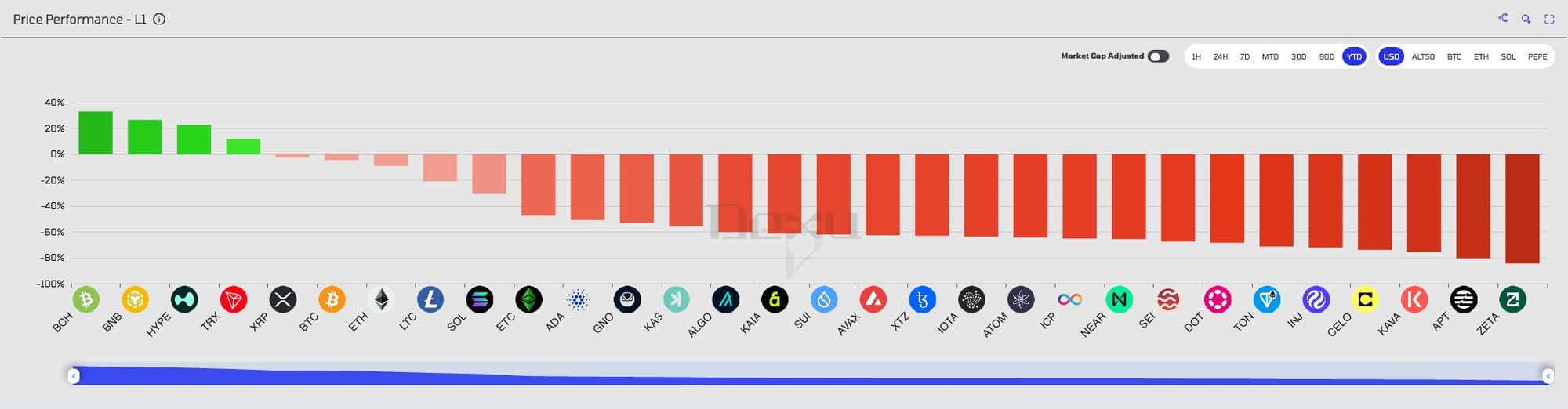

Bitcoin Cash Leads Layer 1 Cryptocurrencies with Strong Gains in 2025

Bitcoin Cash has taken the lead among layer 1 cryptocurrencies in 2025, posting a year-to-date increase of nearly 40% that sets it apart from competitors. This performance comes as many other networks face declines in a challenging market environment. Data analyst Crypto Koryo highlighted these gains in a recent post, noting how Bitcoin Cash stands out without relying on heavy promotion or social media presence.

The Bitcoin Cash price has climbed steadily, reaching around $598 in recent trading sessions. This surge reflects broader interest from investors seeking stable options within the crypto space. While the overall crypto market has experienced volatility, Bitcoin Cash has maintained a consistent upward trajectory that draws attention to its underlying strengths.

Crypto Koryo, a respected voice in crypto analysis, emphasized the asset's resilience based on clear market data. His post quickly gained traction, sparking discussions among traders and enthusiasts about what drives this unexpected success.

Factors Driving Bitcoin Cash Performance

Bitcoin Cash benefits from a straightforward supply structure that reduces common pressures seen in other networks. The entire supply of coins is already in circulation, meaning there are no scheduled unlocks to flood the market with new tokens. This setup avoids the dilution effects that often weigh on prices during uncertain times.

Without a central foundation or venture capital firms offloading holdings, selling pressure remains minimal. Crypto Koryo pointed out this clean dynamic as a key reason for the asset's stability. Investors appreciate the predictability, which allows a free market of demand to play a more direct role in price movements.

On the demand front, the possibility of a Bitcoin Cash exchange-traded fund adds to its appeal. Recent approvals for similar products involving Bitcoin, Ethereum, Solana, and even Dogecoin have opened doors for institutional money. A BCH ETF could follow this path, providing easier access for traditional investors through familiar financial vehicles.

Liquidity stands out as another strength for Bitcoin Cash. It ranks among the most traded assets in its category, offering smooth entry and exit points for buyers and sellers. This high liquidity pairs well with surprisingly low volatility, making it suitable for portfolios focused on measured exposure to the crypto space.

Over the past year, the price of Bitcoin Cash has shifted by just 3% , a figure that underscores its steadiness compared to more erratic peers. In the last month alone, it has risen 17%, showing short-term momentum without wild swings. This balance appeals to those building long-term positions rather than chasing quick trades.

Crypto Koryo described Bitcoin Cash as an ideal choice for liquid funds seeking beta exposure. Beta measures how an asset moves relative to the broader market, and BCH's profile fits neatly into strategies that aim for growth with controlled risk. Retail and institutional players alike find value in this combination of accessibility and reliability.

Bitcoin Cash's roots trace back to a 2017 fork of Bitcoin, designed to enhance scalability for everyday transactions. Larger block sizes enable faster and cheaper peer-to-peer payments, aligning with the original vision of digital cash. In 2025, these features have gained renewed relevance as users prioritize efficiency amid rising network fees on other chains.

Bitcoin Cash's outperformance extends to comparisons with established names like Ethereum and Solana. While those networks have posted losses exceeding 40% this year in some cases, BCH has charted a different course.

This gap highlights shifting preferences in the layer 1 landscape. Traders are rotating toward assets with fewer overhangs and stronger fundamentals. Bitcoin Cash's lack of an official social media account further emphasizes that its rise stems from market mechanics, not hype.

Looking ahead, analysts see potential for continued interest if regulatory tailwinds persist. The ETF narrative could accelerate inflows, much like it did for Bitcoin earlier in the cycle. Network upgrades have also improved transaction speeds, drawing in users for real-world applications from remittances to merchant payments.

As December progresses, Bitcoin Cash trades near $600, with technical indicators pointing to support levels that could fuel further upside. The 50-day moving average continues to rise, offering a buffer against pullbacks. Longer-term charts show a sustained trend that aligns with bullish sentiment in the sector.