Bitcoin Outshines Google, Apple, Microsoft, as Better Long Term Investment

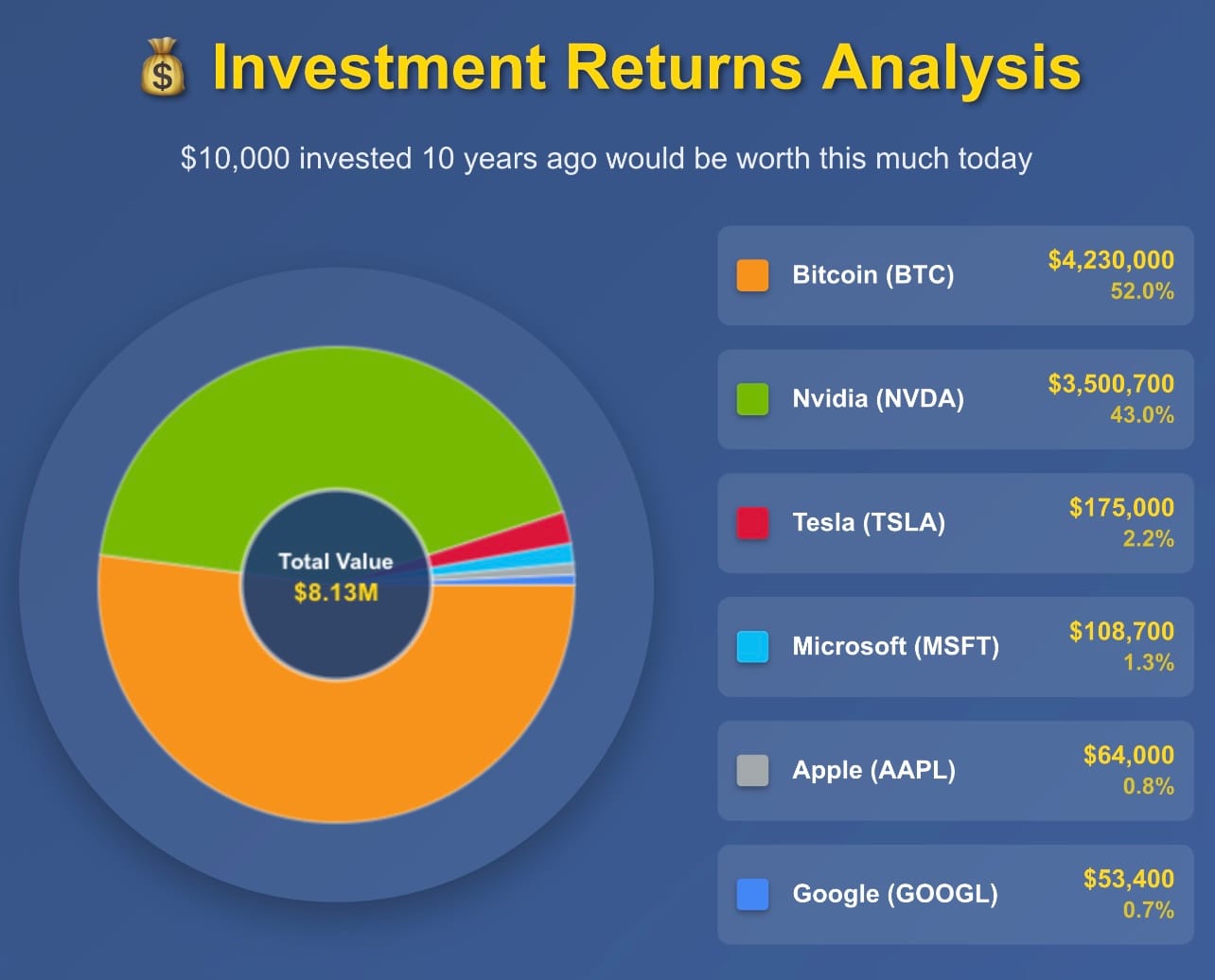

A $10,000 investment made ten years ago in 2015 would have yielded dramatically different results depending on the asset chosen, with Bitcoin emerging as the standout performer among traditional tech stocks.

According to our data, that initial $10,000 in Bitcoin would now be worth an astonishing $4.23 million, far surpassing the returns of major tech giants like Google, Apple, Microsoft, Nvidia, and Tesla. While Nvidia’s remarkable growth driven by artificial intelligence has made it a strong contender, Bitcoin’s unparalleled performance over the decade solidifies its reputation as a formidable store of value, often likened to “digital gold.” This remarkable growth highlights Bitcoin’s unique position, blending scarcity and technological innovation.

The same $10,000 invested in Microsoft would now be valued at $108,700, a solid return but paling in comparison to Bitcoin’s meteoric rise. Nvidia, fueled by the AI boom, comes closer with a $10,000 investment growing to $3.5 million, making it the second-best performer in this group. Google and Apple, with returns of $53,400 and $64,000 respectively, reflect steady but less explosive growth, while Tesla’s $175,000 valuation shows its volatility and innovation-driven gains. These figures show Bitcoin’s dominance over the past decade, outpacing even the most successful tech companies that have reshaped industries.

Bitcoin’s Digital Gold Status

Bitcoin’s comparison to gold stems from its inherent characteristics that align with traditional stores of value. With a fixed supply capped at 21 million coins, Bitcoin mirrors gold’s scarcity, protecting it from inflationary pressures that erode the value of fiat currencies. Its decentralized and secure blockchain ensures that no single entity controls the network, fostering trust and resilience against economic instability. Additionally, Bitcoin’s portability and durability as a digital asset make it a modern alternative to physical gold, allowing seamless global transactions without degradation.

The cryptocurrency’s ability to retain and grow value over time has cemented its nickname as “digital gold.” Unlike tech stocks, which rely on corporate performance and market conditions, Bitcoin’s value is driven by its scarcity and growing adoption as a hedge against economic uncertainty. Its decentralized nature eliminates reliance on central banks or governments, appealing to investors seeking assets outside traditional financial systems. This unique combination of features has propelled Bitcoin’s remarkable performance over the past decade.

The data paints a clear picture of Bitcoin’s dominance as a long-term investment compared to leading tech stocks. While Nvidia’s AI-driven surge has been impressive, Bitcoin’s exponential growth highlights its role as a transformative asset class. Investors looking for a hedge against inflation and a portable, secure store of value have increasingly turned to Bitcoin, drawn by its gold-like qualities in a digital format. As the financial world continues to evolve, Bitcoin’s decade-long track record suggests it will remain a compelling option for those seeking both growth and stability.