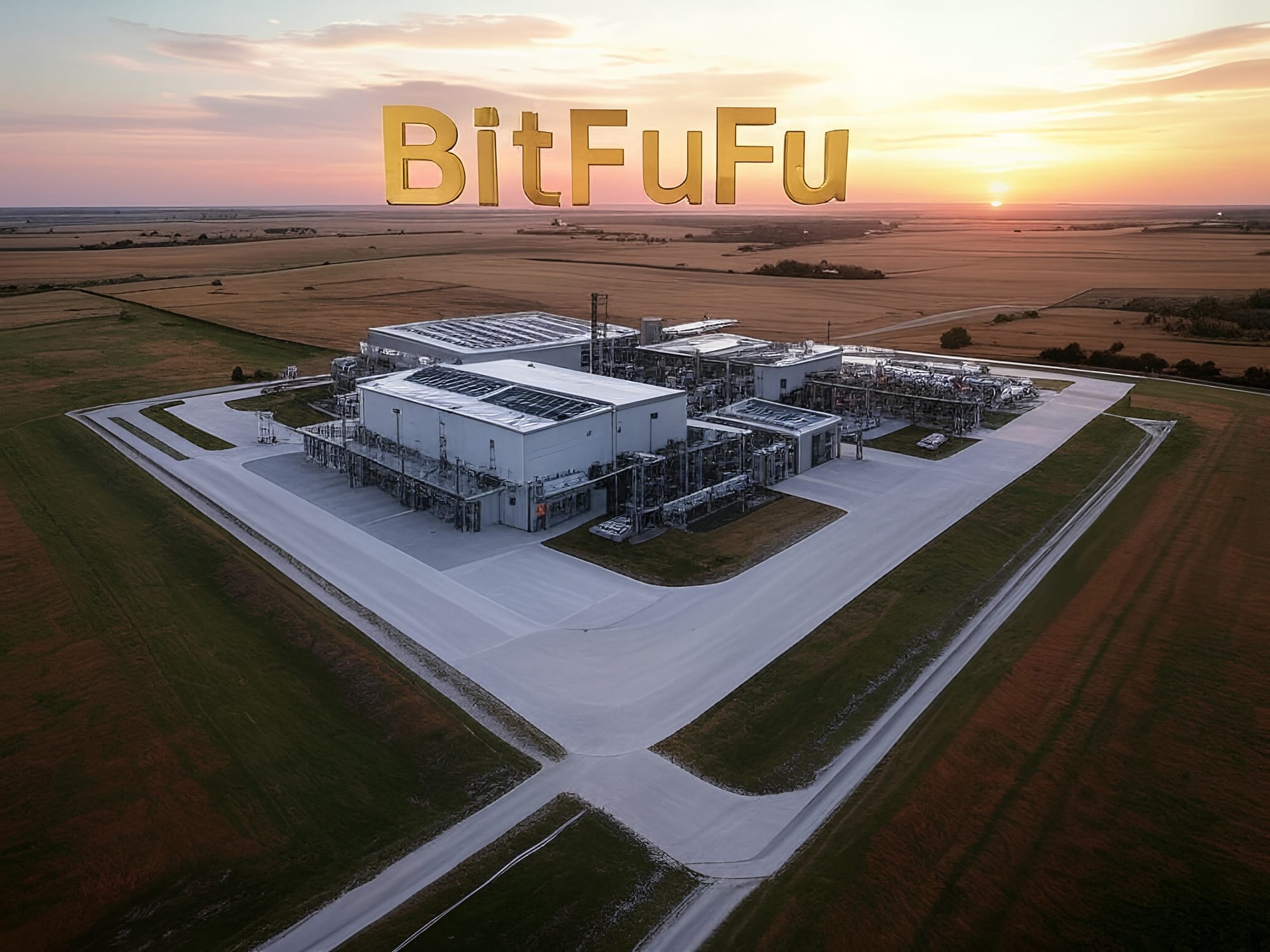

Bitcoin Miner BitFuFu Aims to Boost Operations with Oklahoma Facility Acquisition

Singapore-based BitFuFu, a firm with significant backing from Bitmain, has set its sights on expanding its footprint in North America through an ambitious acquisition. The company has unveiled plans to secure a majority stake in a 51-megawatt Bitcoin mining facility located in Oklahoma, marking a strategic move aimed at enhancing its operational capabilities and market presence in the region.

This strategic acquisition, announced in a press release dated January 16, involves a facility that's strategically placed in an area with minimal population, thus offering ample space and fewer logistical complications. The facility boasts a substantial power capacity of 51 megawatts, which is crucial for the energy-intensive process of Bitcoin mining. One of the key attractions of this site is its cost-effective access to electricity, priced at just 3 cents per kilowatt-hour from the local grid. This low-cost energy source is a significant advantage, directly impacting the profitability of the Bitcoin mining operations.

Leo Lu, Chairman and CEO of BitFuFu, described this move as a "pivotal step" not only for the company's expansion in North America but also for its broader ambition to scale up to a 1GW global power capacity. He emphasized that this acquisition would secure "long-term, low-cost, and reliable power," which is fundamental for maintaining a competitive edge in the volatile crypto mining sector.

Strategic Implications and Market Response

The deal, although not yet finalized, has stirred some positive market response. In pre-market trading, BitFuFu's stock saw a modest increase of 0.39%, reaching $5.19 per share, as reported by MarketWatch. This slight uptick reflects investor confidence in the strategic direction BitFuFu is taking. However, the transaction's completion remains contingent upon several factors including final agreements, thorough financial due diligence, and other customary closing conditions. BitFuFu has cautioned that there is no assurance the deal will proceed to completion.

The company's journey towards this acquisition has been marked by its recent milestones, including its public listing on the Nasdaq under the ticker FUFU in March 2024. This transition to a publicly traded entity has not been without its financial implications, as evidenced by a 111% surge in general and administrative expenses linked to the IPO, primarily driven by a $1.2 million increase in legal and consulting fees. These costs reflect the complexities and expenses associated with going public, which BitFuFu has managed as part of its growth strategy.

Overall, BitFuFu's move to acquire the Oklahoma mining facility is a clear indication of its intent to solidify its presence in North America, leveraging local advantages such as low-cost energy to potentially enhance its operational efficiency and profitability in the competitive landscape of Bitcoin mining. This expansion also aligns with the company's long-term vision of scaling up its global mining infrastructure, a vision that could redefine its standing in the cryptocurrency mining industry.