Bitcoin Cash Stablecoin ‘Moria’ Challenges USDT Dominance with Over $45K Locked Post Launch

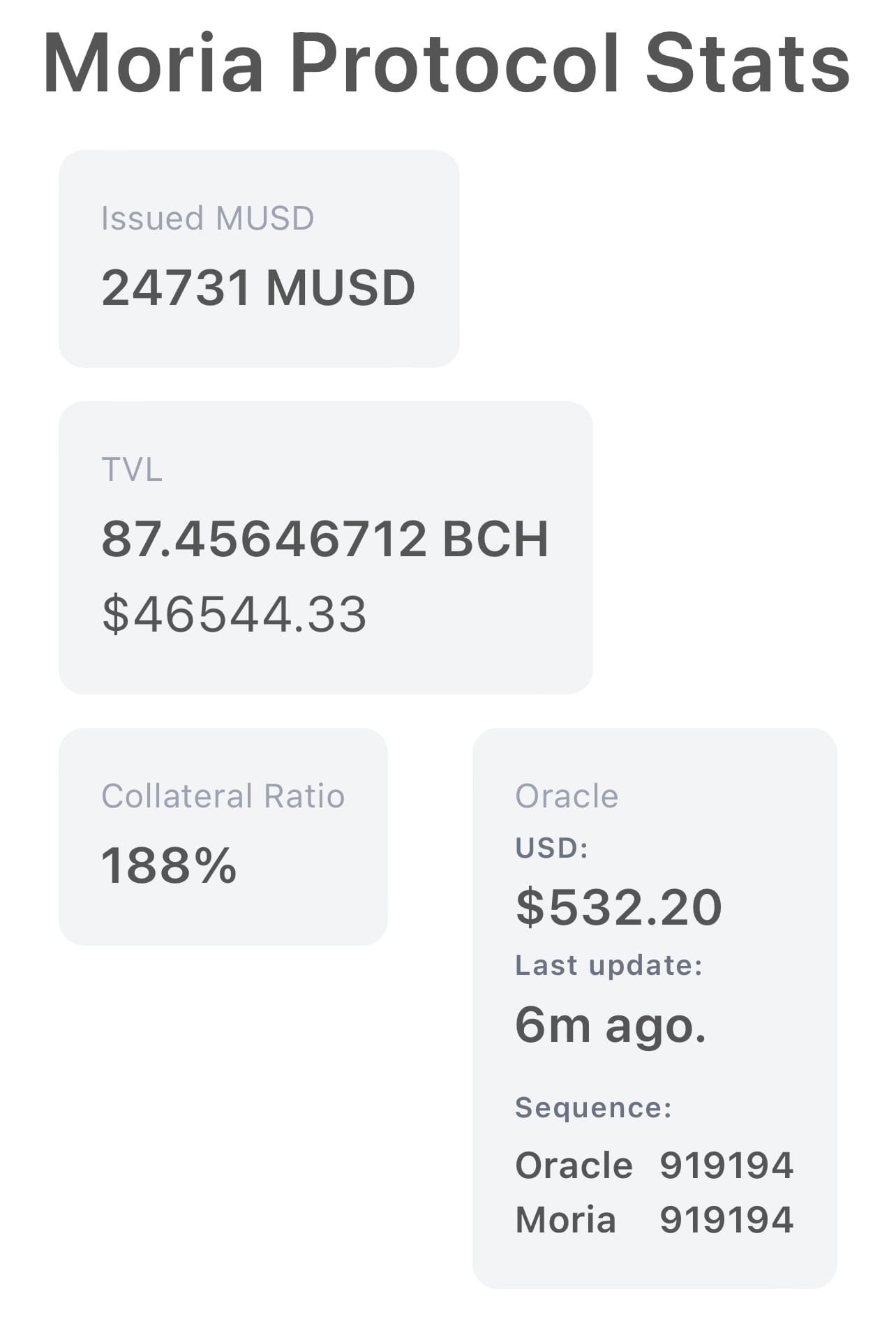

The BCH ecosystem has introduced a new player in the stablecoin arena with the launch of Moria (MUSD), an ambitious project aiming to redefine stability in the crypto space. This decentralized native-backed layer 1 stablecoin protocol has quickly garnered attention by locking over $45,000 in total value after just launching, highlighting a potential shift in how stablecoins might be managed and perceived in the future.

Moria operates through a novel approach by leveraging the UTXO (unspent transaction output) model for smart contracts, made possible by the May 2023 CashTokens upgrade on the Bitcoin Cash network. This upgrade has essentially given BCH the capability to execute smart contracts directly on its blockchain with minimal fees, bypassing the need for expensive second-layer solutions. This could mark a significant departure from the practices of giants like Tether (USDT), which have become synonymous with centralization and closed-source operations, and have boosted blockchains like Bitcoin and Ethereum.

Moria's Vision and Mechanism

Moria isn't just another stablecoin; it's an experiment in financial sovereignty. Created by Riften Labs, the same minds behind the Cauldron DEX, Moria allows users to mint stablecoins backed by Bitcoin Cash, aiming to offer a decentralized alternative to dollar-pegged assets. Users deposit BCH to mint MUSD, which remains over-collateralized to ensure stability and trust. The protocol includes a mechanism for collateral management where, if the value of BCH drops too low, loans can be liquidated to maintain the peg, though users are encouraged to keep their collateralization ratio above 110% to avoid such scenarios.

This system is designed with an end date in sight, with the current test run concluding no later than May 2025, after which Moria will either evolve into a new version or finalize its deployment. This transparency and planned evolution contrast starkly with the opaque operations of many established stablecoins.

Moria's approach also aims to tackle some of the most criticized aspects of centralized stablecoins like USDT. With Moria, everything is open-source, providing a level of transparency that's absent in Tether's operations. Moreover, being backed by BCH rather than a nebulous mix of assets gives it a clear, auditable backing. This could appeal to those who are wary of the complexities and potential vulnerabilities tied to other stablecoins.

However, the BCH community isn't unanimously behind the idea of a stablecoin, particularly one pegged to the USD, which some see as contrary to the ethos of Bitcoin Cash. Critics argue that pegging to a currency backed by government violence undermines the decentralized nature of cryptocurrencies. Despite these reservations, Moria's introduction represents a significant experiment in leveraging BCH's new capabilities, potentially offering a cheaper, more transparent alternative to existing stablecoins.

As Moria continues its test phase, it will be fascinating to watch how this project navigates the volatile waters of cryptocurrency markets. With only $46,544 in TVL compared to USDT's massive scale, Moria might seem like a drop in the bucket, but its implications for DeFi could ripple far beyond its current size. This project underscores the potential for BCH to host complex financial tools at a fraction of the cost and with greater transparency than its counterparts, setting the stage for what could be a new chapter with stablecoins.