BlackRock Report Says Crypto Has Surpassed Growth of Mobile Phones and Internet

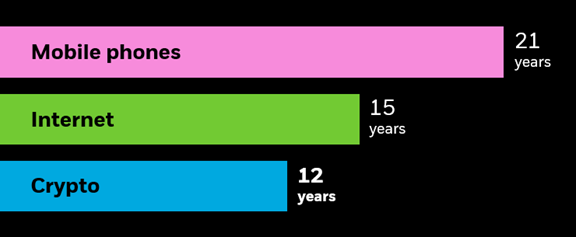

In a new report, BlackRock, the asset management company overseeing $10 trillion, has said that the growth trajectory of cryptocurrencies has exceeded that of both mobile phones and the internet. The report highlights that the crypto sector has now attracted 300 million users worldwide, a milestone reached in just 12 years since Bitcoin's inception in 2009. This is notably faster than the 21 years it took for mobile phones to achieve the same user base, starting from their first use in 1973, and the 15 years for the internet, which was launched on January 1, 1983.

BlackRock attributes this rapid ascent to several pivotal factors. Firstly, demographic shifts play a crucial role; younger generations, often termed "digital natives," show a higher inclination towards adopting Bitcoin. This demographic is more comfortable with technology and less rooted in traditional financial systems. Secondly, global economic and political instability has heightened the appeal of Bitcoin as a decentralized asset, offering an alternative to conventional banking systems amidst fears of inflation and fiscal concerns. Lastly, the ongoing digital transformation of the global economy has not only lowered barriers to entry for cryptocurrency but also expanded its utility in various financial applications.

Bitcoin and Crypto Outlook for 2025

Looking ahead to 2025, Bitcoin's market cap has impressively climbed to $1.82 trillion, with the cryptocurrency frequently flirting with a $2 trillion valuation over recent months, as its price oscillates between $92,000 and $105,000. The sector's future seems bright, with experts viewing Bitcoin and other digital currencies as increasingly integral to the economic fabric of numerous countries. A significant catalyst for this growth, particularly in the U.S., is the introduction of cryptocurrency ETFs.

The emergence of Bitcoin and Ethereum exchange-traded funds (ETFs) has dramatically increased the visibility and legitimacy of cryptocurrencies in the financial world. BlackRock's iShares Bitcoin ETF (IBIT) stands out as a pioneer in this space. This ETF allows investors to gain exposure to Bitcoin through a traditional brokerage account, functioning much like a stock. This accessibility means that investors can engage with Bitcoin without the complexities of managing digital wallets or navigating cryptocurrency exchanges, thereby broadening its appeal to a more traditional investor base.

BlackRock's latest ETF report underscores the significance of these developments, noting, "The emergence of bitcoin ETFs marks a significant milestone for both digital assets and traditional markets." This integration into mainstream investment vehicles not only validates cryptocurrency as an asset class but also paves the way for broader acceptance and adoption in the financial sector.

The rapid growth of cryptocurrency adoption, when juxtaposed with historical technological advancements like mobile phones and the internet, underscores a new era where digital currencies are not just speculative investments but are becoming entrenched in the global financial system.