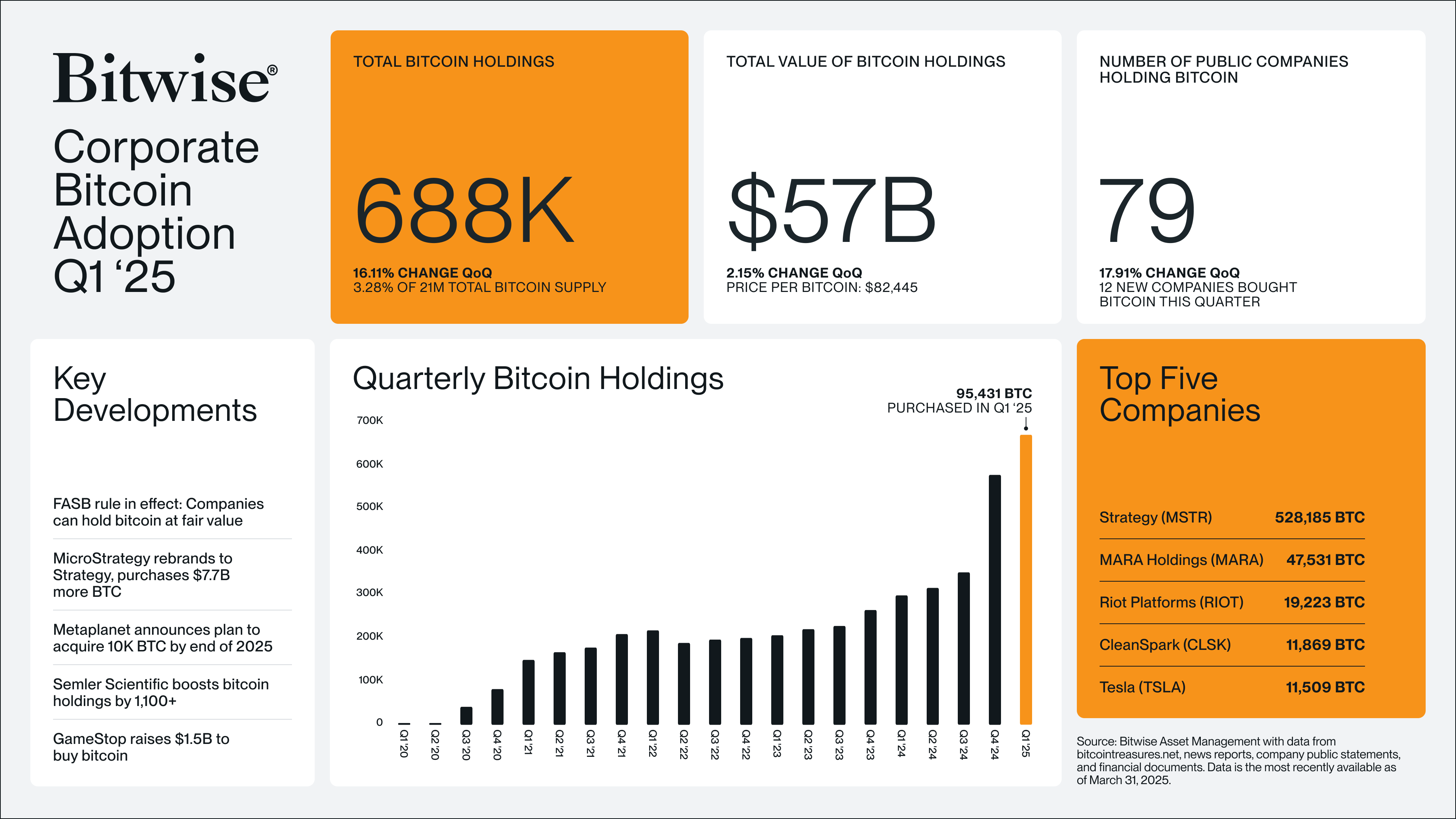

According to the data, 79 public companies now hold a combined total of 688,000 Bitcoins, valued at approximately $57 billion. This marks a notable 31% increase in Bitcoin holdings compared to the previous quarter, reflecting a growing confidence in the cryptocurrency among corporate leaders. The report underscores a broader trend of institutional adoption, driven by a mix of economic factors and evolving financial strategies.

Strategy (formerly MicroStrategy), continues to dominate this space, holding 528,185 BTC, which accounts for over 76% of the total corporate Bitcoin holdings. The company’s long-standing commitment to Bitcoin as a reserve asset has set a precedent for others to follow. Trailing behind are firms like Marathon Digital and Riot Platforms, both of which are primarily Bitcoin mining companies. Their presence in the top five highlights a concentrated trend where mining firms play a significant role in corporate Bitcoin accumulation. Other notable holders include Hut 8 and CleanSpark, rounding out the list of leading corporate adopters.

A Surge in New Corporate Bitcoin Investors

The Bitwise report also highlights a 53% increase in new corporate adopters during Q1 2025, a figure that aligns with predictions made by Bitwise CEO Hunter Horsley. Earlier this year, Horsley forecasted that 2025 would mark a pivotal moment for corporate Bitcoin adoption, a sentiment that appears to be coming to fruition.

Despite this growth, the report acknowledges that widespread adoption among major corporations has been slow in the past, with many firms historically hesitant to allocate significant portions of their treasuries to Bitcoin. However, the recent uptick in new entrants suggests that perceptions are shifting, potentially influenced by Bitcoin’s price appreciation and a more favorable regulatory environment.

This data comes at a time when Bitcoin’s role in corporate finance is under increasing scrutiny. The Bitwise report provides a snapshot of a market in transition, where companies are beginning to see Bitcoin not just as a speculative asset but as a strategic reserve. As more firms explore this avenue, the trend of corporate Bitcoin adoption is likely to gain further momentum, reshaping the financial landscape in the process.