Bitcoin Dominance Holds Strong at 58.79% Amid Altcoin Gains and Institutional Moves

Bitcoin continues to assert its authority over the crypto market, maintaining a dominance of 58.79% as of July 27, 2025, within a total crypto market cap of $3.98 trillion. This metric, which measures Bitcoin’s market cap relative to the broader market, serves as a critical gauge of investor sentiment. Despite a recent dip from 61.8%, Bitcoin’s commanding share shows its role as a stabilizing force in a volatile market. Investors often view Bitcoin as a safe haven compared to riskier cryptos, particularly during periods of uncertainty.

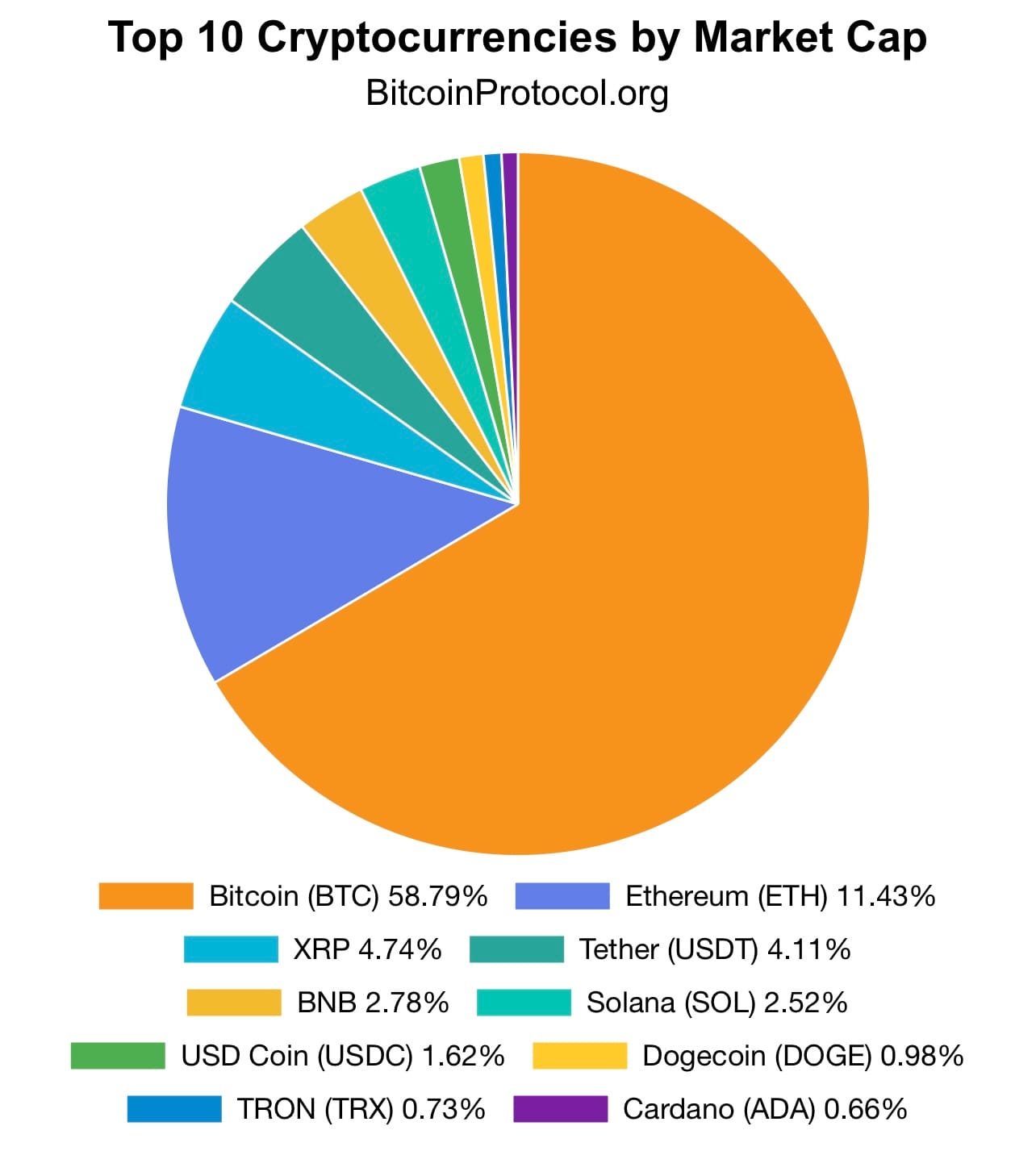

The top 10 cryptocurrencies by market cap further illustrate Bitcoin’s lead, with Ethereum holding a distant second place at 11.43%. Following Ethereum are XRP at 4.74%, Tether at 4.11%, BNB at 2.78%, Solana at 2.52%, USD Coin at 1.62%, Dogecoin at 0.98%, TRON at 0.73%, and Cardano at 0.66%.

Together, Bitcoin and Ethereum account for over 70% of the market, highlighting their outsized influence. This concentration reflects a market where investors lean heavily on established assets, even as altcoins show signs of momentum.

Altcoin Gains and Institutional Confidence Drive Market Dynamics

Over the weekend, Bitcoin regained some ground, rising nearly 1% to reach $119,000, buoyed by consistent inflows into Bitcoin exchange-traded funds (ETFs). Ethereum also saw gains, climbing 3% over the same period, driven by positive ETF inflows. These movements suggest growing institutional interest in the two largest cryptocurrencies, reinforcing their dominance. However, altcoins have also made notable strides, with BNB stealing the spotlight by reaching an all-time high of $829 on Sunday.

BNB’s surge follows significant corporate activity, with Windtree Therapeutics announcing plans to allocate 99% of a $520 million equity raise to BNB purchases. This move mirrors similar strategies by companies like Nano Labs, which committed $90 million to BNB. Such corporate treasury decisions reduce BNB’s circulating supply while signaling strong confidence in its ecosystem, which spans decentralized finance (DeFi), artificial intelligence, and tokenization. BNB’s 37% rally over the past 90 days has outpaced Bitcoin’s 41.68% annual gain, drawing attention to its growing role in the market.

A high Bitcoin dominance typically indicates cautious investor sentiment, as capital flows into the relative safety of Bitcoin. Conversely, a decline in dominance often signals an “altcoin season,” where investors pursue higher-risk, higher-reward opportunities in smaller cryptocurrencies. The recent dip in Bitcoin’s dominance from 61.8% to 58.79% suggests some capital is shifting toward altcoins, yet Bitcoin’s majority share remains unchallenged. This balance reflects a market where Bitcoin retains its crown while altcoins like BNB and Ethereum capture growing interest.