Bitcoin Plummets to $93K Amid Crypto Market Downturn

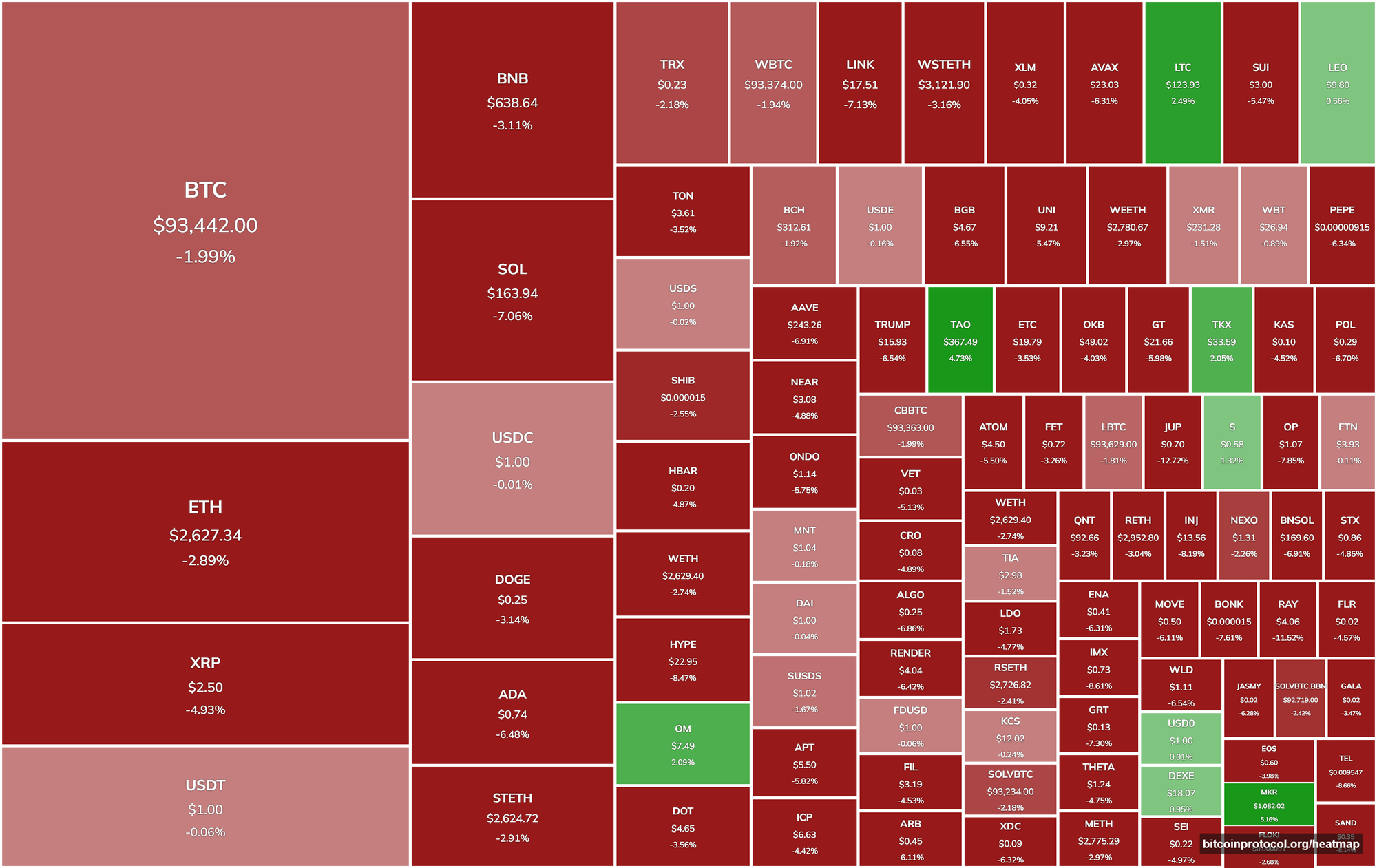

The crypto market took a significant hit on Tuesday, with Bitcoin leading the charge downwards, dipping below $95,000 to reach its lowest point since early February. Currently priced at $93,442, Bitcoin's decline of nearly 2% daily and over 2% weekly might not seem drastic, but it marks a notable shift in the market's direction.

As Bitcoin struggles, other major cryptocurrencies are experiencing even steeper falls. Solana, in particular, has been under intense scrutiny following the scandalous launch of the LIBRA memecoin. The project, which caught the attention of Argentine President Javier Milei, who promoted it on social media, has now turned into a debacle. LIBRA's value collapsed by almost 90% shortly after its peak, leading to Milei deleting his endorsement and facing fraud charges amidst a significant drop in Argentina's stock market.

Impact on Solana and Broader Market Sentiment

Solana's native token, SOL, has not escaped the fallout, dropping by more than 9% in the last 24 hours and a staggering 18% over the past week. This makes it the heaviest loser among the top 10 cryptocurrencies by market cap over these time frames. The negative publicity surrounding LIBRA has undoubtedly contributed to this sharp decline, affecting investor confidence in Solana's ecosystem.

The broader market sentiment isn't much better. Cardano saw a 7% decrease in the last day, while XRP, Dogecoin, and Binance Coin (BNB) each fell by around 6%. Ethereum, one of the market leaders alongside Bitcoin, also couldn't avoid the downturn, losing nearly 5% within the same period.

The ripple effect of these declines extends beyond the top 10, with virtually all cryptocurrencies in the top 100 showing red. This widespread downturn suggests a prevailing negative market sentiment, possibly driven by recent events and broader economic concerns, for example with the recent ongoing tariff wars between Donald Trump, the United States, and other countries. Investors are clearly reevaluating their positions in light of the current market dynamics, leading to a cautious approach that has yet to show signs of reversing.