Circle Debuts on NYSE as USDC Stablecoin Market Cap Soars

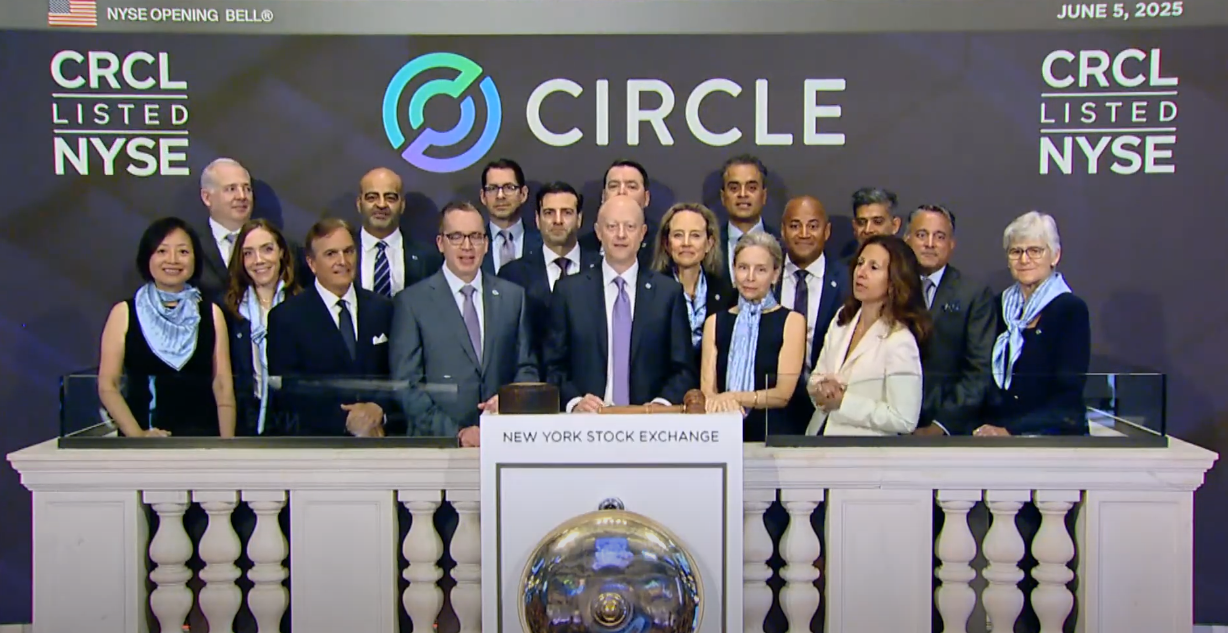

Circle, the issuer of the world’s second-largest stablecoin, USDC, officially began trading on the New York Stock Exchange under the ticker CRCL on June 5, 2025. The milestone marks a significant step for the company, which has grown from a visionary startup to a major player in the global crypto market. Circle’s CEO, Jeremy Allaire, announced the public debut, emphasizing the company’s mission to transform the financial system by leveraging internet-native technologies. Founded in 2013 by Allaire and Sean Neville, Circle has prioritized trust, transparency, and regulatory compliance, positioning itself as a leader in the stablecoin sector.

The public listing follows Circle’s upsized initial public offering, which raised $1.05 billion through the sale of 34 million shares at $31 each. Initially, the company planned to offer 24 million shares priced between $24 and $26, but strong investor demand led to the expansion. This successful IPO reflects growing confidence in Circle’s business model and the broader adoption of stablecoins as a reliable digital asset class. Allaire described the transition to a public company as a “powerful milestone,” signaling readiness for a new era of internet-based financial systems.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishUSDC Growth and Market Position

Circle’s flagship product, the USDC stablecoin, has experienced remarkable growth, solidifying its role as a cornerstone of the cryptocurrency market. Data indicates that USDC’s market value surged by over 40% in 2025, rising from $43.7 billion on January 1 to $61.5 billion, with a peak above $62 billion in April. This expansion underscores the increasing demand for stablecoins, which offer price stability by being pegged to assets like the U.S. dollar. As the seventh-largest cryptocurrency by market value, USDC trails only Tether (USDT) which dominates the stablecoin market with a $153.9 billion market cap.

The stablecoin market has become a critical component of the crypto ecosystem, facilitating transactions, decentralized finance applications, and cross-border payments. Unlike Tether, Circle has emphasized regulatory compliance and transparency, earning trust from institutional and retail users alike. The company’s focus on ethical governance has helped USDC gain traction in a competitive landscape. Other public companies, such as PayPal with its PYUSD stablecoin, have entered the market, but PYUSD remains significantly smaller, with a market cap below $1 billion.

Circle’s NYSE debut arrives at a time when stablecoins are gaining mainstream acceptance. Financial institutions and businesses increasingly view stablecoins as a bridge between traditional finance and blockchain-based systems. Circle’s ability to scale USDC’s adoption while maintaining regulatory standards has positioned it favorably among investors. The company’s public listing not only enhances its visibility but also provides capital to further innovate in the digital asset space.

The broader cryptocurrency market continues to evolve, with stablecoins playing a pivotal role in its maturation. Circle’s growth reflects the sector’s potential to reshape global finance, offering faster, more efficient, and accessible financial services. As USDC’s market cap climbs, Circle’s public status strengthens its ability to compete with industry giants like Tether. The company’s journey from a 2013 startup to an NYSE-listed firm highlights the transformative power of blockchain technology and the growing appetite for digital currencies.