Bitcoin Price Drops to $79,170 as Recession Concerns Weigh on Investors

The crypto market faced a sharp downturn today, with Bitcoin falling to a low of $79,170 per unit. This decline reflects broader unease among investors, as the leading digital asset tracks a similar slide in U.S. equities amid growing fears of an economic recession. The sell-off has rippled across financial markets, leaving traders and analysts closely watching Bitcoin’s as it struggles to regain stability.

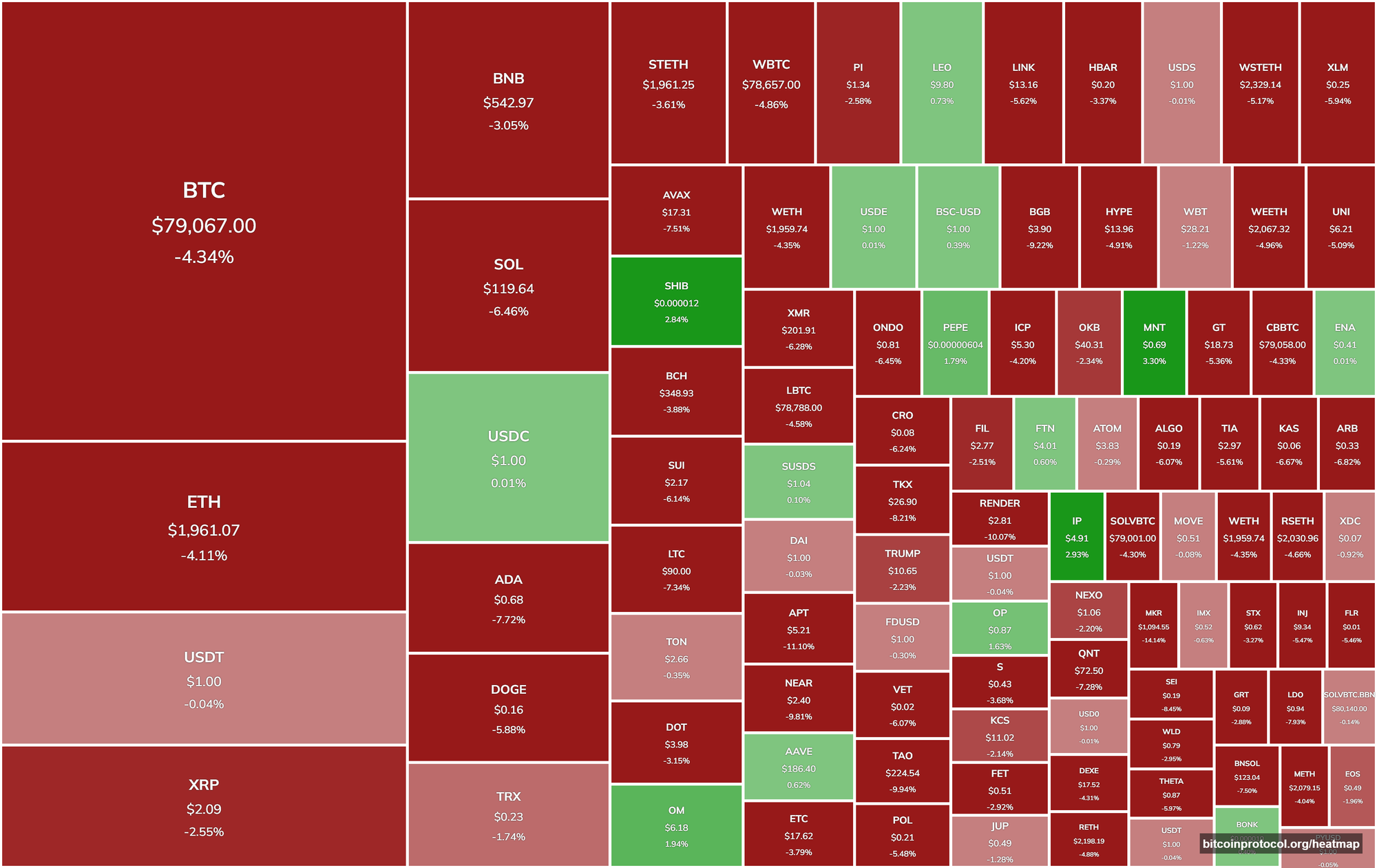

Bitcoin, often viewed as a barometer for the crypto economy, shed an additional 5.2% against the U.S. dollar on Monday, following a 15% drop over the past week. By mid-morning Eastern time, the asset was working to climb back toward the $80,000 mark, though selling pressure remained evident. The broader crypto market also took a hit, with its total value slipping to $2.61 trillion, a 4.6% decrease against the dollar. Other prominent cryptocurrencies felt the strain as well, with Solana losing 9% and Dogecoin dropping 8% in value. Global trading volume in the crypto space surged to $124.32 billion, a 118% increase from the previous day, signaling heightened activity largely driven by sales rather than buying.

The economic backdrop fueling this decline stems from mounting recession worries. Comments from U.S. President Donald Trump, who recently declined to rule out the possibility of an economic slowdown, appear to have unsettled markets. On Wall Street, major indices and the so-called “Magnificent Seven” stocks, a group of high-profile equities, all posted losses, mirroring the crypto market’s trajectory. Investors seem to be reacting to these signals by pulling back from riskier assets, including Bitcoin, which has long been seen as a speculative investment tied to broader economic sentiment.

Liquidations and Market Pressure Intensify

As prices fell, the crypto market saw significant liquidations, with $692.05 million in positions wiped out over the past day. Bitcoin traders betting on a price increase, known as long positions, accounted for $216 million of those losses, while Ethereum longs lost $88 million. Other digital assets saw $58 million in long positions vanish, contributing to a total of 239,539 traders liquidated within 24 hours. One notable casualty was a large Bitcoin trade on Binance, which resulted in a $32.09 million loss, underscoring the scale of the market’s turbulence.

The wave of liquidations has left traders on edge, with some expressing concern that Bitcoin could dip below its prior low of $78,189 if selling continues unchecked. Despite the uptick in trading volume, the mood among investors remains cautious, as many weigh the potential for further declines against the asset’s historical resilience. For now, Bitcoin’s attempt to reclaim the $80,000 level serves as a critical test of its near-term direction.

This downturn arrives at a time when economic uncertainty is casting a shadow over both traditional and digital markets. While Bitcoin has weathered volatility before, its current alignment with equities suggests that macroeconomic factors, rather than crypto-specific developments, are driving the narrative. Analysts will likely keep a close eye on U.S. economic data and policy signals in the coming days, as these could determine whether the sell-off deepens or a recovery takes hold. For investors, the focus remains on navigating a landscape where recession fears continue to shape sentiment across asset classes.