Coinbase CEO Brian Armstrong Emphasizes Bitcoin at Davos Panel

A panel discussion at the World Economic Forum in Davos brought cryptocurrency into sharp focus when Coinbase CEO Brian Armstrong exchanged views with Banque de France Governor François Villeroy de Galhau. The session, titled "Is Tokenization the Future," took place on January 21, 2026, and featured leaders from finance and blockchain sectors. Armstrong used the opportunity to highlight Bitcoin's unique structure as a decentralized protocol during a debate on monetary trust and independence.

The discussion drew wider notice once short clips began circulating online. Armstrong’s clear breakdown of Bitcoin’s architecture, and how it differs from institution‑run financial systems, earned broad praise. The moment added fresh momentum to the broader debate over digital assets and their place in global finance.

Coinbase CEO Brian Armstrong speaking about Bitcoin decentralization at Davos

Armstrong's Defense of Bitcoin Structure

Villeroy de Galhau expressed preference for central banks, noting their democratic mandates provide a level of trust he finds lacking in private alternatives. He specifically mentioned skepticism toward the idea of a Bitcoin standard, emphasizing the importance of public control over money. Armstrong responded by clarifying that Bitcoin operates differently from issued currencies.

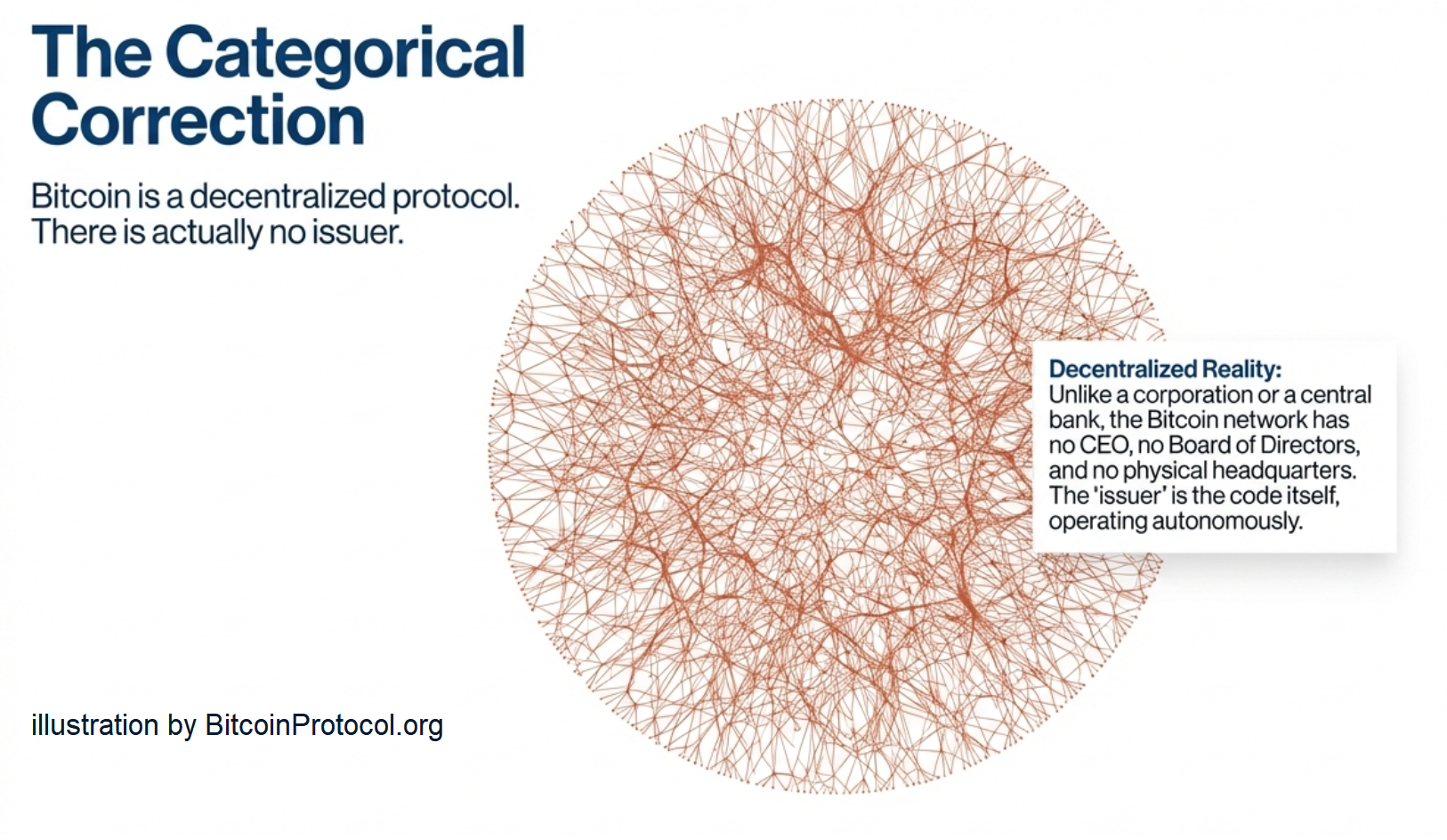

Bitcoin functions as a decentralized protocol with no central issuer, Armstrong explained to the panel. No country, company, or individual controls its supply or operations, making it structurally independent in a way central banks cannot replicate. The benefits of this design, he argued, introduces healthy competition to monetary systems.

"Bitcoin is a decentralized protocol. There's actually no issuer of it ... In the sense that central banks have independence. Bitcoin is even more independent. There's no country or company or individual who controls it in the world."

Armstrong further described Bitcoin as a fixed-supply asset without a money printer, offering predictability through code rather than policy decisions. He suggested this feature serves as a check on excessive deficit spending by governments. Citizens can choose assets they trust more, potentially encouraging fiscal discipline in traditional currencies.

The panel also touched on tokenization's potential to streamline payments and asset management. Participants agreed innovation in private digital money requires regulation to build confidence. Armstrong positioned Bitcoin as complementary to fiat systems, providing options for users concerned about inflation or currency debasement.