Cantor Fitzgerald Unveils $2 Billion Bitcoin Financing Venture to Empower Crypto Investors

In a bold step toward integrating cryptocurrency with traditional financial systems, Cantor Fitzgerald, a prominent global financial services firm, has announced the launch of a Bitcoin financing business.

Based in New York, the Wall Street powerhouse is rolling out this initiative with an initial $2 billion in financing, signaling its intent to cater to the rising demand for Bitcoin related investment tools. The company plans to scale this venture significantly in the coming years, positioning itself as a key player in the evolving digital asset landscape. By offering leverage to Bitcoin holders, Cantor Fitzgerald aims to help investors amplify their positions while collaborating with carefully selected bitcoin custodians to ensure a smooth rollout.

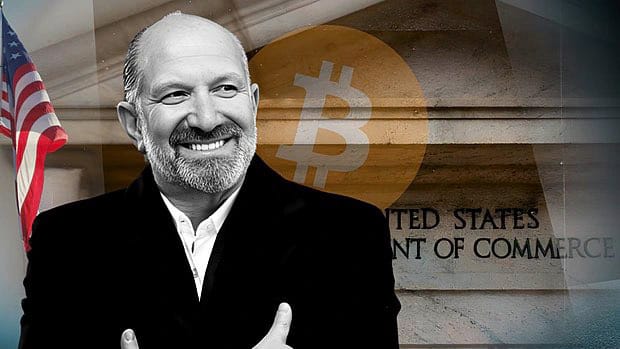

Howard Lutnick, the firm’s chairman, expressed enthusiasm about the move, emphasizing Cantor Fitzgerald’s long-standing expertise in arranging and financing securities and commodities. He highlighted the company’s strong belief in Bitcoin’s potential, noting that this new platform will provide robust support for investors’ financing needs. Lutnick underscored the firm’s ambition to bridge the divide between conventional finance and the burgeoning world of digital assets, a mission that aligns with its decades-long legacy of innovation.

Founded in 1945, Cantor Fitzgerald employs more than 12,000 people worldwide and has built a reputation in investment banking, fixed-income trading, and asset management, bolstered by its status as a Primary Dealer authorized to transact with the Federal Reserve Bank of New York.

Stay In The Loop and Never Miss Important Bitcoin and Crypto News

Sign up and be the first to know when we publishA Strategic Blend of Traditional Finance and Cryptocurrency Expertise

Cantor Fitzgerald’s foray into Bitcoin financing builds on its existing ties to the cryptocurrency ecosystem, notably through its relationship with Tether, the issuer of the world’s largest stablecoin. The firm holds a 5% stake in Tether, valued at $600 million, and acts as the primary custodian for Tether’s vast reserves, which are predominantly invested in U.S. Treasuries.

This partnership generates substantial annual fees, reportedly in the tens of millions, and provides a financial foundation that complements Cantor’s Bitcoin-backed lending ambitions. By leveraging its experience in traditional finance, the company is uniquely positioned to merge established practices with the dynamic opportunities presented by digital currencies.

The firm’s financial health further supports its expansion into this new territory. With annual revenue of approximately $673.6 million and assets under management totaling around $5 billion, Cantor Fitzgerald brings significant resources to the table. Its Irish division, meanwhile, oversees €8.2 billion in assets, reflecting the company’s global reach.

This Bitcoin financing initiative marks a strategic pivot, aligning Cantor Fitzgerald’s deep-rooted expertise with the growing influence of cryptocurrency markets. As investor interest in Bitcoin continues to climb, the firm’s move could set a precedent for how Wall Street engages with digital assets, offering a model that balances innovation with the stability of traditional financial systems.