Bitcoin Mining Costs Surge 47% Amid Rising Expenses

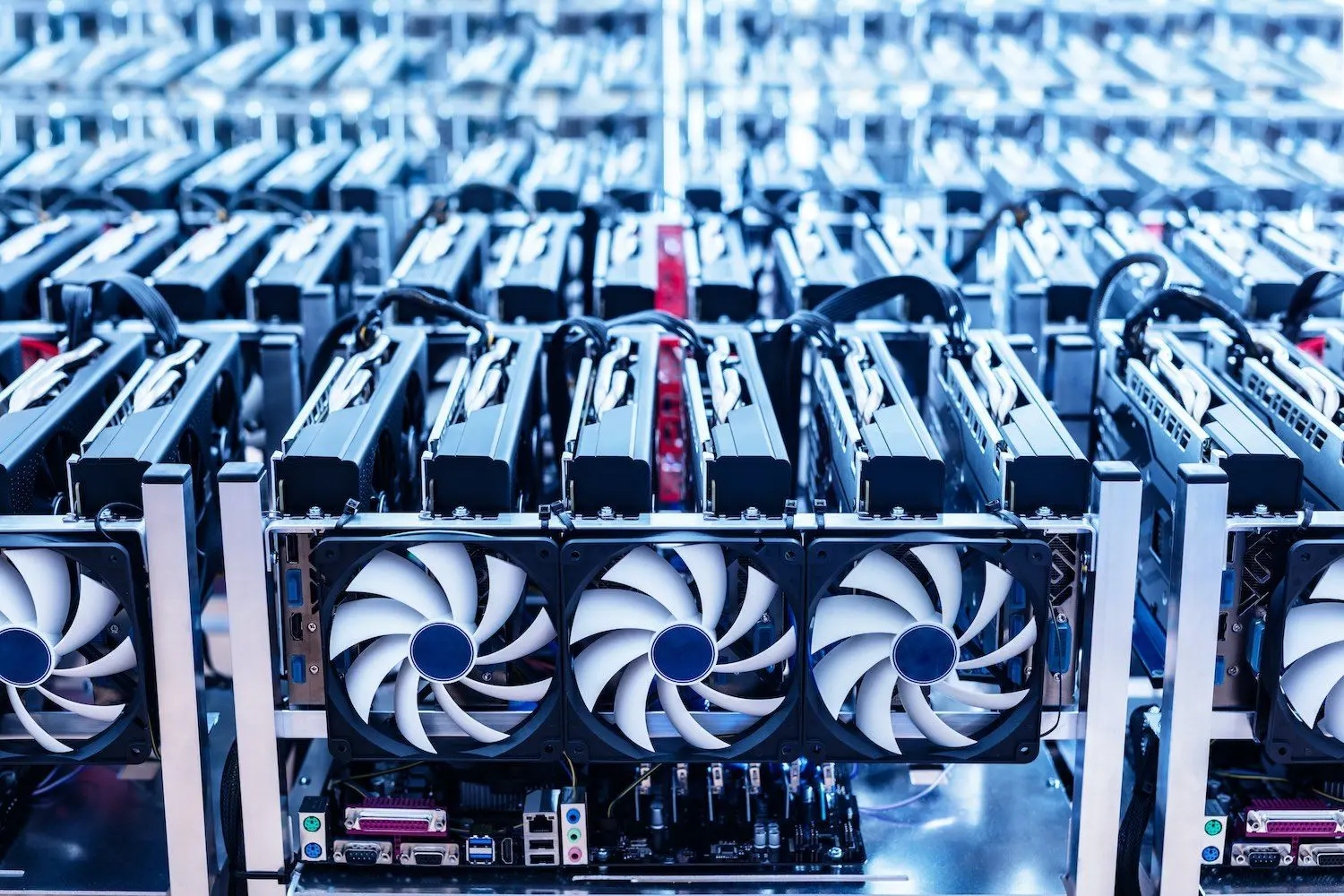

The cost of mining Bitcoin skyrocketed in the final quarter of 2024, climbing to an average of $82,162 for publicly listed miners, a 47% increase from the previous quarter, according to a comprehensive CoinShares industry report.

When factoring in non-cash expenses like depreciation and stock-based compensation, the total production cost per Bitcoin reached a staggering $137,018. This sharp rise stems from a combination of accelerated hardware deployment, escalating tax liabilities, and growing non-cash charges, all of which have squeezed Bitcoin miner profit margins. The report highlights how these pressures, coupled with fluctuating market prices and intensified competition, are reshaping the economics of Bitcoin mining.

The surge in costs reflects broader challenges in the sector. Miners are grappling with faster hardware turnover as new, more efficient equipment becomes essential to stay competitive. This rapid obsolescence of application specific integrated circuits (ASICs) drives significant depreciation expenses, unlike traditional industries where equipment wears out physically. Additionally, electricity remains the largest direct cost, though non-cash items like amortization are increasingly impactful. The CoinShares report shows that while Bitcoin prices hovered around $82,000, enabling most miners to remain profitable, the narrowing margins signal a tougher road ahead.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishEfficiency Gains Offer Some Relief

Despite the industry-wide cost inflation, a few companies have managed to buck the trend by optimizing operations. CleanSpark, for instance, reduced its all-in costs by 13% and cash costs by 15%, thanks to a 56% boost in deployed hash rate, near-perfect operational uptime, and improved fleet efficiency. Similarly, Iren slashed electricity costs by 39% at its Childress facility by adopting spot pricing, boosting its hash rate significantly. Cormint also achieved a remarkable 44% reduction in total mining costs, driven by lower power prices. These examples highlight how strategic investments in efficiency and infrastructure can mitigate the financial strain felt across the sector.

Looking forward, the outlook is mixed. Tariff increases on imported mining rigs from countries like China and Malaysia, ranging from 24% to 54%, could further elevate costs for miners reliant on foreign equipment. Valuation multiples for mining firms are also compressing, reflecting investor skepticism about the sustainability of current profit models in a hyper-competitive hash rate race. In response, some miners are diversifying into data center infrastructure and artificial intelligence to supplement traditional revenue from block rewards and transaction fees. Meanwhile, the industry continues to innovate, with new ASIC models achieving efficiency levels five times better than those in 2018. This has stabilized network energy consumption despite the global hash rate soaring to 900 exahashes per second, with projections suggesting it will surpass one zetahash per second by mid-2025.

The CoinShares report paints a picture of an industry at a crossroads, balancing technological advancements with mounting financial pressures. As miners navigate these challenges, their ability to adapt through efficiency gains and diversified revenue streams will likely determine their long-term viability in an increasingly complex market.