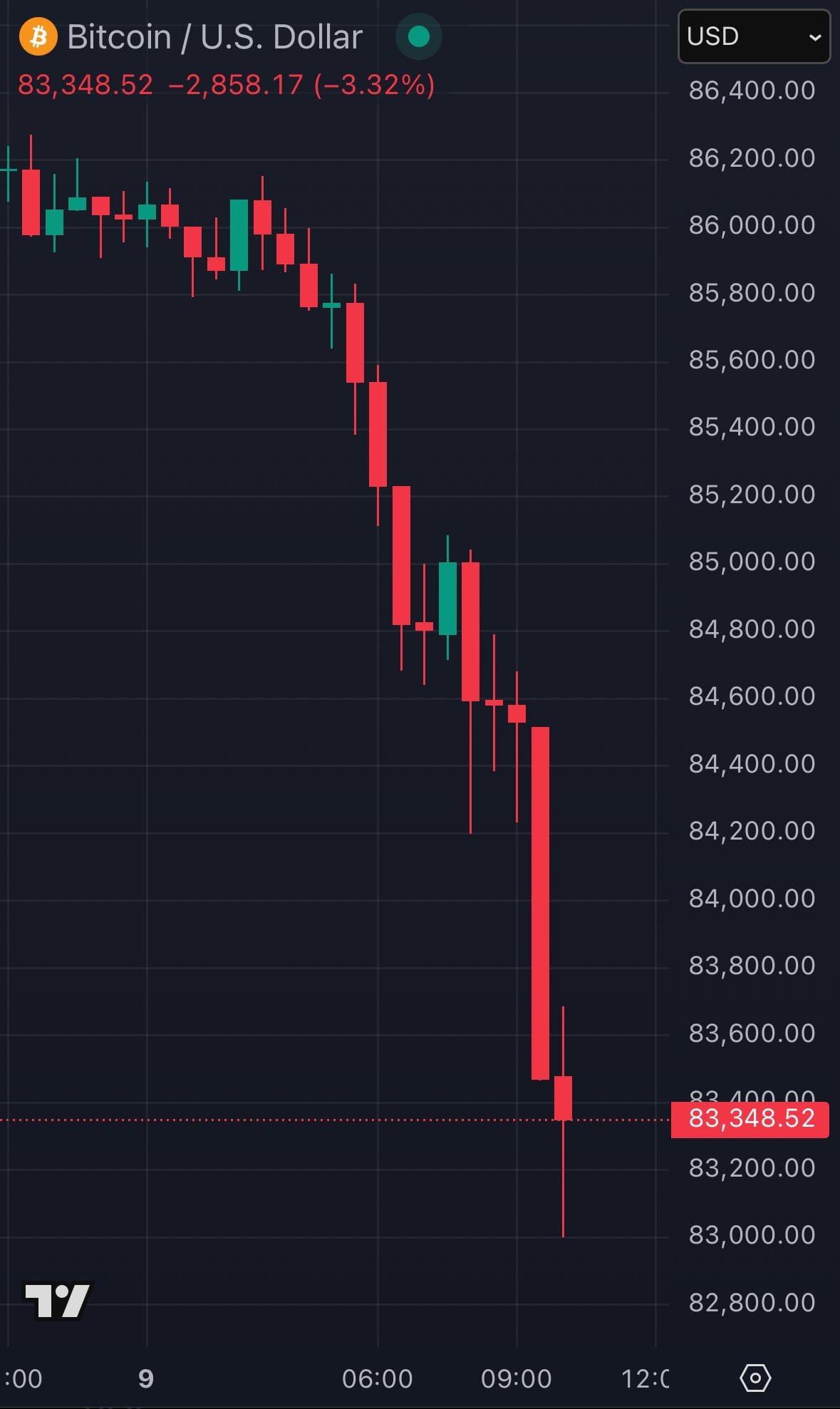

Bitcoin Falls Below $84,000 as Crypto Markets Lose $100 Billion in Value Over Weekend

This Sunday morning Sunday, Bitcoin’s price experienced a significant decline, falling below $84,000 and wiping out $100 billion from the broader crypto market. The drop shows Bitcoin’s value tumbling from around $98,000 to $83,946.52, marking a 3.2% decrease in just a short period. This sudden shift has raised concerns among investors and market watchers about the stability of crypto markets and the potential for liquidity challenges.

The chart, which traces Bitcoin’s price movement throughout the morning, highlights a sharp downward trend, with red candlesticks dominating the visual, signaling heavy selling pressure. The chart begs the question whether liquidity is drying up, a critical factor that could exacerbate volatility in the cryptocurrency space. This comes at a time when Bitcoin has been navigating a complex landscape of institutional adoption, regulatory developments, and technological advancements, all of which have shaped its trajectory in 2025.

Understanding the Liquidity Question

Market analysts have noted that Bitcoin’s volatility aligns with its recent history of rapid price fluctuations. Following its record-breaking surge past $100,000 in 2024, driven by increased participation from major financial institutions and clearer regulatory frameworks, Bitcoin entered 2025 with high expectations.

However, events like this weekend’s drop underscore the asset’s inherent unpredictability. According to recent insights, Bitcoin’s price in 2025 depends on a combination of factors, including institutional interest from firms like BlackRock and Fidelity, as well as ongoing regulatory clarity. These elements have historically stabilized the market, but sudden drops like the one observed today suggest that liquidity concerns, potentially tied to lower trading volumes on weekends, could still pose challenges.