Coinbase Launches Bitcoin Rewards Credit Card to Compete with Gemini

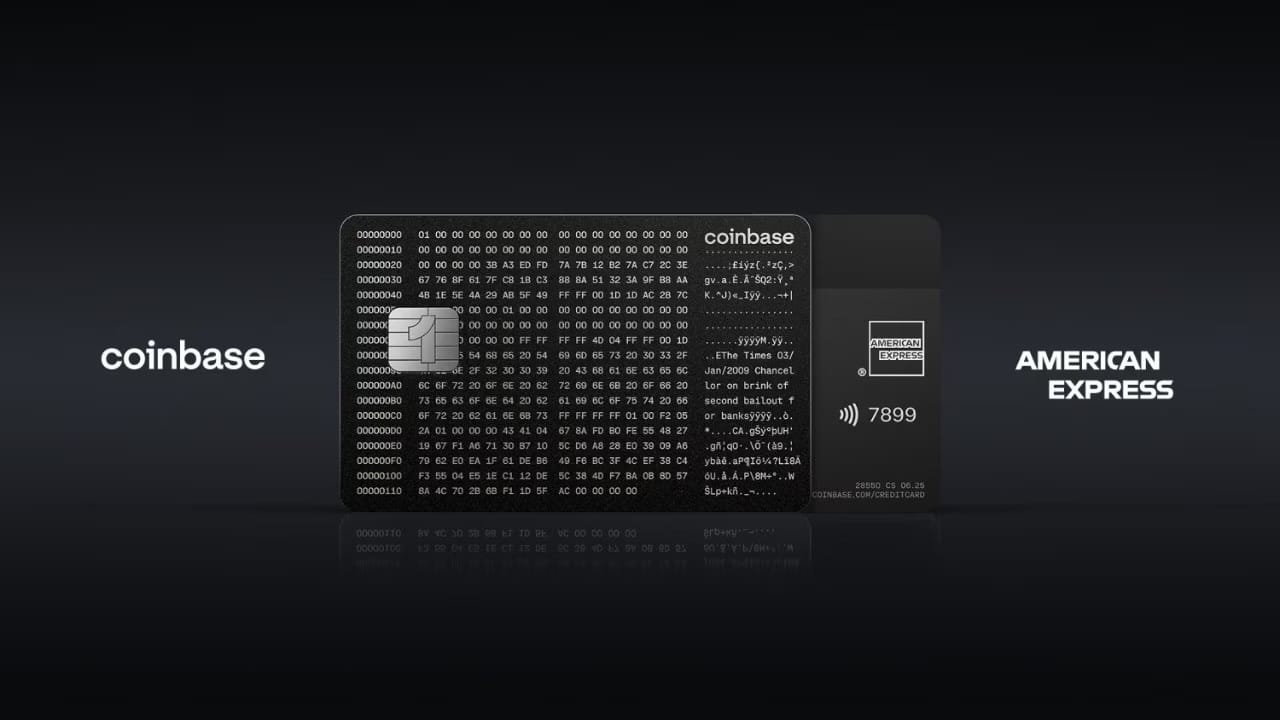

Coinbase, a leading cryptocurrency exchange, announced the launch of a new American Express credit card offering Bitcoin cashback rewards at its 2025 State of Crypto Summit on Thursday. The Coinbase One Card, exclusively available to Coinbase One subscribers, aims to integrate cryptocurrency into everyday spending by providing up to 4% in Bitcoin rewards on purchases. This move positions Coinbase as a direct competitor to rival exchange Gemini, which introduced a similar crypto rewards credit card in 2021. Set to launch this fall, the Coinbase One Card marks a significant step in bridging traditional finance with digital assets.

The Coinbase One Card is designed to appeal to the exchange’s premium subscribers, who pay a monthly fee for benefits like zero transaction fees, priority customer support, and enhanced staking rewards. Rewards on the card scale based on the amount of digital assets a user holds on Coinbase, incentivizing deeper engagement with the platform. By partnering with American Express, Coinbase taps into a reputable network for premium services, though its merchant acceptance is slightly limited compared to competitors like Mastercard. The card’s Bitcoin rewards structure aims to attract crypto enthusiasts looking to earn digital assets through routine purchases.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishComparing Coinbase and Gemini’s Crypto Credit Cards

Gemini’s credit card, launched in 2021, offers up to 4% in Bitcoin or various cryptocurrencies as rewards through a partnership with Mastercard. With its Mastercard backing, Gemini ensures broader merchant acceptance, particularly at smaller businesses and globally. American Express, while widely accepted at major U.S. retailers, restaurants, and online platforms, often faces resistance from smaller merchants due to higher transaction fees, typically ranging from 2% to 3% more. This difference could influence user preference depending on their spending habits and preferred merchants.

The Coinbase One Card’s reward potential may appeal to users heavily invested in Coinbase’s ecosystem, particularly those holding significant digital assets. However, the card’s exclusivity to Coinbase One subscribers limits its accessibility compared to Gemini’s offering, which has no such subscription requirement, and Gemini also offers various cryptocurrency reward options. The choice between the two cards may hinge on factors like merchant acceptance, reward rates, and whether users value Coinbase’s premium subscription perks. As competition in the crypto rewards space heats up, both exchanges are betting on integrating digital assets into everyday financial products to drive adoption.