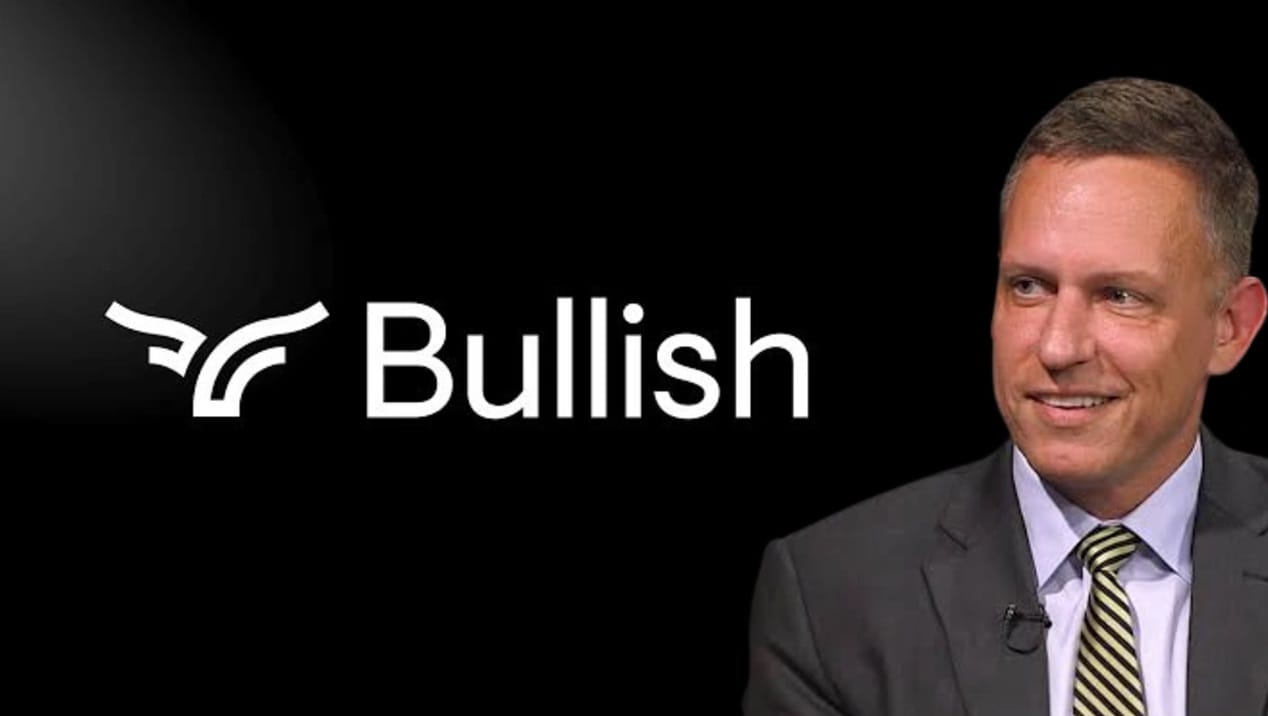

Bullish Crypto Exchange Backed by Peter Thiel Files for IPO

Bullish, a crypto exchange backed by billionaire investor Peter Thiel, filed for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC) on July 18, 2025. The Cayman Islands-based firm aims to list on the New York Stock Exchange (NYSE) under the ticker symbol BLSH, positioning itself as a key player in the rapidly evolving crypto market. Led by CEO Tom Farley, a seasoned finance executive and former president of the NYSE, Bullish is capitalizing on a favorable regulatory environment and robust market performance to attract institutional investors. The filing highlights the growing acceptance of digital assets within traditional financial systems, driven by recent legislative developments and strong investor interest.

Bullish was launched with significant backing from Thiel’s Founders Fund and Thiel Capital, alongside other notable investors like Nomura and crypto veteran Mike Novogratz. The exchange has quickly established itself as a leader in the crypto space, reporting an average daily trading volume of over $2.5 billion in the first quarter of 2025, ranking among one of the top exchanges for Bitcoin and Ethereum spot trading. Since its inception, Bullish has processed over $1.25 trillion in total trading volume as of March 31, 2025, according to its SEC filing. The company also owns CoinDesk, a leading cryptocurrency news outlet acquired in 2023, further expanding its influence in the digital asset ecosystem.

Stay In The Loop and Never Miss Important Crypto News

Sign up and be the first to know when we publishRegulatory Tailwinds and Financial Performance

The IPO filing comes at a pivotal moment for the cryptocurrency industry, bolstered by the recent passage of the GENIUS Act, signed into law by President Donald Trump on July 18, 2025. This legislation introduces consumer protections for stablecoins, cryptocurrencies pegged to assets like the U.S. dollar to minimize price volatility. The act has been hailed by industry leaders as a step toward clearer regulations, fostering investor confidence and encouraging institutional participation. Bullish’s mission, as stated in its SEC filing, includes driving the adoption of stablecoins, digital assets, and blockchain technology, aligning with the regulatory clarity provided by the GENIUS Act.

Financially, Bullish has shown a mixed performance. In 2023, the company reported $302 million in revenue and $150 million in net income, reflecting strong operational growth. However, it recorded a net loss of $349 million in the first quarter of 2025, compared to a $104.8 million profit in the same period the previous year. Despite this loss, Bullish maintains a robust financial position, holding $874 million in cash and $2.4 billion in customer assets, including $963 million in Bitcoin and $1 billion in EOS. The company’s significant liquid assets and trading volumes position it as a formidable competitor to industry giants like Coinbase, Kraken, and Gemini, as noted in its prospectus.

The broader crypto market has seen a surge in public offerings this year, with stablecoin issuer Circle achieving a sevenfold increase in value since its June IPO and Gemini, founded by the Winklevoss twins, confidentially filing for a U.S. IPO in the same month. Bitcoin’s price has also risen sharply, climbing from $94,000 at the start of 2025 to over $117,000, reflecting growing investor enthusiasm. Bullish’s IPO, led by underwriters J.P. Morgan, Citigroup, and Deutsche Bank, is poised to capitalize on this momentum, offering institutional investors a regulated platform to engage with digital assets.

Bullish’s move to go public follows a failed attempt in 2021 to list through a special purpose acquisition company (SPAC), which was abandoned due to market volatility. This time, the company is leveraging a more favorable environment, with CEO Tom Farley emphasizing the need to bridge traditional finance with digital assets. The involvement of high-profile investors like Thiel, who has also recently invested in other crypto ventures, adds credibility to Bullish’s ambitions. Social media sentiment on platforms like X reflects cautious optimism, with some users noting the potential for significant market impact, though others express skepticism about the sustainability of crypto IPOs. Just last month in June we reported that Bullish was taking significant steps toward going public by submitting a confidential filing in June.

As Bullish prepares for its NYSE debut, its filing represents a broader trend of cryptocurrency firms seeking to integrate with traditional financial markets. The combination of strong institutional backing, significant trading volumes, and a supportive regulatory landscape positions Bullish to play a pivotal role in shaping the future of digital assets. The company’s focus on stablecoins and blockchain technology, coupled with its leadership’s Wall Street expertise, signals a maturing crypto industry increasingly aligned with mainstream finance.