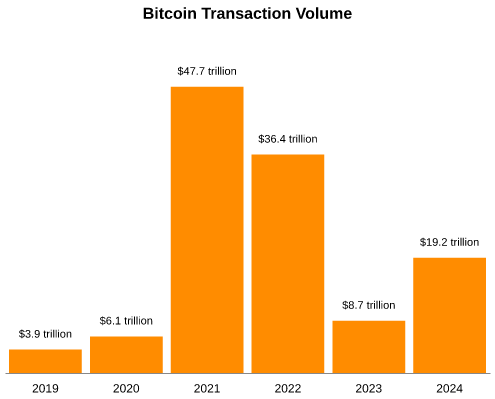

Bitcoin Transactions Soar to $19 Trillion in 2024, Doubling Previous Year

In 2024, Bitcoin not only solidified its position as a formidable asset in the financial world but also demonstrated its robustness with an astounding $19 trillion in transactions processed through its network. This figure marks a significant rebound from the previous years, showcasing a more than double increase from the $8.7 trillion in transactions settled in 2023. This resurgence in transaction volume is particularly noteworthy as it reverses a trend of declining activity observed since the peak in 2021.

The year 2024 was transformative for Bitcoin, with its market cap soaring to approximately $1.9 trillion, outpacing silver's $1.6 trillion market cap. This growth in market value was paralleled by an increase in its utility as both a store of value and a medium of exchange.

The Dynamics of Bitcoin's 2024 Performance

The year was marked by several key events that likely contributed to Bitcoin's enhanced performance. One significant catalyst was the introduction of a Bitcoin exchange-traded fund (ETF) in the United States. This move brought Bitcoin closer to mainstream investment portfolios, making it more accessible to investors who were previously hesitant to engage directly with cryptocurrencies. The ETF provided a regulated, familiar vehicle for investment, thereby broadening Bitcoin's investor base.

Additionally, the Bitcoin halving event in April 2024 played an important role. Halvings reduce the reward for mining new blocks, effectively controlling the influx of new bitcoins into circulation, which historically has led to price increases due to the decreased supply rate. Following this halving, Bitcoin reached a new all-time high price of roughly $108,000, signaling strong market confidence and investor interest.

This price surge wasn't merely a speculative bubble; it was underpinned by substantial transactional activity. The volume of transactions processed on the Bitcoin network in 2024 indicates a growing trust and reliance on Bitcoin not just as an investment but as a functional currency for various types of transactions. This dual role of Bitcoin as both a speculative asset and a practical payment system underscores its unique position in the financial landscape.

The narrative of Bitcoin in 2024 is one of resilience and growth. From reversing a downward trend in transaction volumes to achieving new heights in market value and price, Bitcoin has proven its capacity to adapt and thrive amidst evolving economic conditions. The significant increase in transactions processed suggests that Bitcoin is increasingly seen not just as a digital gold but as a viable alternative to traditional financial systems, capable of handling vast sums of monetary exchange with security and efficiency.