BlackRock's Bitcoin Video Sparks Controversy Saying 21 Million Fixed Supply May Be Changed

BlackRock's recent Bitcoin explainer video has thrown a wrench into the gears of the Bitcoin community. The investment giant, now a significant player in the Bitcoin landscape through its management of over 524,000 Bitcoins worth $53 billion via its ETF, has inadvertently stirred up a hornet's nest with a single, seemingly innocuous disclaimer.

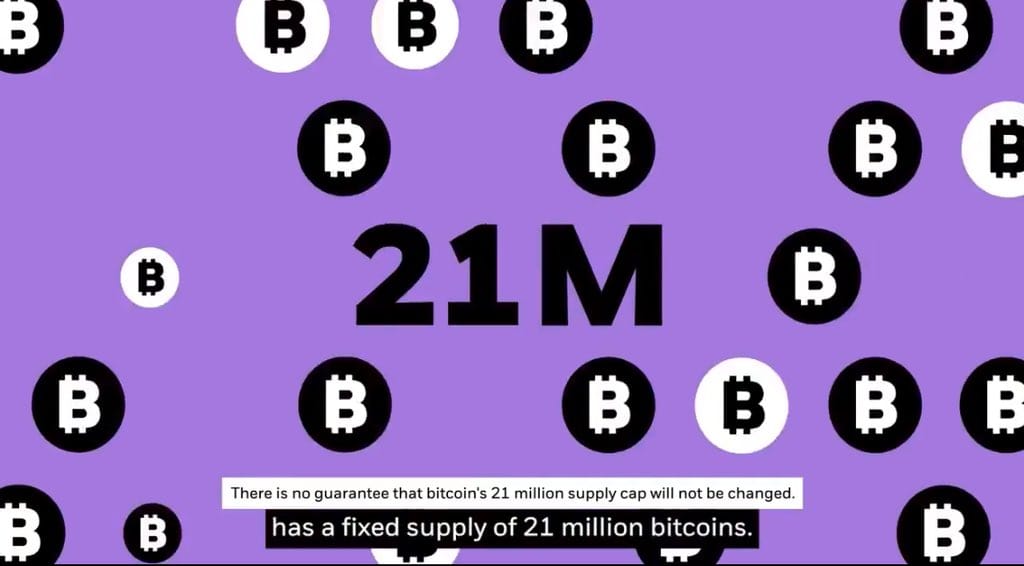

The video, a concise three-minute introduction to Bitcoin, outlines one of its most celebrated features: a fixed supply cap of 21 million coins. This cap, hard-coded into Bitcoin's protocol, is often touted as the digital currency's shield against inflation, providing a scarcity that mirrors, or even exceeds, that of precious metals like gold. However, the video subtly undermines this notion with a disclaimer that reads, "There is no guarantee that Bitcoin’s 21 million supply cap will not be changed." This statement has not just raised eyebrows but has led to a cacophony of concern and speculation among Bitcoin enthusiasts.

BlackRock released a video explaining Bitcoin pic.twitter.com/LpmH9zVico

— DΛVID (@DavidShares) December 18, 2024

The Reaction and the Historical Context

The reaction was swift and fierce. Bitcoiners, long protective of their cryptocurrency's foundational principles, expressed skepticism and alarm. Many wondered if this was BlackRock's way of foreshadowing an attempt to influence or alter Bitcoin’s protocol through their considerable market power. The mention of this possibility has brought back memories of the Bitcoin Blocksize War from 2015 to 2017, a period marked by fierce debates and battles over the blockchain's capacity and governance, which ultimately led to a chain-split and hard fork creating Bitcoin Cash.

The sanctity of Bitcoin's capped supply is not just a technical detail but a philosophical cornerstone for its community. It's seen as what differentiates Bitcoin from fiat currencies, providing a defense against inflation and potential governmental or institutional manipulation. The mere suggestion that this could be altered strikes at the heart of what many believe makes Bitcoin valuable.

The discourse around this issue is complex and speculative. This debate over Bitcoin's future, whether its supply cap should remain immutable or be subject to change, encapsulates the broader tension between Bitcoin's original ethos of decentralization and the practical necessities of maintaining network security and relevance in an evolving financial landscape. BlackRock's video, whether intentionally or not, has ignited these discussions, reminding everyone that Bitcoin's journey is far from settled and that its very nature might be up for negotiation in the years to come.