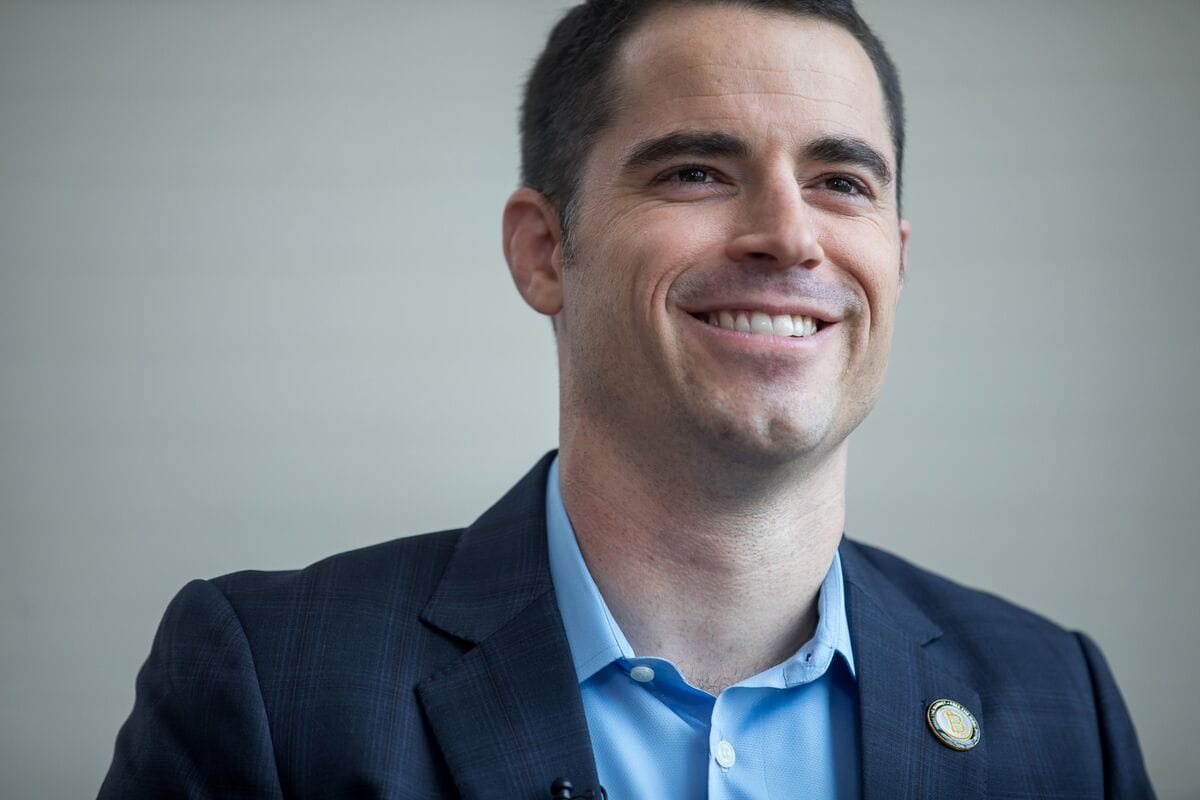

Bitcoin Jesus, Roger Ver, Strikes Deal with DOJ to Resolve US Tax Fraud Charges

Roger Ver, early Bitcoin and cryptocurrency advocate often called “Bitcoin Jesus” has entered a tentative agreement with the US Justice Department to address a criminal tax fraud case filed against him last year. Federal prosecutors accused Ver of evading taxes on his substantial digital asset holdings, leading to charges that could have resulted in significant prison time. Sources familiar with the matter indicate the deal requires Ver to pay approximately $48 million to settle the obligations, with the charges set for dismissal upon full compliance.

The agreement remains subject to court approval and could evolve before finalization, marking a potential turning point for Ver after many months of legal battles overseas. Ver built his reputation in the crypto space through aggressive promotion of Bitcoin in its nascent days, investing in key projects that helped shape the industry. This development comes amid a broader shift in federal approaches to cryptocurrency enforcement.

Stay In The Loop and Never Miss Important Bitcoin News

Sign up and be the first to know when we publishTracing the Roots of Ver’s Legal Challenges

Roger Ver’s journey in the cryptocurrency world began in earnest around 2011, when he emerged as one of Bitcoin’s most vocal supporters, earning his nickname for proselytizing its potential to disrupt traditional finance. Born in California and raised in the Silicon Valley area, he quickly transitioned from other business ventures to backing early Bitcoin startups, including payment processor BitPay and exchange Kraken. His investments and public endorsements played a crucial role in drawing attention to the technology.

The tax charges against Ver stem from events tied to his 2014 renunciation of US citizenship, a move that triggered an exit tax on his assets, including a large Bitcoin portfolio. Prosecutors alleged he failed to report about $240 million in capital gains from selling around 70,000 Bitcoins between 2017 and 2018, along with the required exit tax on those holdings. The indictment, unsealed in April 2024, included three counts of mail fraud, two counts of tax evasion, and three counts of filing false tax returns, with potential penalties exceeding 100 years in prison if convicted on all counts. Authorities arrested Ver in Spain that same month on a US warrant, where he had been residing after years in Japan.

Throughout the proceedings, Ver maintained his innocence and explored options to avoid extradition, including a lawsuit filed in July 2025 against Spanish authorities to block his return to the United States. In earlier statements, he expressed hope for a presidential pardon under the incoming Trump administration, denying any fugitive status and emphasizing his cooperation with legal counsel. Ver’s case drew attention not just for its scale but for highlighting the complexities of taxing digital assets during expatriation, a scenario that has ensnared other high-profile figures in the sector.

When reached for comment on the tentative deal, Ver deferred to his attorneys, stating in an email that he would adhere to their guidance as he has for years. A Justice Department spokesperson offered no details, consistent with protocols for ongoing negotiations. The arrangement, first reported by The New York Times, underscores the fluid nature of such resolutions, where payment and adherence to terms pave the way for case closure without a trial.

This resolution aligns with evolving federal priorities under President Trump, whose administration has prioritized fostering innovation in digital finance over aggressive pursuits of past infractions. An executive order issued in January 2025 directed agencies to support the responsible expansion of blockchain and cryptocurrencies, halting sales of seized Bitcoin and exploring a national strategic reserve. By July, Trump signed the GENIUS Act, establishing clear guidelines for stablecoins and signaling a departure from the prior emphasis on enforcement actions that targeted industry players.

For Ver, the agreement offers a path forward after a saga that captivated the crypto community, from his early triumphs to the scrutiny of his financial maneuvers. His story illustrates the intersection of personal choices and regulatory realities in the volatile world of digital currencies. As the deal awaits formal submission, it serves as a reminder of how quickly fortunes can shift in an industry still defining its place in the global economy.