Bitcoin Mining Embraces Sustainability as Cambridge Study Reveals 52.4% Clean Energy Use

A recent study from Cambridge University highlights a significant shift in the Bitcoin mining industry, with sustainable energy sources now accounting for 52.4% of its power consumption. This marks a notable increase from 37.6% in 2022, surpassing the 50% threshold set by Tesla CEO Elon Musk for resuming Bitcoin payments for the electric vehicle manufacturer.

The findings, detailed in the Cambridge Digital Mining Industry Report by the Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School, reflect the industry’s evolving approach to energy use and environmental responsibility. While Tesla has yet to reinstate Bitcoin as a payment option, the report underscores progress that could influence corporate policies and public perceptions of the cryptocurrency sector.

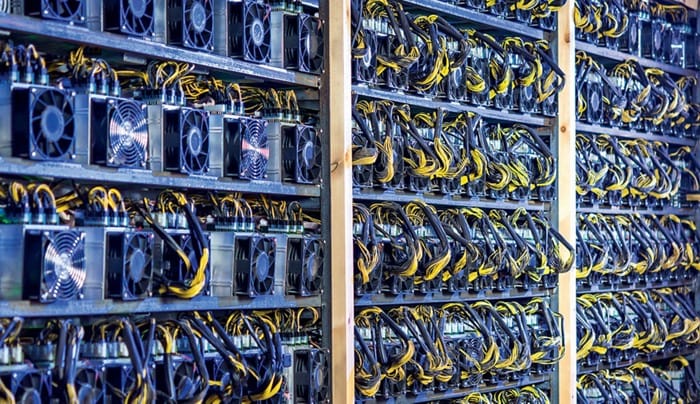

The study draws on data from 49 mining firms, including major players like Bitfarms, CleanSpark, Hut 8, IREN, MARA, and Riot, representing 48% of global Bitcoin mining activity by hashrate. It estimates the network’s annual electricity consumption at 138 terawatt-hours, roughly 0.5% of global usage, with emissions totaling 39.8 megatonnes of CO2 equivalent. Despite a 24% improvement in hardware efficiency, the industry continues to navigate challenges, including high operational costs, with electricity comprising over 80% of expenses at a median of $45 per megawatt-hour. The report also notes that 86.9% of decommissioned mining hardware is resold, repurposed, or recycled, generating approximately 2.3 kilotonnes of e-waste in 2024.

Sustainable energy adoption is a key focus, with 9.8% of the industry’s power coming from nuclear sources and 42.6% from renewables like wind and hydropower. Natural gas has overtaken coal as the dominant energy source, rising to 38.2% from 25% in 2022, while coal usage dropped to 8.9% from 36.6%. North America leads in mining activity, with the United States accounting for 75.4% and Canada 7.1%, though emerging operations in South America, the Middle East, and Northern Europe signal growing global interest. Miners are also contributing to grid stability, curtailing 888 gigawatt-hours of electrical load in 2023 to support demand management.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishAdapting to Challenges and Shaping Perceptions

As the Bitcoin mining industry faces scrutiny over its environmental impact, the CCAF report offers a counterpoint to a recent Harvard-led study published in Nature Communications.

That study, which claimed Bitcoin mining in the U.S. significantly contributes to air pollution, was criticized by energy experts as flawed. It alleged that 34 major U.S. mines consumed 32.3 terawatt-hours of electricity, largely from fossil fuels, impacting 1.9 million Americans with increased exposure to fine particulate matter. The Cambridge findings, however, suggest a more nuanced reality, with miners diversifying into high-performance computing, artificial intelligence, and innovative energy strategies like flared gas utilization and waste-heat recovery to enhance efficiency and explore new revenue streams.

The report’s implications extend to corporate decisions, particularly for companies like Tesla. In 2021, Elon Musk announced Tesla’s $1.5 billion Bitcoin purchase and briefly allowed Bitcoin payments, emphasizing the company’s direct operation of Bitcoin nodes and retention of payments in cryptocurrency.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Musk’s 2021 Twitter post about suspending Bitcoin payments

However, citing concerns over fossil fuel use in mining, Tesla suspended Bitcoin payments two months later, stating it would resume when clean energy usage reached approximately 50%. With Tesla still holding 11,509 Bitcoin, valued at around $1.1 billion, the Cambridge study’s findings could prompt renewed discussions about reintegrating Bitcoin payments, aligning with Musk’s sustainability criteria.

The Bitcoin mining industry’s strides toward sustainability reflect a broader effort to balance innovation with environmental responsibility. As miners adapt to rising costs and regulatory pressures, their adoption of cleaner energy and flexible grid practices signals a maturing sector. While challenges remain, the Cambridge report provides evidence of progress, potentially reshaping how stakeholders view Bitcoin’s role in a sustainable future.