Bitcoin Hashrate Soars to Record High While Price Holds Steady

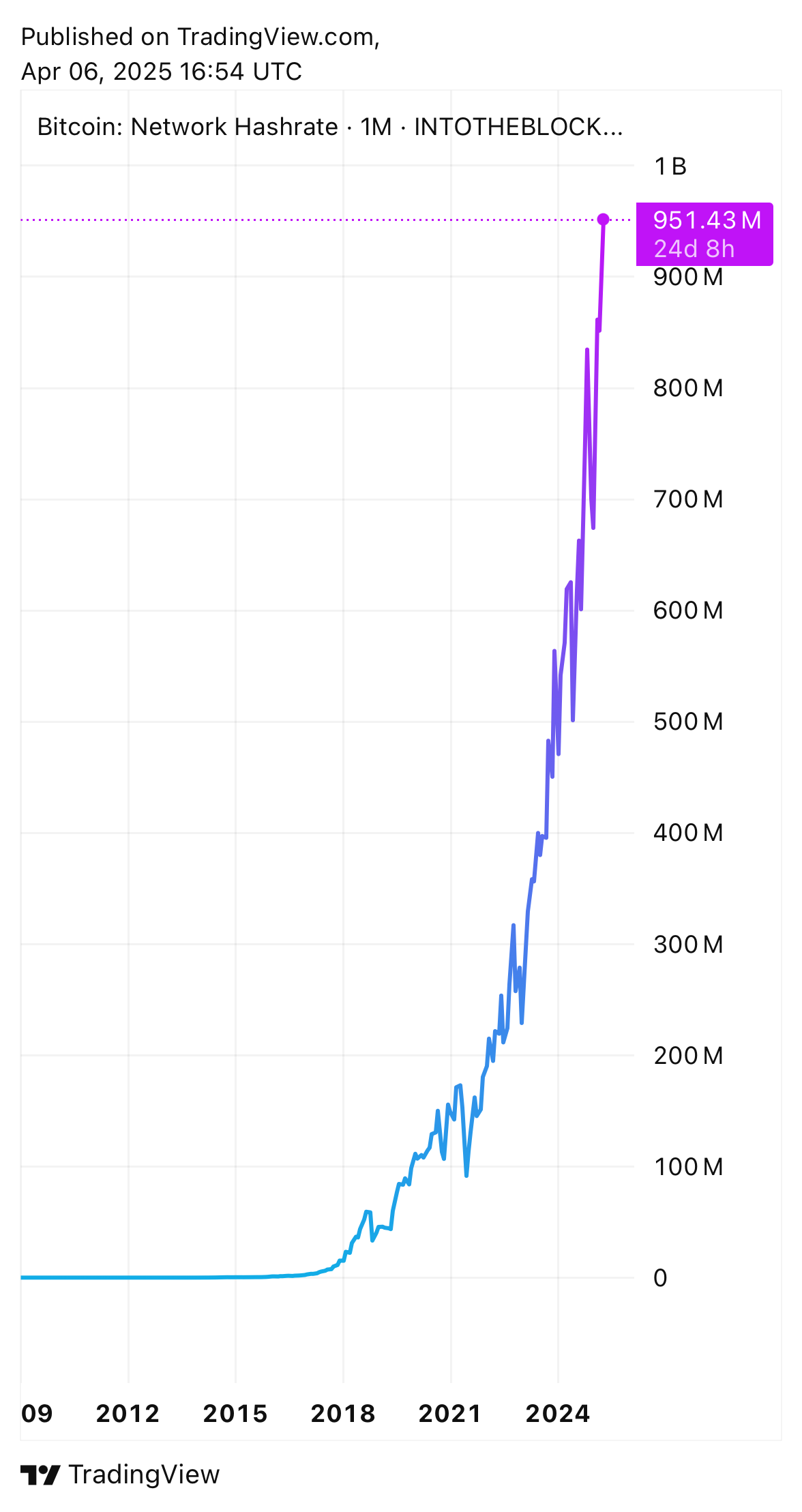

In a significant development, Bitcoin's hashrate has reached an all-time high as of April 2025, signaling robust growth in the network's computational power. This milestone shows the increasing activity and security within the Bitcoin ecosystem. The hashrate, which measures the total computational power used to mine and process transactions on the Bitcoin blockchain, has seen a remarkable upward trajectory since 2015. The hashrate chart shared below illustrates this exponential rise, with a particularly sharp increase in early 2025, pushing the hashrate to unprecedented levels.

Despite this surge in mining activity, Bitcoin's price has remained relatively stable, hovering around the $82,000 mark. This contrast between a booming hashrate and a steady price has sparked discussions among investors and analysts about the potential implications for Bitcoin's future. The increased hashrate suggests that miners are investing heavily in the network, likely driven by confidence in its long-term value. However, the lack of corresponding price movement raises questions about whether this computational growth will eventually translate into market gains.

Market Dynamics and Future Predictions

The broader context of this hashrate milestone reveals a complex landscape for Bitcoin. Recent trends indicate that large investors, often referred to as whales, have been accumulating Bitcoin, according to historical on-chain data.

This accumulation is seen by many as a bullish signal, suggesting that these investors anticipate a price increase. Some community members are even more optimistic, with predictions suggesting Bitcoin could reach $200,000 by the end of 2025. However, not all sentiment is positive, as retail investors have shown signs of selling off, possibly due to market uncertainty and global macro issues such as tariffs and wars.

Adding to the discussion, the rising hashrate also highlights challenges for miners, particularly in terms of Bitcoin miner profitability. With block rewards halving every four years and transaction fees remaining low, miners are increasingly reliant on price appreciation to sustain their operations. Despite these hurdles, the record hashrate reflects a strong commitment to the network's security and decentralization, which are core principles of Bitcoin's design.