Bitcoin Surges Past $104,900 as Trump Signals Trade Progress with China

Bitcoin reached a new milestone on Saturday evening, climbing to $104,916 and marking a 2% gain following President Donald Trump’s optimistic remarks about trade negotiations with China. The announcement, shared on Truth Social, sparked a broader rally in the crypto market, with major cryptos like Ethereum and Dogecoin also posting significant gains. Trump’s comments about a “total reset” in U.S. and China relations, delivered after a high-level meeting in Geneva, Switzerland, fueled market optimism and underscored Bitcoin’s role as a barometer of global economic sentiment.

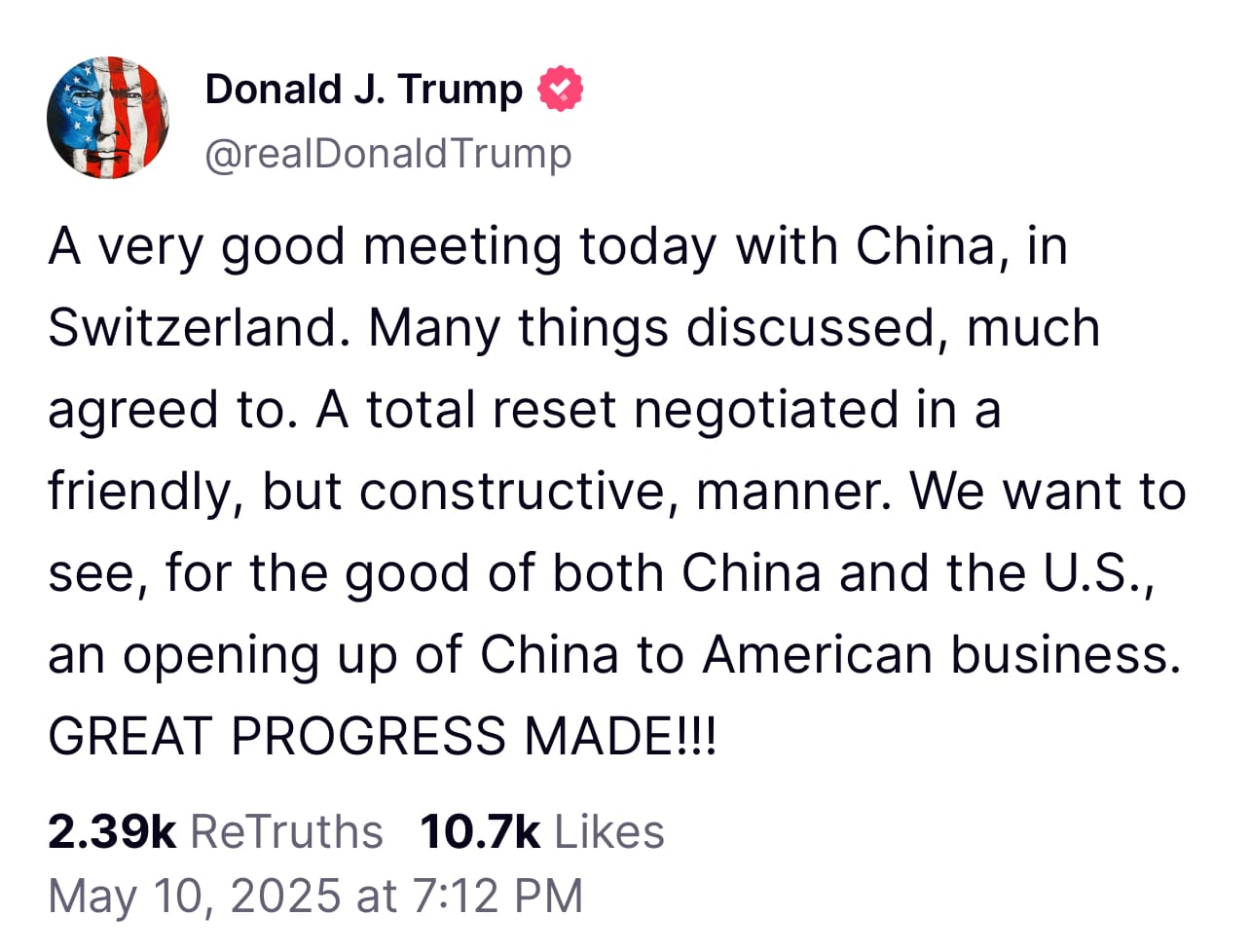

In his Truth Social post, Trump described the discussions with Chinese officials as productive, emphasizing a mutual interest in fostering better trade relations. He noted that the talks, conducted in a friendly yet constructive manner, covered a range of issues and resulted in several agreements. Trump highlighted the potential for China to open its markets further to American businesses, calling the progress “great” for both nations. The statement came amid efforts to de-escalate tensions following recent tariff disputes, which have weighed heavily on global markets.

Altcoins Join the Rally

The market’s response was immediate, with Bitcoin leading a surge that extended to other digital assets. Ethereum rose over 10% within 24 hours, reaching $2,600, while Dogecoin jumped nearly 21% to $0.25, emerging as a standout performer among other cryptos. The rapid price movements reflect the crypto market’s sensitivity to geopolitical developments, particularly those involving the world’s two largest economies. Traders appeared to interpret Trump’s remarks as a sign of reduced economic friction, creating a favorable environment for risk assets like Bitcoin and its counterparts.

Bitcoin’s price, recorded at $104,916, highlights its growing influence as a gauge of global liquidity and investor confidence. The cryptocurrency’s ability to rally in response to positive trade signals underscores its evolving role in financial markets. As U.S. and China relations continue to shape economic outlooks, Bitcoin and cryptocurrencies are likely to remain closely tied to such developments, offering investors a real-time reflection of shifting geopolitical dynamics. The sustained momentum in the cryptocurrency market suggests that optimism surrounding the trade talks could drive further gains in the near term, provided diplomatic progress continues.