Bitcoin Reaches 1.3% of Global Money Supply in March 2025

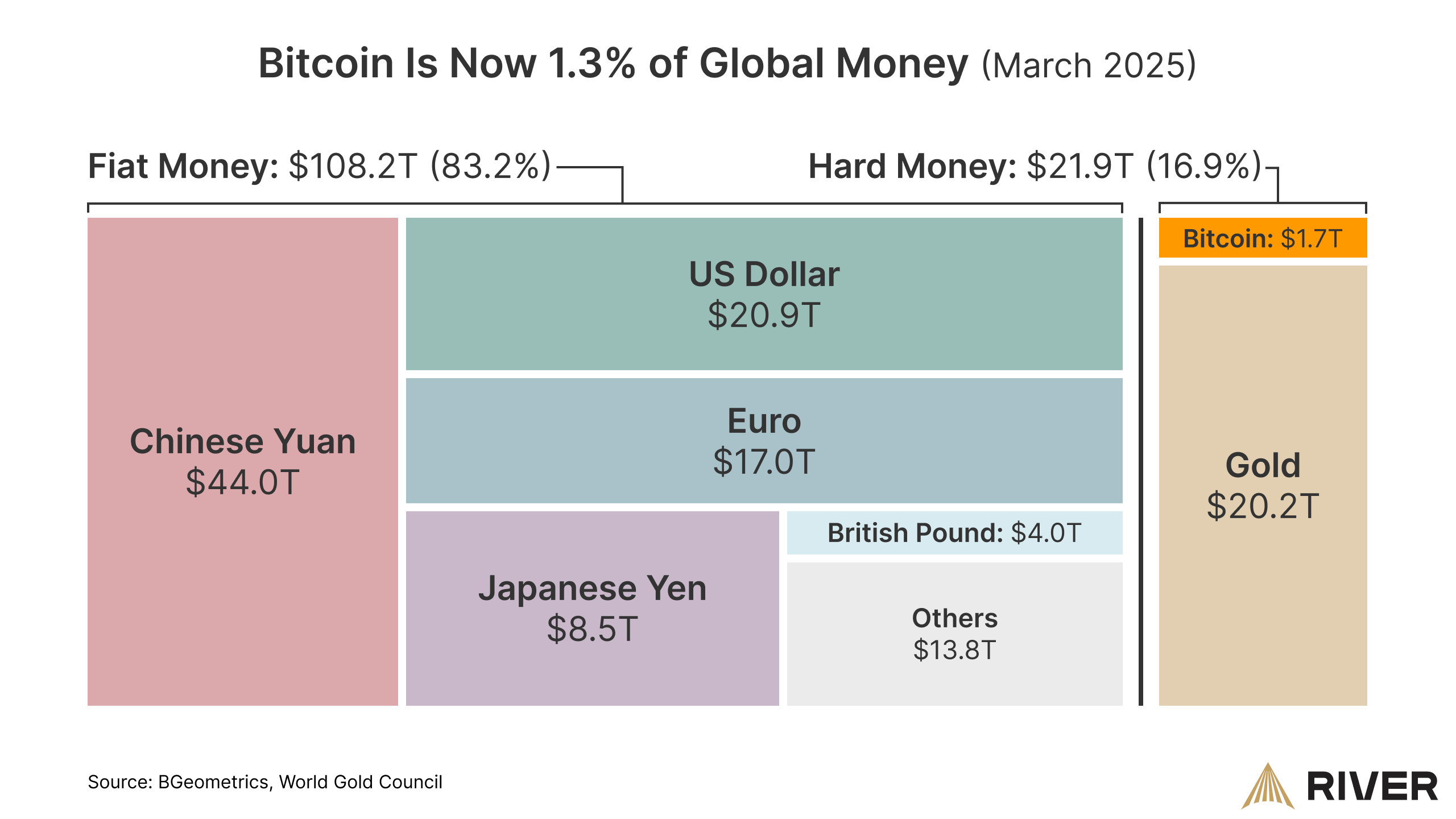

In a significant milestone, Bitcoin has achieved a total market value of $1.7 trillion as of March 2025, accounting for 1.3% of the global money supply.

This data, sourced from River and the World Gold Council, highlights Bitcoin's growing presence in the financial world. The global money supply is divided into fiat money, totaling $108.2 trillion or 83.2%, and hard money, which includes assets like gold at $21.9 trillion or 16.9%. Bitcoin's $1.7 trillion valuation positions it as a notable player, surpassing the British Pound's $4.0 trillion and approaching the Japanese Yen’s $8.5 trillion in circulation.

The rise of Bitcoin reflects its increasing acceptance as a legitimate asset class. Back in November 2021, Bitcoin's market cap stood at $1.15 trillion. Despite experiencing volatility over the years, its growth to $1.7 trillion by March 2025 demonstrates resilience and a steady upward trajectory.

This increase aligns with broader trends in the crypto space, where digital assets are gaining traction among investors and institutions. The data also places Bitcoin in context with other major currencies, such as the US Dollar at $20.8 trillion, the Euro at $17.0 trillion, and the Chinese Yuan at $44.0 trillion, illustrating the scale of traditional fiat systems while underscoring Bitcoin's emerging role.

A Closer Look at Bitcoin's Market Position

Bitcoin's journey to 1.3% of global money is a testament to its evolving status in the financial ecosystem. Unlike fiat currencies, which dominate the global money supply, Bitcoin operates as a decentralized digital asset, offering an alternative to traditional financial systems.

It now exceeds that of smaller fiat currencies like the British Pound, signaling a shift in how value is perceived and stored globally. Gold, a long-standing hard asset, remains a significant part of the hard money category at $20.2 trillion, yet Bitcoin's growth suggests that digital assets are carving out a meaningful space alongside these traditional stores of value.

As Bitcoin continues to mature, its role in global finance is likely to expand, potentially reshaping the way we think about money in the years to come. This development invites further exploration into how cryptocurrencies might influence economic policies and investment strategies moving forward.