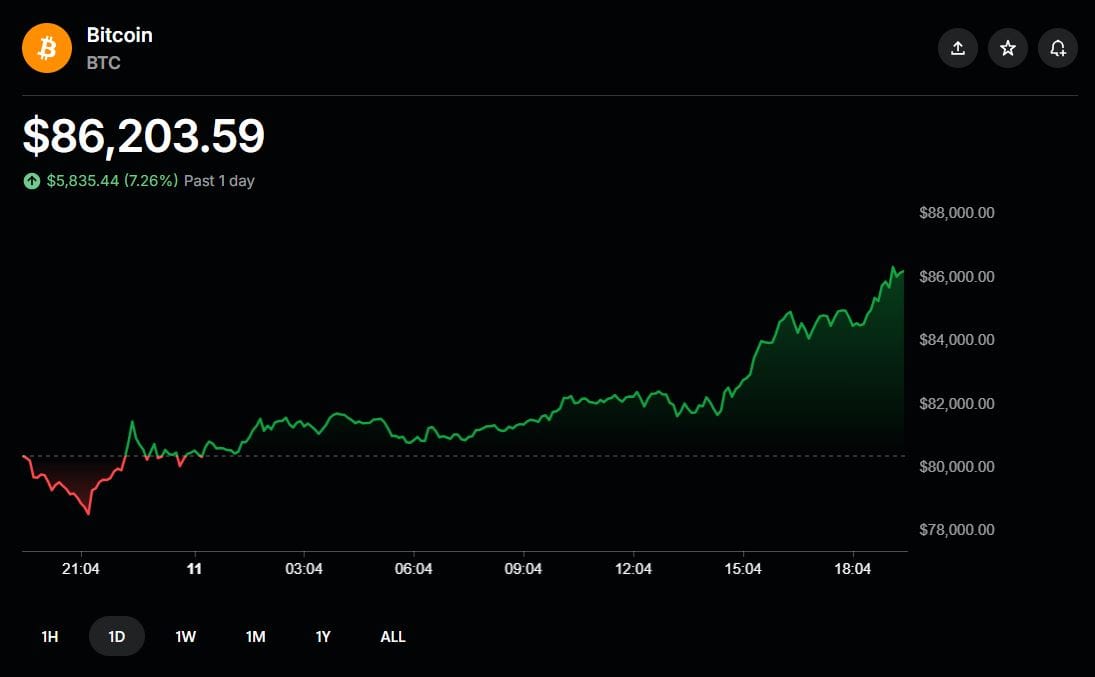

Bitcoin Surges Past $86,000 After Trump's Election Win

In a whirlwind of economic activity following Donald Trump's surprising victory in the U.S. presidential election, Bitcoin has soared to unprecedented heights, breaking through the $85,000 mark.

This surge reflects broader market trends where investors, reacting to the political shift, have turned to cryptocurrencies for potential high returns amidst an uncertain political climate.

The Trump Effect

The election of Donald Trump, known for his pro-business policies and regulatory rollback, has historically been viewed as beneficial for financial markets. His victory in the recent election has once again triggered a bullish sentiment, particularly in assets like Bitcoin. Investors often flock to cryptocurrencies in times of political uncertainty, viewing them as a hedge against traditional market volatility. This time, however, the reaction has been notably aggressive, with Bitcoin's price not just inching up but leaping forward significantly.

Following Trump's win, the market dynamics shifted rapidly. Analysts had predicted a possible uptick in Bitcoin's value due to anticipated regulatory changes and a potential weakening of the dollar under Trump's administration. Yet, the scale of the rally has taken many by surprise. The crypto markets, already volatile, reacted with a fervor that underscored the deep-seated belief in Bitcoin's potential as a safe haven during times of political upheaval.

Market Dynamics and Investor Sentiment

The immediate aftermath of Trump’s election saw Bitcoin's price jump from around $75,000 to over $85,000 within just a few days. This spike can be attributed to a concoction of factors:

Increased Institutional Investment: Trump’s policies are expected to favor large investors. His administration's stance on reducing regulations could make it easier for institutional money to flow into cryptocurrencies.

Speculative Trading: The unpredictability of Trump’s economic policies has led to a surge in speculative trading. Traders, looking for quick gains, have found Bitcoin's volatility particularly enticing post-election.

Global Economic Uncertainty: With Trump’s known unpredictability in international relations, many investors globally are hedging against possible economic sanctions, trade wars, or other geopolitical risks by investing in Bitcoin.

The narrative around Bitcoin evolved from being a speculative asset to a more recognized investment class, particularly after the halving events that historically precede price increases due to the reduced new supply entering the market. This fundamental change in how Bitcoin is perceived has played a crucial role in its price dynamics post-election.

Impact on Broader Financial Markets

The rally in Bitcoin's price has not occurred in a vacuum. It has ripple effects across the financial markets:

Stock Markets: While some sectors of the stock market might benefit from Trump’s policies, the uncertainty has led investors to diversify their portfolios, with Bitcoin emerging as a significant component.

Gold and Other Safe Havens: Traditionally, gold prices would surge in times of political uncertainty. However, Bitcoin's role as a 'digital gold' has intensified, making it a competitor to gold for investors looking for safe havens.

Cryptocurrency Alternatives: Bitcoin's performance has a halo effect on other cryptocurrencies, although not all have seen similar gains. Ethereum, for instance, has also risen but not to the same degree, indicating Bitcoin's unique position in investor psyche.

Future Outlook

Looking ahead, the trajectory of Bitcoin could be influenced by several factors:

Policy Implementation: How quickly and effectively Trump’s administration implements economic policies will affect investor confidence. Any delay or policy backfire could see a retreat in Bitcoin's price.

Regulatory Environment: While less regulation is generally seen as beneficial, unexpected crypto-specific regulations could dampen the current bullish trend.

Global Adoption: Continued or increased adoption by countries, especially if major economies start to hold Bitcoin in their reserves, could solidify its value further.

As we navigate through this new political landscape, Bitcoin's role in the financial ecosystem seems increasingly pivotal. Its recent price surge post-Trump's victory is not just a reaction to immediate political events but a testament to its growing acceptance as a legitimate asset class. This development warrants close observation by investors, policymakers, and anyone interested in the intersection of finance, technology, and politics.