Bitcoin Surges to Record High of $119,300 Amid Crypto Week Anticipation

Bitcoin soared to an all-time high of $119,300 on Sunday, fueled by growing optimism in the crypto market as the U.S. Congress prepares for a pivotal week of legislative discussions. The U.S. House Financial Services Committee has dubbed the week starting July 14 as “Crypto Week,” setting the stage for debates on three significant bills that could reshape the regulatory landscape for digital assets. This milestone comes as Bitcoin’s bullish momentum continues to build, driven by favorable market conditions and increasing mainstream adoption. The crypto industry is closely watching these developments, which could provide much-needed clarity and support for future growth.

The recent price surge reflects a 9.5% gain over the past week, pushing Bitcoin’s year-to-date increase to an impressive 27%. Other major cryptocurrencies are also riding this wave, with Ethereum climbing 16.5% and Solana gaining 7.1% in the same period. The rally, which saw Bitcoin break through the $112,000 mark earlier this week, is supported by expectations of monetary easing, robust inflows into spot Bitcoin exchange-traded funds, and growing corporate interest in digital assets. These factors have created a strong foundation for Bitcoin’s upward trajectory, with market participants increasingly confident in its near-term prospects.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishLegislative Push and Market Outlook

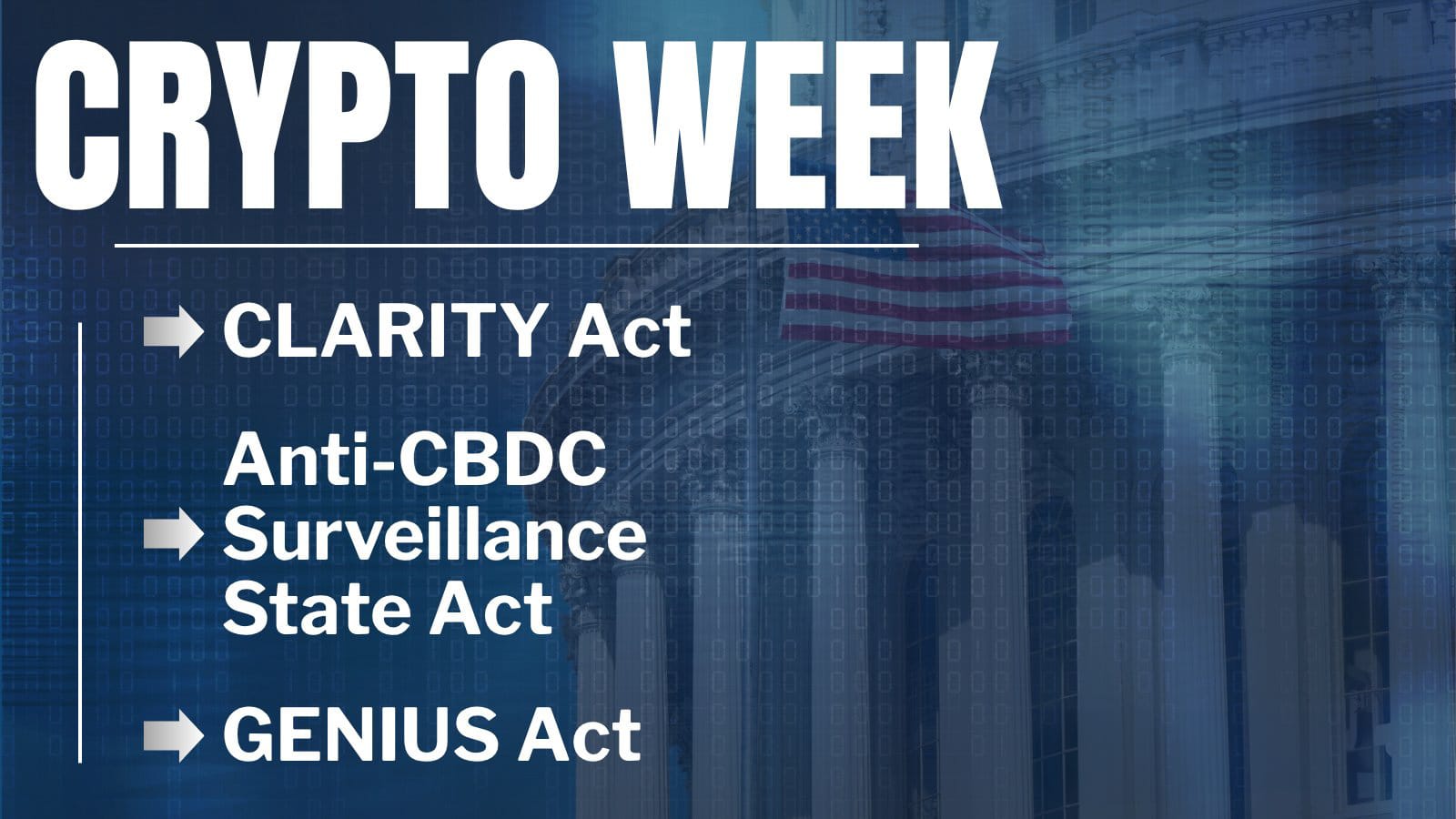

The upcoming Crypto Week is generating significant buzz, as the proposed bills could establish a clearer framework for the crypto industry. The Digital Asset Market CLARITY Act aims to place crypto transactions under the exclusive oversight of the Commodity Futures Trading Commission while offering exemptions for well-established blockchain networks. Another bill, the GENIUS Act, would permit private companies to issue fully cash-backed stablecoins, potentially fostering innovation in the stablecoin market. Meanwhile, the Anti-CBDC Surveillance State Act seeks to block the development of a U.S. Central Bank Digital Currency, reflecting concerns about privacy and government overreach.

Analysts are optimistic about Bitcoin’s trajectory, with some projecting a peak of $130,000 by the end of 2025, potentially followed by a brief correction and a subsequent rally to $136,000. This outlook aligns with expectations of a multi-year bull cycle nearing its climax. Adding to the bullish sentiment, the recently released Grok 4, an advanced AI developed by xAI, offered a bold prediction, suggesting Bitcoin’s price could range between $150,000 and $180,000 by year-end, driven by steady monthly gains. While such forecasts are speculative, they underscore the growing confidence in Bitcoin’s role as a leading asset in the evolving financial landscape.

The combination of legislative progress and market dynamics is creating a fertile environment for cryptocurrencies. Investors are particularly encouraged by the potential for regulatory clarity, which could attract more institutional capital and bolster mainstream adoption. As Crypto Week unfolds, the outcomes of these debates could serve as a catalyst for further price appreciation across the crypto market. For now, Bitcoin’s record-breaking performance signals robust demand and a market poised for potential transformation in the months ahead.