Chinese Laundering Networks Process $16.1 Billion as Crypto Crime Rises

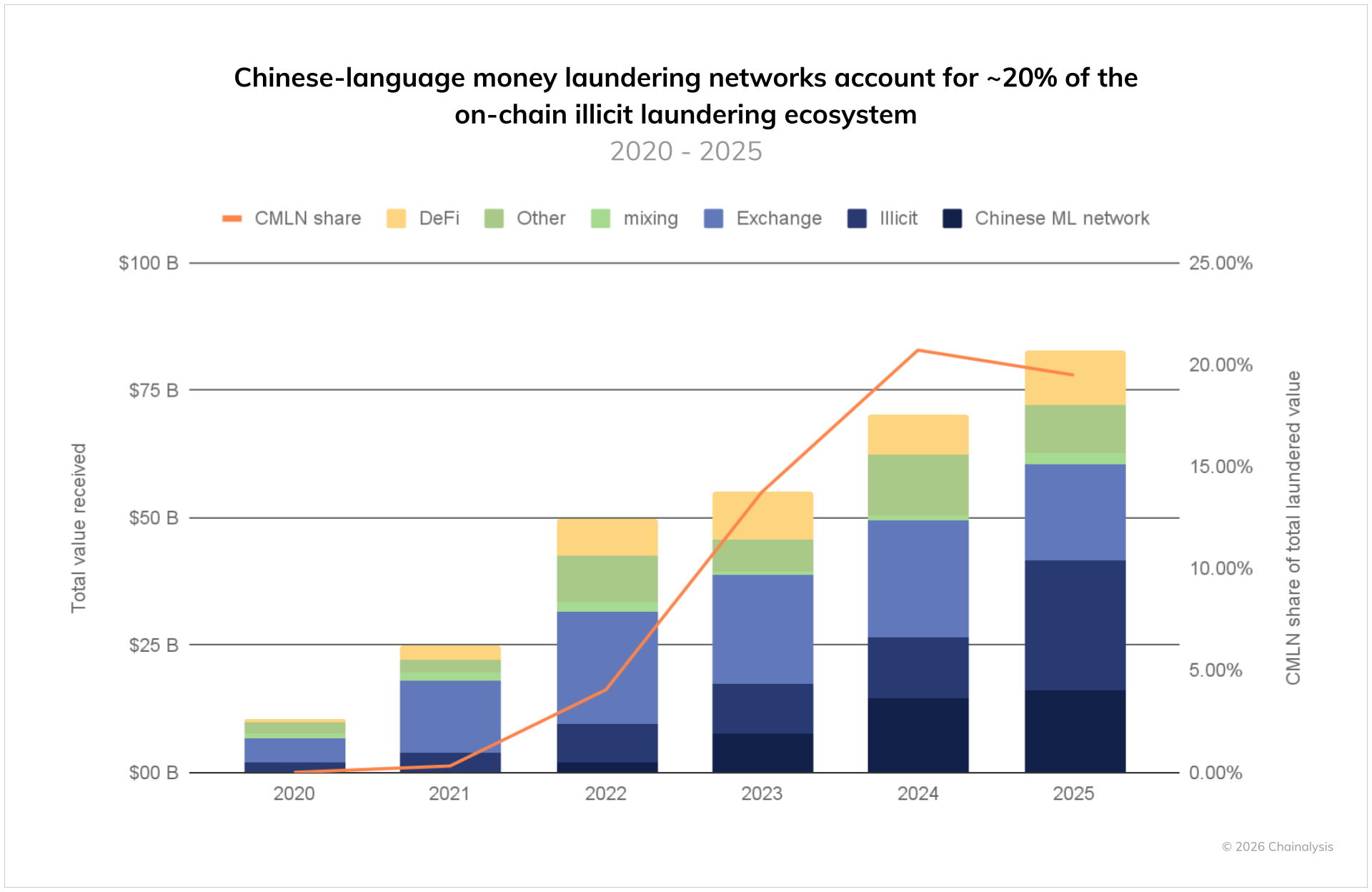

New data shows that Chinese-language money laundering networks have become the leading channel for illicit cryptocurrency flows worldwide. According to a new report from Chainalysis, these networks processed an estimated $16.1 billion in 2025 through more than 1,799 active wallets. This activity now accounts for roughly 20% of all known crypto laundering globally.

The shift represents a significant change in the criminal landscape. Traditional centralized exchanges, once the primary route for cleaning illicit funds, have been overtaken by decentralized, Telegram-based operations run predominantly in Chinese. These networks have demonstrated remarkable resilience despite ongoing enforcement efforts by authorities in multiple countries.

Rapid Growth Fueled by Capital Controls

Inflows to these Chinese-language networks have expanded at an extraordinary pace since 2020. Chainalysis found that funds moving into identified networks grew 7,325 times faster than inflows to centralized exchanges used for laundering during the same period. Growth also far outpaced decentralized finance platforms and other on-chain illicit transfers.

The report identifies six main service categories within this ecosystem: running point brokers, money mules, over-the-counter desks, Black U services, gambling platforms, and specialized money movement providers. Black U services, which focus on laundering proceeds from hacks, exploits, and scams, reached $1 billion in volume in just 236 days, the quickest scaling of any category tracked. These services completed large transactions in an average of 1.6 minutes during the final quarter of 2025.

Chinese capital controls are widely cited as the primary driver behind the networks’ development. Wealthy individuals seeking to move funds out of the country created a deep liquidity pool that criminal groups later tapped. Tom Keatinge, director at the Centre for Finance & Security at RUSI, explained that these networks quickly evolved into multi-billion-dollar operations serving transnational crime groups in Europe and North America.

Chris Urben, managing director at Nardello & Co, noted a clear transition in recent years from traditional underground banking to cryptocurrency-based methods. This shift has made the networks more efficient and harder to trace than older informal value transfer systems. The combination of restricted capital movement and ready liquidity, value-for-money laundering services has attracted a growing client base beyond Asia.

Disrupting advertising platforms like Huione Guarantee has not stopped the underlying activity. After Telegram removed certain accounts linked to Huione (Haowang), many vendors simply migrated to alternative channels and continued operations without interruption. Chainalysis emphasizes that these guarantee platforms primarily serve as marketing and escrow venues rather than direct controllers of the laundering process.

The geographic reach of these networks now extends across multiple continents. Some vendors openly coordinate teams in Africa, indicating expansion far beyond East Asia. Different service types employ distinct on-chain behaviors, with some fragmenting large sums into smaller transactions and others consolidating funds for integration into legitimate systems.

Law enforcement continues to face significant obstacles in addressing the scale and speed of these operations. Experts stress the need for closer public-private collaboration and the combined use of open-source intelligence, human sources, and blockchain analysis. Recent U.S. actions, including FinCEN’s designation of the Huione Group and Treasury sanctions on related entities, highlight growing recognition of the national security risks posed by networks that handle funds from scams and state-sponsored hacking campaigns.