Bitcoin Price Opens at $74,422 on Black Monday as Global Markets Face Uncertainty

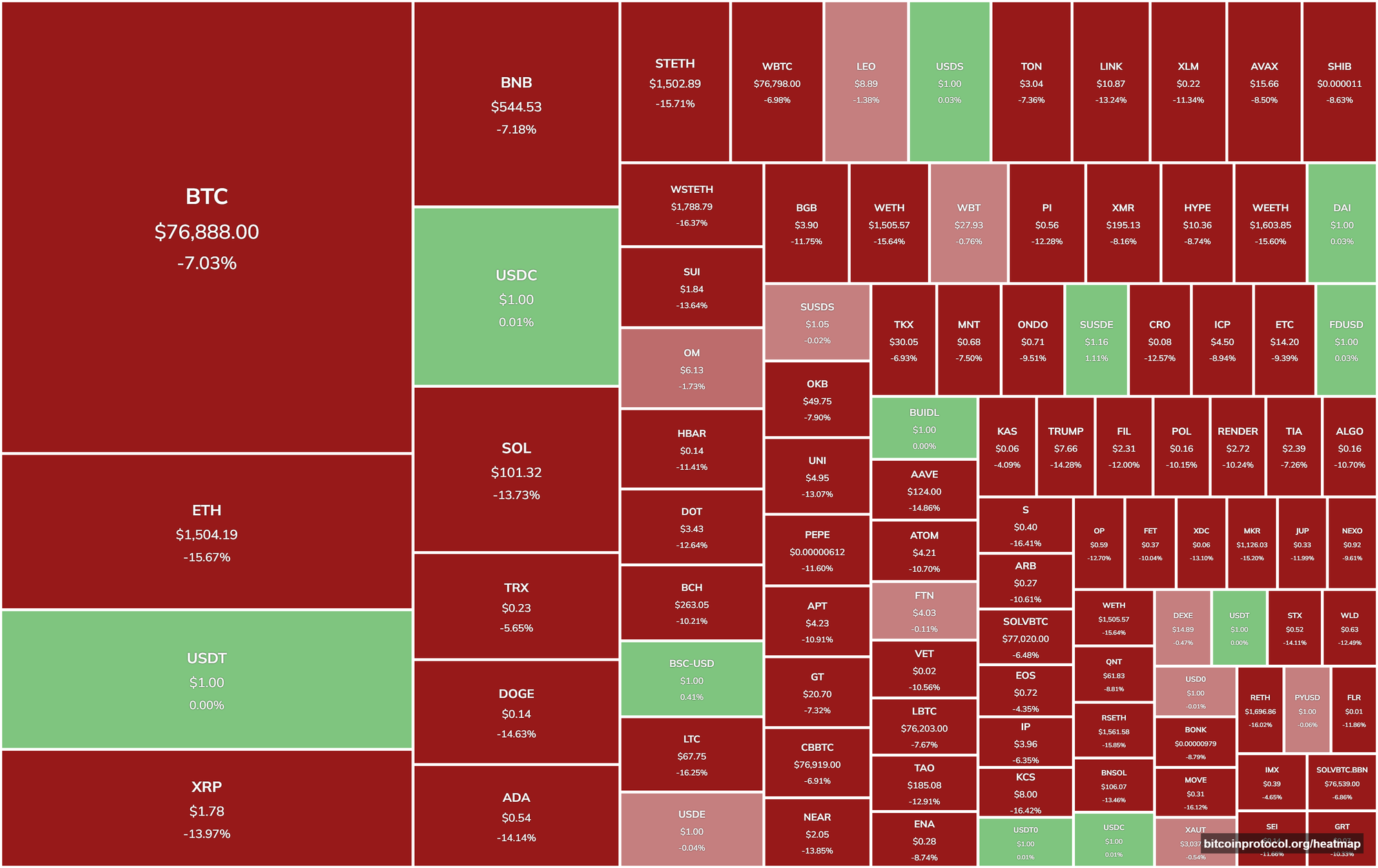

Bitcoin opened the trading day at $74,422, slipping below the $75,000 mark and reflecting a steep decline of over 7% in a single day. This downturn comes as financial markets worldwide grapple with heightened volatility, sparked by a combination of economic concerns and shifting policy signals from the Trump administration. The cryptocurrency’s value, now roughly 31% below its peak from three months ago, mirrors a broader selloff that has rattled traditional markets, including a notable drop in the Dow Jones Industrial Average.

The early 'Black Monday' plunge in Bitcoin’s price unfolded alongside a sharp downturn in Asian stock markets, where Hong Kong’s Hang Seng index fell by more than 9% and China’s CSI300 lost over 5%. Analysts suggest this widespread market reaction ties back to the Trump administration’s push for what it describes as a “reciprocal” tariff strategy, aimed at addressing long-standing trade imbalances. Investors appear jittery as they brace for a week that could bring further economic turbulence.

Tariffs Fuel Market Shifts and Debate

The tariff escalation shows no signs of a swift resolution, with U.S. officials framing the current market unrest as part of a deliberate structural shift. Treasury Secretary Scott Bessent, speaking to NBC, emphasized that nations now seeking negotiations have been problematic trade partners for years, suggesting that quick fixes are unlikely. Commerce Secretary Howard Lutnick echoed this sentiment, stating that tariffs would remain in place for the foreseeable future, a stance that has left markets searching for stability.

President Trump addressed the selloff directly, likening it to a necessary remedy for deeper economic issues. He argued that short-term discomfort is an essential step toward correcting years of uneven trade practices, a perspective that has divided market watchers. Some see this as a bold move to rebalance global trade, while others worry about the ripple effects on investor confidence and asset prices.

Bitcoin’s latest dip highlights its sensitivity to macroeconomic currents, moving in tandem with stocks rather than serving as the independent hedge its advocates often champion. As the week progresses, traders and analysts will likely keep a close eye on both U.S. policy developments and global market responses. For now, crypto prices reflect a broader narrative of uncertainty, with no clear bottom in sight as tariff talks and market adjustments continue to unfold.

The interplay between Bitcoin and traditional markets underscores a moment of transition, where policy decisions are reshaping economic expectations. Investors, whether in crypto or equities, face a landscape where volatility may persist until clearer signals emerge.