Bitcoin Price Crashes Below $82,000 Amid Massive Liquidations and ETF Outflows

Bitcoin experienced a sharp decline on November 21, 2025, falling to around $82,000 during early trading hours. This move marked the lowest level for the cryptocurrency since April and triggered widespread turmoil across the market. Traders faced nearly $2 billion in leveraged liquidations over the past 24 hours, with long positions bearing the brunt of the losses.

The drop came after Bitcoin had reached an all-time high above $126,000 in October, highlighting the volatile nature of the asset. Analysts have pointed to a combination of factors driving the sell-off, including shifting investor sentiment and reduced liquidity. Spot trading volumes surged as prices fell, reflecting heightened activity among both retail and institutional players.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishKey Factors Behind the Bitcoin Price Decline

Institutional investors appeared to lead the retreat through spot Bitcoin and Ethereum ETFs. U.S.-listed ETFs recorded approximately $3.79 billion in net outflows for November, setting a new monthly record since their launch in early 2024. BlackRock's IBIT fund accounted for about $2.47 billion of those withdrawals, representing over 60 percent of the total and indicating a notable pullback from traditional finance channels.

Technical indicators also played a role in accelerating the downside. Bitcoin broke below key support levels near $90,000-$88,500, falling below major moving averages and prompting automated stop-loss orders. This breakdown contributed to over $1 billion in long liquidations on November 21 alone, as leveraged bets unraveled quickly in thin weekend-approaching liquidity.

Broader macroeconomic pressures added to the pressure on risk assets like cryptocurrencies. The Federal Reserve's ongoing balance sheet reduction and signals of caution on further rate cuts reduced overall market depth. Equities showed similar weakness, with the Nasdaq declining as technology stocks faced profit-taking, demonstrating Bitcoin's continued correlation to traditional markets during periods of risk aversion.

Regulatory developments further clouded the outlook for some market segments. Reports emerged that index provider MSCI might exclude Strategy from certain benchmarks due to its heavy Bitcoin holdings, potentially forcing sales of related shares. Such moves could indirectly impact Bitcoin demand from corporate treasuries that had previously accumulated the asset.

Recent U.S. economic data reinforced concerns about persistent inflation. A revised non-farm payroll figure for September showed 119,000 jobs added, exceeding lowered expectations but highlighting uneven labor market strength. This reading contributed to speculation that the Federal Reserve might slow its pace of monetary easing, with market tools pricing in only a modest chance of a rate cut in the near term.

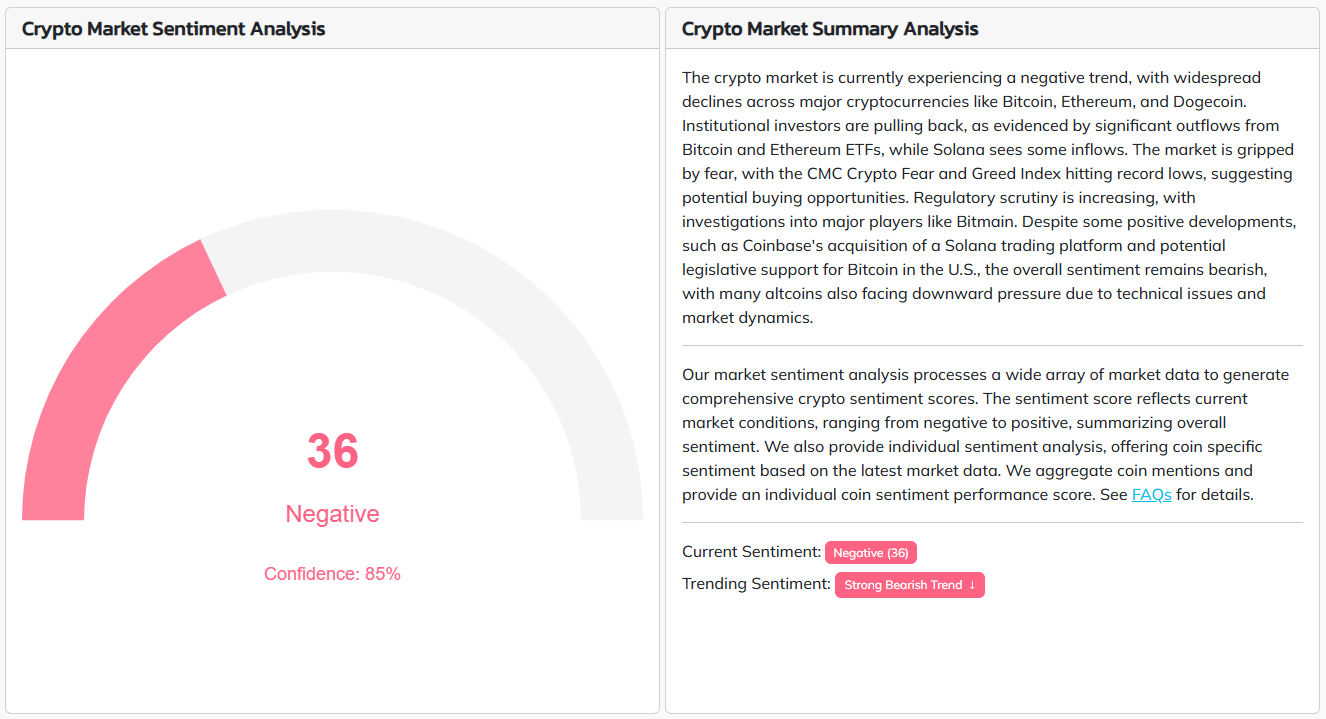

Thin liquidity conditions amplified the price swings observed throughout the week. Short-term holders realized significant losses, pushing onchain metrics to levels comparable to past major corrections. While some analysts noted oversold conditions that could lead to a short-term rebound, others cautioned that reclaiming $90,000 would be necessary to shift crypto market sentiment from negative to a more neutral or positive tone.

The crypto market as a whole is feeling the effects, with Ethereum and major altcoins such as Solana posting double-digit percentage declines. Total market cap has dipped below $3 trillion temporarily before stabilizing slightly. Trading activity remained elevated as participants reassessed positions amid the ongoing volatility.

Analysts have watched for signs of capitulation that might signal a bottom. Historical patterns suggest sharp drawdowns often precede recoveries, though current headwinds from institutional outflows and macro uncertainty present challenges. Market depth on exchanges thinned considerably, making further moves possible in either direction depending on incoming flows.

Bitcoin's price action reflects a recalibration rather than a fundamental shift away from long-term adoption trends. Spot demand from ETFs had slowed, but underlying network metrics like hash rate remained robust. Upcoming economic releases and policy decisions will likely influence the next phase of trading in the coming days and weeks.